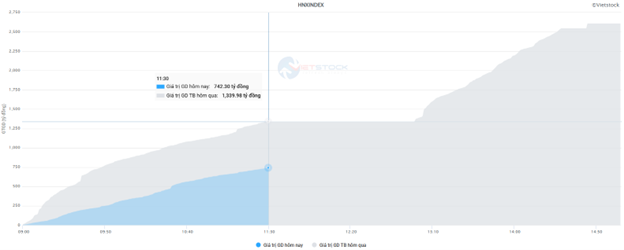

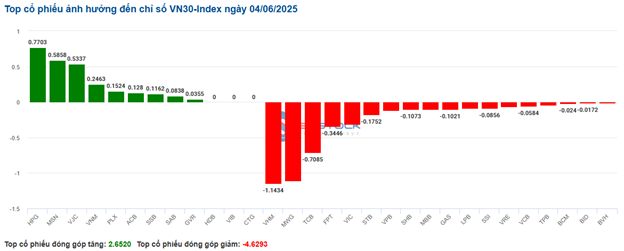

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 786 million shares, equivalent to a value of over 17 trillion dong; HNX-Index reached over 73.2 million shares, equivalent to a value of more than 1.2 trillion dong.

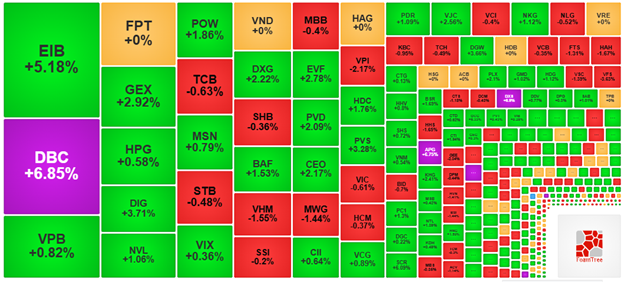

VN-Index opened the afternoon session with increased selling pressure, causing the index to weaken despite the return of buyers at the end of the session, but the index still closed in the red. In terms of impact, GAS, VHM, TCB, and VCB were the codes with the most negative impact on the VN-Index, with a decrease of 1.8 points. On the other hand, VNM, EIB, MSN, and VJC were the codes that remained green and contributed more than 1.9 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on 04/06/2025 (in points) |

In contrast, the HNX-Index had a rather optimistic performance, with the index positively impacted by the codes THD (+6.34%), PVS (+3.61%), HUT (+1.5%), and TIG (+5.41%)…

|

Source: VietstockFinance

|

The utilities sector was the group with the largest decrease in the market, falling by 1.19%, mainly due to the codes GAS (-1.52%), REE (-0.82%), DNH (-13.04%), and GEG (-0.6%). This was followed by the materials and financial sectors, which decreased by 0.47% and 0.36%, respectively. On the other hand, the energy sector was the group that recorded a positive performance, with an increase of 1.65%, mainly contributed by PVS (+3.61%), PVD (+1.57%), and PVC (+0.98%).

In terms of foreign trading, foreigners net sold more than 31 billion dong on the HOSE exchange, focusing on the codes VHM (133.54 billion), STB (118.47 billion), DXG (71.18 billion), and MWG (56.52 billion). On the HNX exchange, foreigners net sold more than 3 billion dong, focusing on the codes CEO (8.53 billion), VFS (4.84 billion), PVS (4.16 billion), and BVS (4.01 billion).

| Foreign buying and selling dynamics |

Morning session: The market was clearly divided

VN-Index continued to fluctuate around the reference level in the late morning session, taking a mid-session break with a slight decrease of 0.64 points (-0.05%), reaching 1,346.61 points. Meanwhile, the HNX-Index continued its impressive winning streak, adding 1.74 points (+0.76%) to reach 230.68 points. The breadth of the market was slightly higher on the upside, with 353 gainers and 290 losers.

On the HOSE exchange, trading value did not change much compared to the same period yesterday, reaching nearly 12 trillion dong. However, the liquidity of the HNX exchange decreased by almost half, indicating that investors are becoming more cautious.

Source: VietstockFinance

|

In the top stocks with the most positive impact on the VN-Index this morning, no code contributed too significantly, with EIB leading but only adding more than half a point. On the other hand, VHM, with its overwhelming capitalization, took away more than 1.1 points from the index. Other stocks had a negligible impact.

Source: VietstockFinance

|

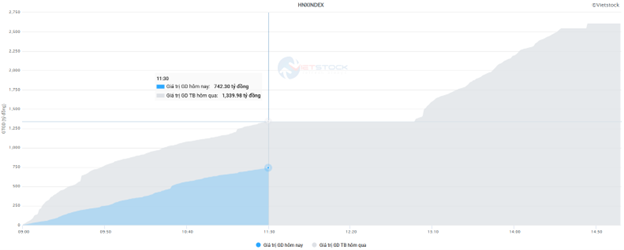

The most attractive liquidity highlights this morning included EIB (+5.18%), DBC hitting the ceiling, GEX (+2.92%), DIG (+3.71%), NVL (+1.06%), and POW (+1.86%), DXG (+2.22%), BAF (+1.53%), and PVD (+2.09%). Notably, most of these were also among the codes with the strongest net foreign buying in the morning session.

| Top 10 stocks with the strongest foreign buying and selling in the morning session of 04/06/2025 |

In terms of sectors, only the energy and telecommunications groups ended the morning session with a notable increase of more than 1.4%, thanks to the main contributions from PVS (+3.28%), PVD (+2.09%), BSR (+1.69%); VGI (+1.62%), and FOX (+1.95%). The remaining sectors continued to fluctuate with a mix of green and red.

10:30: Cautious sentiment prevailed, with PVS and PVD continuing to perform well

Investor caution caused the market’s main indices to fluctuate and hover around the reference level. As of 10:30, the VN-Index fell slightly by 1.17 points, trading around the 1,346-point level. The HNX-Index rose by 1.09 points, trading around the 230-point level.

Stocks in the VN30 basket showed a mixed performance, but selling pressure gradually became more dominant. Specifically, VHM, MWG, TCB, and FPT took away 1.14 points, 1.11 points, 0.71 points, and 0.34 points from the index, respectively. On the other hand, HPG, MSN, VJC, and VNM were among the few codes that managed to stay in positive territory, contributing more than 2.1 points to the VN30-Index.

Source: VietstockFinance

|

The market reversed its early gains and fell slightly by 0.03%. The energy group maintained its position as the best-performing sector, with a gain of 1.8%. This was driven by PVS (+3.28%), PVD (+2.09%), PVC (+0.98%), and PVB (+0.34%). On the other hand, some codes remained in negative territory, such as TMB (-0.58%), MGC (-1.59%), and THT (-1.2%).

Meanwhile, the real estate sector, which has the second-largest market capitalization after the financial sector, recorded a decline amid a highly divided performance. VHM fell by 1.29%, BCM fell by 0.49%, and NVL fell by 1.06%… On the upside, only a few codes managed to stay in positive territory, such as SSH (+0.56%), DXG (+1.9%), DIG (+0.86%), and HDG (+0.93%)… However, their gains were not significant.

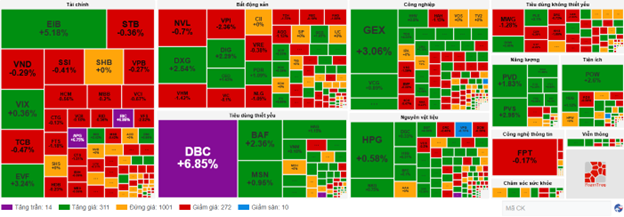

Compared to the opening, the buying side still held a slight advantage. There were 311 gainers and 272 losers.

Source: VietstockFinance

|

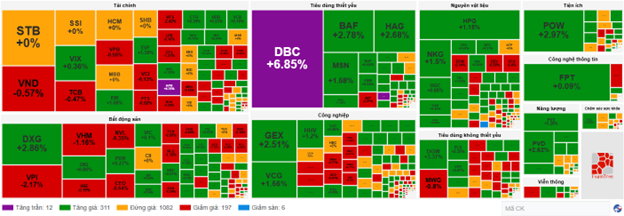

Opening: Green dominated the early session, with DBC hitting the ceiling at the opening

At the opening of the 04/06 session, as of 9:50, the VN-Index rebounded and fluctuated around the 1,348-point level. The HNX-Index also rose slightly by 0.89 points, hovering around the 229-point level.

The VN30 basket showed a mixed performance, with a slight advantage for the gaining side. Specifically, there were 13 gainers, 11 losers, and 6 codes trading at reference prices.

The energy sector continued to be among the best-performing groups in the market at the opening, with PVS and PVD increasing by 2.3% and 1.57%, respectively.

The materials sector also contributed to the market’s strength, with all codes trading in positive territory. Specifically, stocks such as HPG (+1.15%), GVR (+0.51%), DGC (+0.88%), KSV (+1.45%), VGC (+0.11%), and HSG (+0.92%) all recorded gains.

In addition, it is worth noting that consumer staples stocks also traded in positive territory. Notably, DBC hit the ceiling at the opening after news that the company requested the Ministry of Public Security to investigate allegations of selling diseased pork. Other gainers included HAG (+1.92%), MSN (+1.11%), and BAF (+2.78%)…

As of 9:50, the market continued to show a mixed performance, but the buying side maintained a slight advantage. There were 311 gainers, 197 losers, and more than 1,000 codes trading at reference prices.

Source: VietstockFinance

|

– 15:25 04/06/2025