The gold market still has room to grow as economic uncertainty and geopolitical turmoil fuel safe-haven demand. However, a market strategist believes it’s time to consider silver – the metal considered gold’s “sibling.”

In a recent interview with Kitco News, Michele Schneider, director of market strategy at MarketGauge, shared her neutral stance on gold and silver, as prices are in a consolidation phase. However, she would look to buy silver if prices firmly break above the $34 per ounce level.

This comment comes as silver prices surged earlier this week. Spot silver traded at $34.39 per ounce on June 2, surging over 4% on the day. The precious metal witnessed its biggest rally since mid-October 2024.

While silver is grabbing some attention in the market, Schneider remains patient. She added that she wants to see further buying after the current rally. Her message to investors is to “let the price tell the story.” “When buyers aggressively step in, that’s the beginning of a bigger move,” she said. “If we can hold above $34 per ounce, I think it’s just a matter of time before we see $40 per ounce.”

Meanwhile, spot gold traded at $3,374.9 per ounce on June 2, surging over 2.6% on the day. “Gold and silver seem to want to go higher. At this point, anything could spark a rally. It won’t take much.”

Although gold remains a solid choice in the current environment, Schneider noted that the recent rise in the gold-silver ratio indicates that silver is “ready to shine.”

Last month, the gold-silver ratio hit a five-year high, spiking to 107 points as gold reached an all-time high of $3,500 per ounce. Schneider sees some parallels between the 2020 peak and the current price action. In 2020, the gold-silver ratio fell from record highs to six-year lows, adjusting 51% in one year.

Domestic silver prices also surged in the morning of June 3, following the global trend.

On what could drive silver prices higher, Schneider expects the Federal Reserve to cut rates sooner than expected. Despite high inflation, a slowing economy could force the US central bank to loosen rates. Lower rates would support new industrial demand for silver – making the precious metal a better inflation hedge than gold.

In Vietnam, silver prices also jumped 3.7% on the morning of June 3, following the global trend. Referring to Phu Quy Group, a gold and jewelry company, silver ingot prices for 1 tael were listed at VND 1,311,000 (buying) and VND 1,352,000 (selling). Silver ingot prices for 1 kg were VND 34.9 million (buying) and VND 36.05 million (selling)

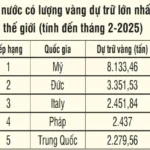

Gold: From Traditional Reserve to Modern Financial Weaponry

For centuries, gold has been a core component of the global monetary system, offering a lower-risk asset class compared to many other alternatives. In today’s volatile geopolitical climate, with soaring inflation and strained global trade, nations are re-evaluating their approach to this precious metal.