Deputy Governor of the State Bank of Vietnam, Pham Thanh Ha, shared the above information at a conference on implementing the National Assembly’s Resolution 201 on special mechanisms and policies for social housing development, held by the government on the afternoon of June 2, 2025.

According to the Deputy Governor, since the implementation of the credit program under Resolution 33, the State Bank has been working closely with ministries, sectors, and local authorities. It also directed commercial banks and branches of the State Bank in provinces and cities to actively get involved. A hotline was established, and each investor and project was scrutinized to identify specific difficulties and obstacles in accessing loan capital.

To date, the State Bank has issued 11 documents guiding credit institutions and local State Bank branches to remove bottlenecks. At the same time, the State Bank has coordinated with the Ministry of Construction to organize and participate in 10 conferences to promote the program’s implementation.

This year, following the Prime Minister’s instructions, the State Bank issued Document No. 55 on January 3, 2025, allowing commercial banks participating in the program not to count loan balances against annual credit growth targets.

The State Bank also issued two documents instructing credit institutions to regularly review loan procedures, paperwork, and conditions to make it more accessible for people and businesses, while still ensuring compliance with the law.

“Regarding the implementation results, according to the State Bank’s report, nine commercial banks have registered to participate in the program with a total credit limit of VND 145,000 billion,” said Deputy Governor Pham Thanh Ha.

The most significant difficulty in implementing the social housing credit package is the limited supply.

Regarding interest rates, the Deputy Governor said that the State Bank has continuously instructed credit institutions to reduce costs, apply information technology, and take other management measures to lower interest rates. Since the program’s launch, the State Bank has announced interest rate adjustments five times, gradually reducing them. Currently, the lending rate has decreased to 6.6% per annum for investors and 6.1% per annum for home buyers.

As of April 30, 2025, 38 out of 63 provinces and cities have sent documents or announced lists of social housing projects participating in the program. In total, about 100 projects nationwide have been included in the list.

Commercial banks have committed to providing about VND 7,800 billion in credit, of which VND 3,866 billion will be disbursed. Of this, VND 3,281 billion will go to investors, and VND 585 billion will be for home buyers.

According to reports from State Bank branches in provinces and cities, out of the 100 social housing projects nationwide, 53 have received loans. Twenty-eight projects did not require loans as they could arrange capital independently or because the projects had not reached the capital mobilization stage. The remaining 19 projects are mostly new, and commercial banks are considering providing loans.

Governor’s Delight: Special Interest Rates for Under-35s to Buy Social Housing

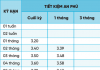

With this program, you can enjoy significantly lower interest rates for the first 5 years, at 2% less per year, and for the subsequent 10 years, rates will be 1% lower annually compared to the conventional long-term VND lending rates.

“Affordable Housing Should Be Accessible, Not Relegated to Inaccessible Locations: Prime Minister”

In the afternoon of June 2nd, Prime Minister Pham Minh Chinh chaired a conference to deploy Resolution 201/2025/QH15 of the National Assembly on piloting several special mechanisms and policies for the development of social housing and reviewing and evaluating the situation of social housing development in the first five months of 2025, as well as the implementation plan for the remaining months of this year.

Allow Private Investors to Build Social Housing Without Bidding from July 1st

With a new resolution in effect from July 1st, 2025, social housing and accommodation for armed forces projects will be allocated to investors without a bidding process. This streamlined approach is part of a pilot program that tests special mechanisms and policies to accelerate the development of much-needed social housing.

Prime Minister: Implement Special Mechanisms for Social Housing and Establish the National Housing Fund by June

Prime Minister demands immediate action from the Ministry of Construction: Streamline cumbersome procedures and establish a National Housing Fund by June 2025.

“Vice Governor: Youth Under 35 to Enjoy Subsidized Loans for Affordable Home Ownership”

“A standout initiative, according to the Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, is the introduction of a dedicated credit package for individuals under 35 years of age to purchase social housing. This initiative stands alongside the comprehensive program outlined in Resolution 33.”