In the latest development, Hoang Anh Gia Lai Joint Stock Company (HAGL) has proposed a debt restructuring plan by issuing bond-swap shares, as per the resolution dated June 2, 2025. The company also unveiled its 2025 business plan, with a significant focus on the fruit segment.

Specifically, the HAGL Board of Directors proposed to issue shares to swap a portion of the debt from Bond Group B, which was issued in late 2016, covering the entire principal and accrued interest.

The bond, with the code HAGLBOND16.26, was issued on December 30, 2026, with a 10-year term. As of December 31, 2024, the bond’s principal amounted to VND 2,000 billion, along with nearly VND 1,940 billion in interest.

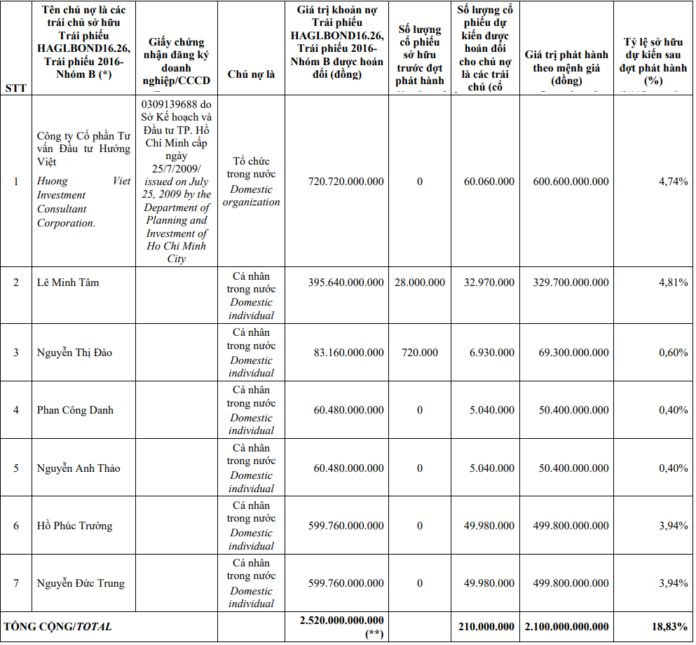

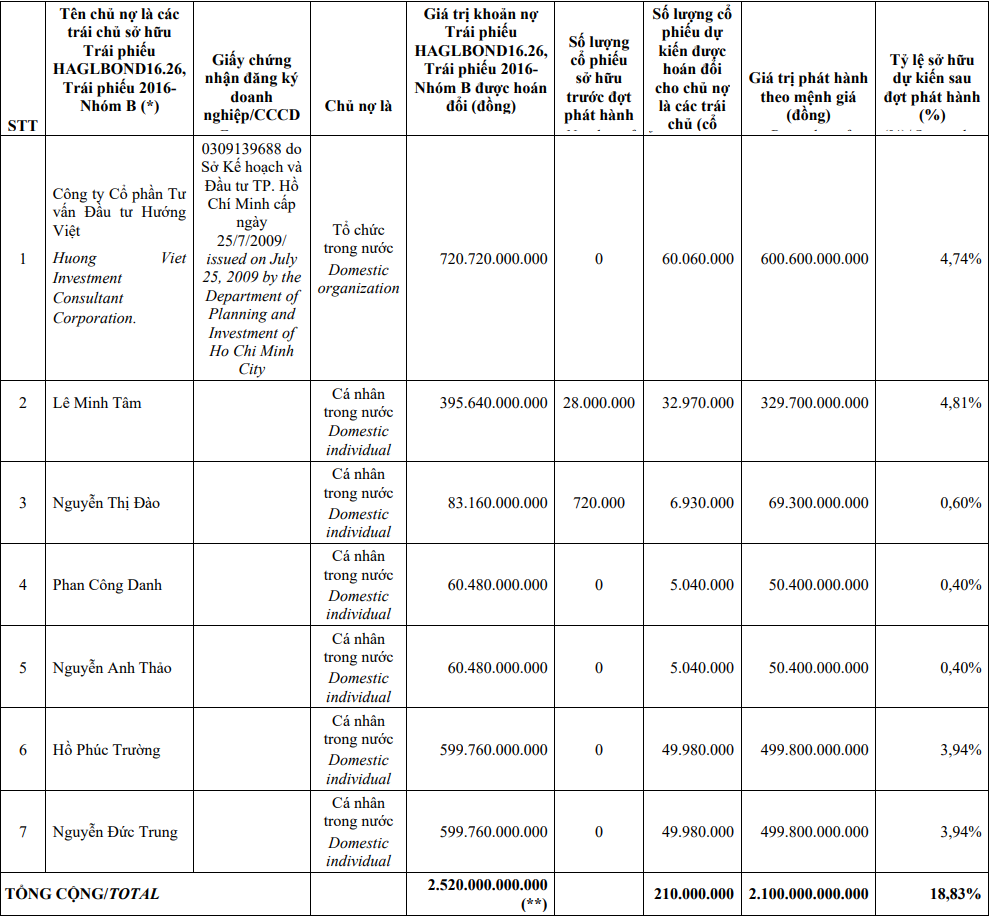

The company plans to issue 210 million shares (equivalent to nearly 70% of the current circulating shares) at a price of VND 12,000 per share, resulting in a maximum expected swap value of VND 2,520 billion. The issuance is targeted at eight bondholders of the aforementioned bond and is expected to take place in 2025, subject to the approval of the State Securities Commission (SSC).

According to the published bondholder list, Tu Van Dau Tu Huong Viet Joint Stock Company is currently the largest bondholder of HAGL, holding nearly VND 721 billion. They are expected to receive over 60 million shares, amounting to a 4.74% ownership stake if the issuance is successful. Additionally, there are two significant individual bondholders, Ho Phuc Truong and Nguyen Duc Trung, each holding nearly VND 600 billion in bonds. They are projected to receive nearly 50 million new shares, equivalent to a 3.94% stake post-issuance.

|

List of HAGL’s bondholders for the proposed issuance of 210 million shares

|

Along with the bond-swap share issuance, HAGL proposed to cancel the employee stock ownership plan (ESOP) that was previously approved at the 2023 Annual General Meeting of Shareholders (AGM). Instead, a new ESOP will be presented at the upcoming AGM, taking into account the actual situation and the need to adjust employee compensation policies.

The company plans to issue an additional 12 million ESOP shares to members of the Board of Directors and employees who have worked for the company for at least ten years. The shares will be subject to transfer restrictions in phases: 10% transferable after three years from the issuance date, an additional 10% after four years, and fully transferable after five years. The issuance is expected to take place in 2026 or at an appropriate time, following written notification from the SSC.

Furthermore, the HAGL Board of Directors announced the 2025 business plan, targeting revenue of over VND 5,500 billion, a decrease of approximately 5%. The fruit segment (bananas and durians) is expected to contribute the largest proportion of 76% to the revenue. Hog farming is projected to account for 19% of revenue, with the remaining coming from other goods. The company aims to achieve a profit after tax of over VND 1,100 billion, representing a 5% growth rate. If successful, it will be the fourth consecutive year of achieving profits exceeding VND 1,000 billion.

HAGL stated that it has no plans for new investments in 2025. Instead, the company will focus on maintaining the stability of its existing fruit plantation areas (bananas, durians, and macadamia) and improving the efficiency of its hog farming operations.

The 2025 AGM of HAGL is scheduled for the morning of June 6, 2025.

Thaigroup and LPBS nominate members to HAGL’s Board of Directors

Chau An

– 11:17, June 4, 2025