Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code HAG) has just announced additional information to be presented to shareholders at the upcoming Annual General Meeting of Shareholders.

Issuing 210 million shares to swap debt with Group B bondholders

HAGL plans to approve the proposal to handle its bond debt to Group B bondholders by issuing shares in exchange for part of the debt.

The total principal amount of the bond debt is VND 2,000 billion, and the interest accrued as of December 31, 2024, amounts to VND 1,936.5 billion. These bonds are expected to mature on December 30, 2026.

HAGL will issue 210 million shares to all Group B bondholders to swap a portion of the debt. The maximum expected debt to be swapped is VND 2,520 billion.

In parallel, HAGL also proposed to cancel the 2023 ESOP issuance and replace it with a bonus share issuance for employees.

2025 revenue from pig farming to resume, with an expected profit of VND 1,114 billion

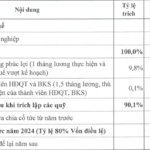

In terms of business performance, HAGL forecasts a revenue of VND 5,514 billion for 2025, with fruit sales accounting for 76%, pig farming contributing 19%, and the remaining 5% from other goods.

The company targets a net profit of VND 1,114 billion.

For the fruit business, HAGL does not plan to invest in new crops but will instead maintain the current area, focusing on caring for existing trees such as bananas, durians, and macadamia.

In the pig farming segment, the company will not expand its pigsties but will concentrate on improving operational and management efficiency.

According to the consolidated financial statements for the first quarter of 2025, HAGL recorded a revenue of nearly VND 1,379 billion, an increase of 11.2% compared to the same period last year. After deducting taxes and fees, the company reported a net profit of over VND 360.4 billion, up 59.2% from the first quarter of 2024.

“HAGL Proposes Issuing 210 Million Shares to Swap Bond Debt, with a Focus on Fruit-Centric Business Ventures”

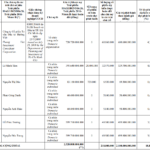

At the upcoming 2025 Annual General Meeting, HAG is expected to propose a plan to issue 210 million shares at VND 12,000 per share to swap bond debts with eight bondholders. These bondholders include several individuals who have lent the company billions of VND, ranging from tens to hundreds of billions.

“Nội Bài Cargo Announces Cash Dividend of VND 8,000 per Share, Stock Inches Up”

The growth of e-commerce, coupled with the Red Sea conflict, has boosted air cargo volumes, lining the pockets of shareholders of Noi Bai Cargo Services Joint Stock Company (NCTS, HOSE: NCT).