Gold prices dropped sharply after hitting a four-week high during Tuesday’s trading session (June 3rd) as a stronger US dollar and cautious investor sentiment ahead of a potential phone call between US President Donald Trump and Chinese President Xi Jinping this week weighed on the precious metal. The SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, continued to accumulate gold, adding over 2.5 tons.

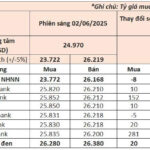

As of 8:30 AM local time on Wednesday (June 4th), the spot gold price in Asian markets rose by $11.3/oz compared to the previous session’s close in the US, equivalent to a 0.34% increase, trading at $3,365.1/oz according to data from Kitco, a leading precious metals marketplace. Converted using the selling rate for USD at Vietcombank, this price corresponds to approximately VND 106.3 million per tael, a decrease of VND 100,000 per tael compared to yesterday’s open.

At the same time, Vietcombank quoted the USD at VND 25,840 (buying rate) and VND 26,230 (selling rate), an increase of VND 20 for both rates compared to the previous day’s open.

During the previous night’s session in New York, spot gold closed at $3,353.8/oz, a decrease of $27.8/oz or 0.8% from the prior session’s close. Earlier in the session, gold prices touched their highest level since May 8th.

The strengthening of the US dollar put downward pressure on gold prices, with the dollar index, which measures the greenback’s strength against a basket of six major currencies, rebounding to 99.23 at the close from 98.71 in the previous session.

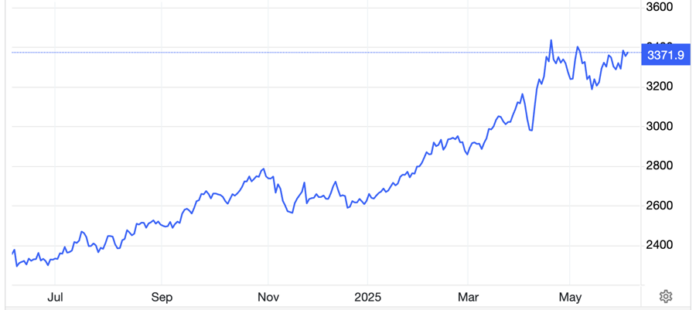

Gold, being priced in USD, often moves inversely to the US dollar. Prior to this decline, gold prices had rallied nearly 2.8% on Monday as the dollar weakened significantly during that session. This recent volatility is characteristic of gold’s performance over the past month, fluctuating within a broad range of $3,100-3,400/oz.

According to some analysts, seasonal factors are also influencing gold prices. “The market is entering a period known for the summer doldrums. As a result, there is an expectation that gold prices may pull back slightly or enter a period of consolidation,” said David Meger, director of metal trading at High Ridge Futures, in an interview with Reuters.

Investors are cautious ahead of the anticipated phone call between Trump and Xi, which is expected to focus on trade and tariff issues. The call comes amidst recent accusations from both Washington and Beijing of violating the trade truce agreed upon in Geneva last month.

In another development related to Trump’s trade policies, the US has sent letters to its negotiating partners, urging them to submit proposals to the US by Wednesday’s deadline to advance the negotiations. Meanwhile, the European Commission has stated it will do whatever it takes to be exempt from US tariffs, despite Trump’s decision on Tuesday to sign an order doubling tariffs on steel and aluminum imports to 50%.

Market participants are also awaiting key economic data, including the US non-farm payrolls report for May, which is expected to be released on Friday. Additionally, they are closely monitoring statements from Fed officials this week for insights into the future direction of monetary policy.

“I believe the Fed is ready to resume interest rate cuts, but it may be as far out as September before they do so. The prospect of Fed rate cuts is another factor weighing on the US dollar and providing some support for gold,” Meger added.

Many analysts remain bullish on gold’s long-term prospects, citing factors such as expectations of lower interest rates, geopolitical uncertainties, and continued central bank gold purchases. These factors have contributed to gold’s impressive performance so far this year, with prices surging nearly 28% since the start of 2025.

In a sign of continued risk aversion among investors, the SPDR Gold Trust added 2.6 tons of gold to its holdings on Tuesday, bringing its total holdings to nearly 935.7 tons. After purchasing approximately 8 tons of gold last week, the fund has bought an additional 5.5 tons in the first two sessions of this week.

“Oil Prices Surge to a Two-Week High: A Market Update”

The energy complex witnessed a boost on June 3rd, with oil prices reaching a 2-week high. Silver maintained its strength, holding near a 7-month high, while gold experienced a notable decline of almost 1%. In contrast, rubber plunged to a 1-year low, and raw sugar prices plummeted to levels not seen in 4 years, creating a challenging environment for commodities.

“Global Markets on June 3rd: Oil Prices Surge by Almost 3%, Robusta Coffee Plunges to a 7-Month Low”

As of the market close on June 2nd, oil prices surged by nearly 3%, while natural gas and gold reached their highest levels in three weeks. Silver shone even brighter, climbing to its highest point in over seven months. Conversely, Robusta coffee prices plummeted to a seven-month low, marking a stark contrast in the commodities market.

Is Now the Right Time to Buy or Sell Gold?

The domestic gold price has been on a downward spiral in recent sessions, leaving many investors wondering whether now is the time to buy or sell.