Regarding this issue, Mr. Nguyen Quang Huy, CEO of Finance and Banking at Nguyen Trai University, advised that people should not merely consider buying or selling gold but should instead incorporate it into a clear personal financial plan.

If individuals purchased gold at a high price, they should refrain from panic-selling and instead monitor the market for a few weeks to assess the stability of the trend.

Moreover, gold should not be regarded as the sole investment avenue. Mr. Huy suggested that people need to shift their mindset from gold speculation to asset management and business production. Instead of holding onto a defensive mindset of “hoarding gold and waiting for the right time,” individuals and investors should gradually redirect their capital towards production and business, areas that create real value and employment for society, he added.

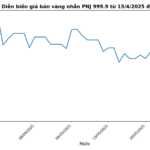

Gold prices in the domestic market have been continuously declining in recent sessions. (Illustrative image: Cong Hieu)

Meanwhile, offering advice on whether to buy or sell gold at this juncture, expert Tran Duy Phuong suggested that those who previously purchased gold for asset accumulation need not be overly concerned about offloading their holdings at this point. Over time, gold prices will rise again.

For investors, the current price range is not too high, but it is still ideal for selling and realizing profits.

To determine the right time to sell gold, investors need to set a plan for their expected profits and should be content with the planned profits rather than regretting not selling earlier, anticipating further price increases, explained Mr. Phuong.

For instance, if we bought gold at VND 100 million per tael and set a profit target of VND 10 million per tael, then when the gold price reaches VND 110 million or VND 118 million per tael, as it is now, the profit target has been achieved, and even exceeded. Therefore, investors should sell to lock in profits. One should not hold onto regrets about not selling earlier, as that could be risky in a volatile market, he analyzed.

The expert also cautioned that gold investors need to be cautious and thoroughly research the market to ensure they buy gold when prices are at their lowest and sell when they reach their highest or meet their profit expectations.

Echoing this sentiment, economic expert Nguyen Tri Hieu advised that investors with idle funds should not concentrate solely on gold but instead diversify their investments across various avenues such as stocks, real estate, and bank deposits.

Conversely, for those with gold reserves who wish to sell and realize profits, they can calculate whether the current profit level aligns with their predefined goals.

If one invests in gold to make a profit, it is necessary to set an annual profit target. This way, you can calculate the desired gold price for selling and, once that target profit is achieved, sell to lock in the profit, advised Mr. Hieu.

Gold prices to continue declining

Mr. Nguyen Quang Huy predicted that the sharp decline in domestic gold prices recently is not merely due to supply and demand factors but also results from fundamental changes in the management of the gold market to narrow the price gap between domestic and international markets.

After a long period where domestic gold prices were VND 10-20 million higher than global prices, the government has sent a strong message about restoring the economic nature of the gold market. The policy to eliminate gold bar monopolies and expand market participants is a decisive step towards re-establishing market discipline, Mr. Huy stated.

Additionally, the consideration of establishing a domestic gold exchange marks a significant turning point, aiming for transparent pricing, public disclosure of volumes, and reduced speculation and manipulation.

These factors have influenced the herd mentality, which previously pushed gold prices higher, and now drives the selling trend. As confidence in rising gold prices erodes, the market naturally self-corrects.

Moreover, global gold prices are no longer a “safe haven” due to pressure from a stronger US dollar, the Fed’s delay in cutting interest rates, and unresolved inflation concerns. Hence, gold is not an automatic haven during crises or heightened uncertainty.

Based on these observations, Mr. Huy forecast that gold prices in Vietnam would decline in the short term and, in the long term, would move in tandem with global trends as the market is reorganized with enhanced transparency and professionalism.

On June 2nd, gold bars were quoted by Doji and SJC at VND 116-118 million/tael (buying-selling). Meanwhile, gold jewelry was quoted at VND 111.2-113.7 million/tael.

Consequently, within just one week, gold bar buyers suffered a loss of VND 5 million per tael, while gold jewelry buyers lost VND 4.8 million per tael.

By the end of the afternoon, the precious metal had reversed course and climbed higher. Gold bars were quoted at VND 115.8-117.8 million/tael.

The $2.2 Million Dollar Question: Upgrading the Island Airport, Will We Choose a Domestic Investor and Create a “Made by Vietnam” Landmark?

The government has unveiled plans to expand the international airport on the island city. In a bid to boost tourism and economic growth, the resolution includes investments to enhance the airport’s capacity and infrastructure.

A Dynamic Approach to Administrative Efficiency: Exploring Multi-Site Operations for a Seamless Transition

I hope that captures the essence of your request. Let me know if you would like me to elaborate on this title or provide any additional creative inputs.

“In a recent directive, the Prime Minister has outlined a strategic approach to managing the transition during the initial stages of administrative unit reorganization. Acknowledging the challenges posed by infrastructure and transportation logistics, the directive emphasizes the importance of maintaining multiple office locations. This decision aims to ensure uninterrupted governance in merged territories and alleviate travel and lifestyle inconveniences for civil servants and employees. The primary objective is to uphold seamless public service delivery to citizens without any disruptions.”

The Billionaire’s Stand: Why Tran Dinh Long Opted Out of the High-Speed Rail Race and Stuck to His Strengths

“In the past, Mr. Tran Dinh Long, Chairman of Hoa Phat Group, has repeatedly emphasized his focus on the core business domain where the company excels – steel. With a steadfast commitment to this core competency, Mr. Long has steered the group towards unparalleled success and established a formidable reputation in the industry.”