Deputy Governor Pham Thanh Ha speaking at the conference

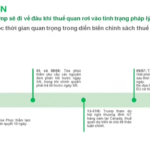

At the conference on implementing the National Assembly’s Resolution 201 on special mechanisms and policies for social housing development, Deputy Governor of the State Bank of Vietnam (SBV) Pham Thanh Ha announced that the SBV had worked with commercial banks on preferential credit packages for young people under 35 years old buying social housing. Based on the banks’ expressions of interest, on May 29, 2025, the SBV issued Document No. 4290/NHNN-TD on deploying preferential loans for young people under 35 years old to buy social housing for a period of 15 years. Specifically, the interest rate for the first five years will be 2% lower, and for the next 10 years, it will be 1% lower than the average medium and long-term VND lending rate.

“The interest rate for the first five years will be 2% lower, and for the next 10 years, it will be 1% lower than the average medium and long-term VND lending rate,” said the Deputy Governor.

Earlier, at the meeting of the Government’s Standing Committee with commercial banks to accelerate, break through, promote growth, and control inflation, and at the conference between the Government and localities, the Prime Minister directed: Establish a credit package to support young people (under 35) to buy houses and strongly promote social housing credit.

Immediately following the Prime Minister’s instructions, many banks quickly deployed low-interest loan packages to remove capital bottlenecks for home buyers. For example, Asia Commercial Joint Stock Bank (ACB) offers the “First Home” credit package for young people with preferential interest rates from 5.5%/year and a maximum loan term of 30 years. Similarly, banks such as PVcomBank, SHB, ABBank, and others have also launched preferential home loan packages.

“Affordable Housing Should Be Accessible, Not Relegated to Inaccessible Locations: Prime Minister”

In the afternoon of June 2nd, Prime Minister Pham Minh Chinh chaired a conference to deploy Resolution 201/2025/QH15 of the National Assembly on piloting several special mechanisms and policies for the development of social housing and reviewing and evaluating the situation of social housing development in the first five months of 2025, as well as the implementation plan for the remaining months of this year.

Allow Private Investors to Build Social Housing Without Bidding from July 1st

With a new resolution in effect from July 1st, 2025, social housing and accommodation for armed forces projects will be allocated to investors without a bidding process. This streamlined approach is part of a pilot program that tests special mechanisms and policies to accelerate the development of much-needed social housing.

“Vice Governor: Youth Under 35 to Enjoy Subsidized Loans for Affordable Home Ownership”

“A standout initiative, according to the Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, is the introduction of a dedicated credit package for individuals under 35 years of age to purchase social housing. This initiative stands alongside the comprehensive program outlined in Resolution 33.”

Mr. Tran Hoang Son (VPBankS): The Market Prepares for the September – October Wave

In May, the VN-Index reached a high of nearly 1,348 points and several Fibonacci resistance levels. As such, it’s not surprising to see some corrective sessions in early June. Should a pullback opportunity present itself in mid or late June, medium-term investors can consider entering the market to position themselves for the potential wave in September-October.