I. MARKET ANALYSIS OF STOCKS AS OF JUNE 4, 2025

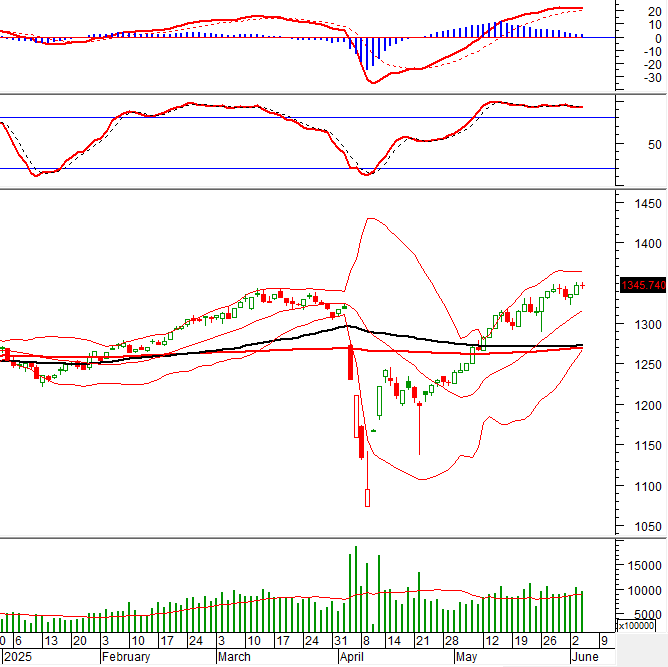

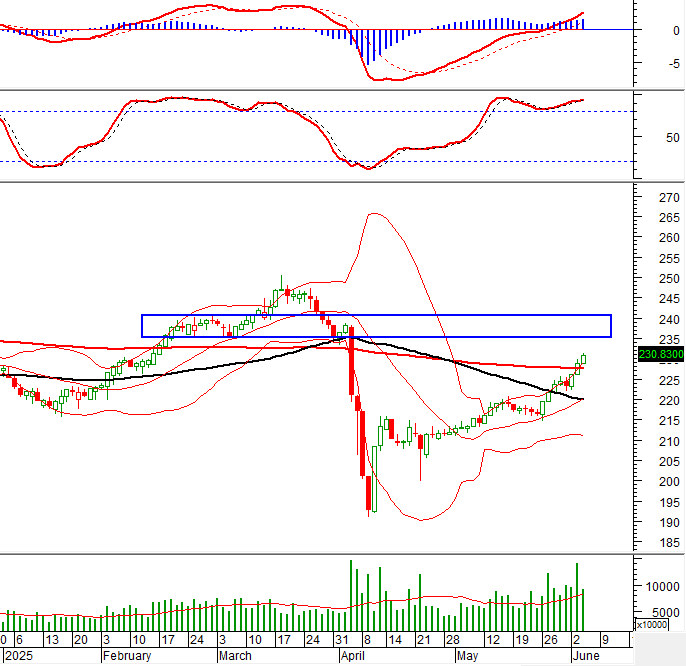

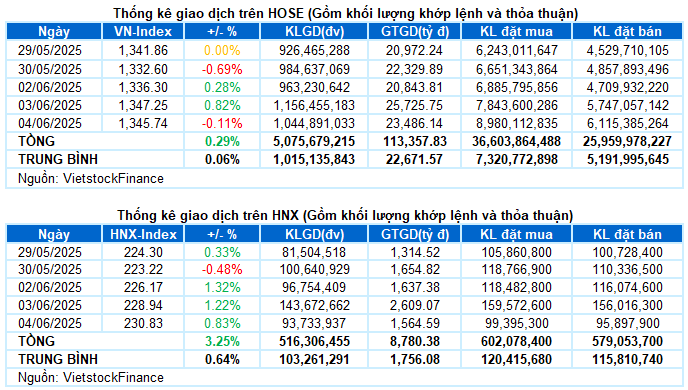

– The main indices showed mixed performance during the trading session on June 4th. Specifically, the VN-Index edged down 1.51 points (-0.11%) to 1,345.74. In contrast, the HNX-Index climbed 1.89 points (+0.83%) to reach 230.83.

– Market liquidity declined significantly compared to the previous session’s high. The matched order volume on the HOSE decreased by 24%, reaching over 786 million units. Similarly, the HNX recorded over 73 million units, a drop of 47.8%.

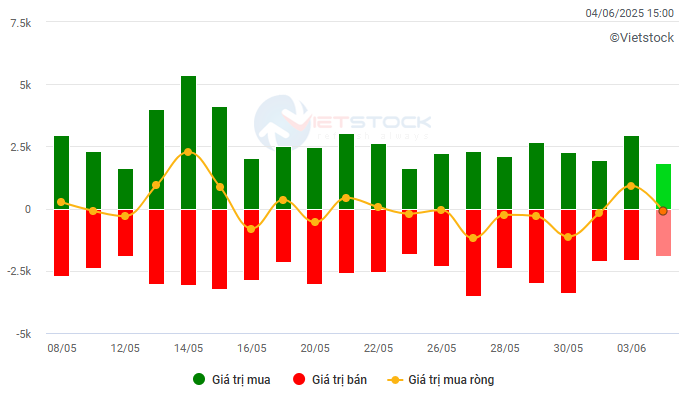

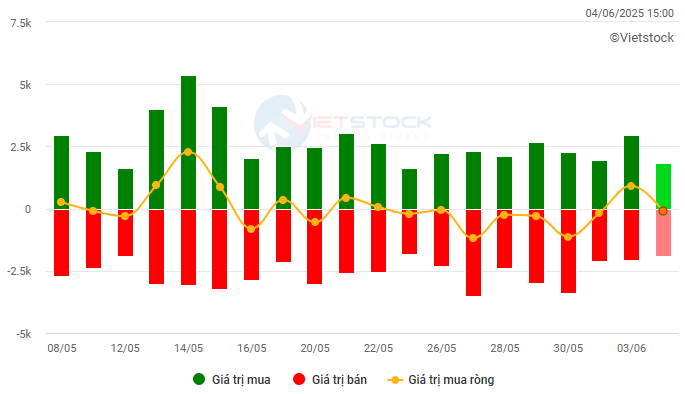

– Foreign investors turned to net sellers with a slight margin, recording a net sell value of nearly VND 60 billion on the HOSE and over VND 3 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM. Unit: VND billion

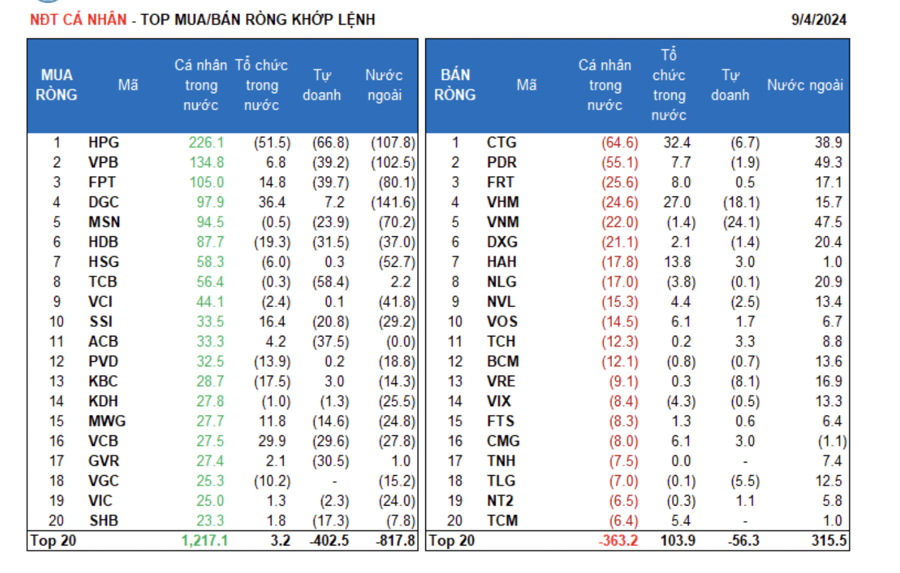

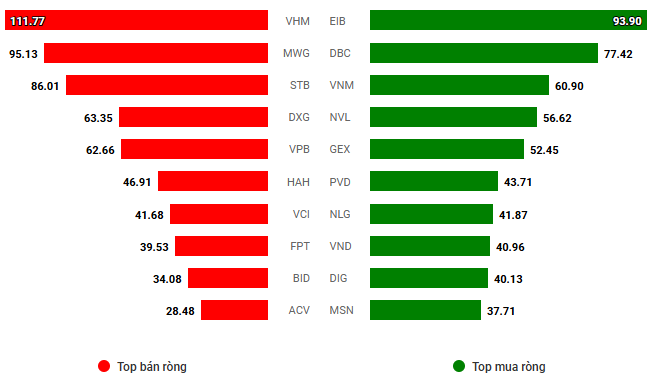

Net trading value by stock code. Unit: VND billion

The market experienced volatility during the June 4th session. The VN-Index fluctuated around the reference level throughout the morning session. Despite scattered bright spots in various sectors with active trading, the lack of momentum from large caps prevented the index from breaking higher. The afternoon session saw continued fluctuations between gains and losses, with decreasing liquidity towards the end, resulting in a slight decline of 0.11% for the VN-Index, closing at 1,345.74.

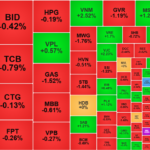

– In terms of contribution to the VN-Index, VNM and EIB were the most positive influencers, each contributing approximately 0.7 points to the index’s gain. Conversely, GAS, VHM, and TCB led the decliners, taking away more than 1.5 points from the overall index.

– The VN30-Index closed 0.18% lower at 1,435.28. The decliners outnumbered the advancers, with 21 stocks falling, 6 rising, and 3 remaining unchanged. MWG topped the losers’ list with a nearly 2% drop. It was followed by GAS, STB, SSI, GVR, and TPB, which all adjusted by more than 1%. On the other hand, VNM and VJC were notable gainers, rising 2.5% and 2.2%, respectively.

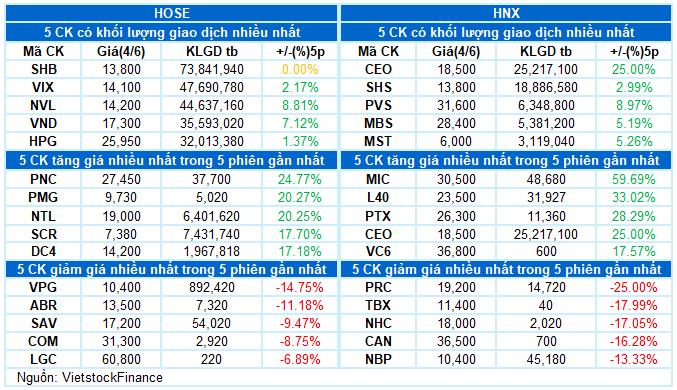

Sectors showed clear divergence. The energy sector led the market with a 1.65% gain, driven mainly by large caps such as BSR (+1.41%), PVS (+2.62%), and PVD (+1.57%). However, most other stocks in this sector remained unchanged or posted slight losses.

Additionally, telecommunications and non-essential consumer goods sectors also witnessed significant gains, with green signals across VGI (+1.32%), FOX (+1.41%), YEG (+3.32%); VNM (+2.52%), MSN (+1.26%), SAB (+1.21%), HAG (+1.15%), MML (+4.85%), BAF (+1.67%), and DBC hitting the ceiling price.

In contrast, utilities experienced the most negative adjustment, falling by 1.19%. This decline was influenced by the downward movement of stocks like GAS (-1.52%), REE (-0.82%), DNH (-13.04%), PGC (-0.96%), TDM (-1.1%), NT2 (-0.79%), and others.

Furthermore, there were multiple bright spots among small and medium-sized real estate stocks. Notably, SCR, DXS, QCG, EVG, and CRE all hit the ceiling price, while NTL (+%), HQC (+%), HDC (+%), TIG (+%), and IDJ (+%) also posted gains. However, the overall index for this sector remained slightly in the red as most large-cap stocks in the industry traded below the reference level.

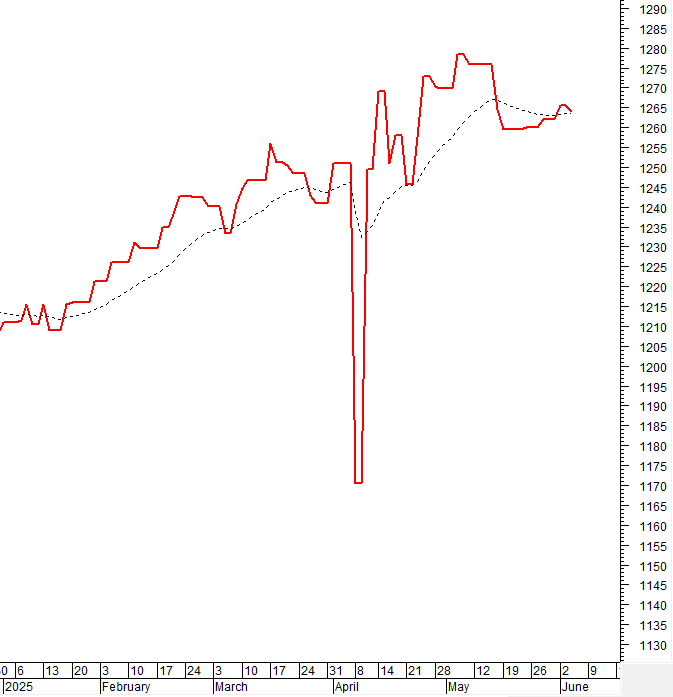

The VN-Index witnessed a minor decline amid fluctuating trading and decreasing liquidity below the 20-day average. A throwback phenomenon is occurring as the VN-Index has just broken through a strong resistance zone (1,320-1,340 points). Currently, the MACD indicator is narrowing the gap with the Signal line in recent sessions. If this indicator triggers a sell signal in the near future, there may be a risk of short-term corrections.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD Indicator May Signal a Sell

The VN-Index witnessed a minor decline amid fluctuating trading and decreasing liquidity below the 20-day average. This decline occurred as the index experienced a throwback phenomenon after breaking through a strong resistance zone of 1,320-1,340 points.

At present, the MACD indicator is narrowing the gap with the Signal line in recent sessions. If a sell signal is triggered in the upcoming sessions, there could be a potential risk of short-term corrections in the market.

HNX-Index – Aiming for the February 2025 Peak

The HNX-Index posted its third consecutive gaining session and closely followed the Upper Band of the Bollinger Bands. The index’s next target is the peak reached in late February 2025, which corresponds to the 235-240-point zone.

Currently, the MACD indicator continues to rise and widen the gap with the Signal line after triggering a buy signal, suggesting that the index’s upward trend may persist in the near future.

Analysis of Capital Flows

Changes in Smart Money Flows: The Negative Volume Index indicator of the VN-Index has crossed above the EMA 20 line. If this status persists in the next session, the risk of an unexpected downturn (thrust down) will be mitigated.

Changes in Foreign Capital Flows: Foreign investors turned to net sellers during the trading session on June 4, 2025. If foreign investors maintain this stance in the upcoming sessions, the outlook may become more pessimistic.

III. MARKET STATISTICS AS OF JUNE 4, 2025

Analysis and Strategy Department, Vietstock Consulting and Investment

– 17:28 06/04/2025

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.

The Money Vacuum: Small Caps Suck In Cash, Weighing Down Indexes

The HoSE exchange witnessed a significant drop in liquidity today, falling by approximately 9% from the previous day, equating to a loss of over VND 2,000 billion. Amidst this decline, the VNSmallcap basket stood out as the sole exception, experiencing a slight uptick in liquidity. The representative index of this basket also outperformed the broader market, with numerous stocks reaching their ceiling prices.

The Ultimate Trading Stock Has Arrived

The VN-Index closed today’s session (June 3rd) at a year-to-date high of 1,347 points. The stock market witnessed a robust rally across securities as investors circulated rumors about the market upgrade progress. A notable highlight was the massive transaction by foreign funds, with over 37 million shares traded through a block deal in APG.

Market Pulse June 4th: A Tale of Two Markets

The VN-Index witnessed a tug-of-war around the reference mark in the morning session, closing the mid-session with a slight loss of 0.64 points (-0.05%), settling at 1,346.61. Meanwhile, the HNX-Index continued its impressive winning streak, adding 1.74 points (+0.76%) to reach 230.68. The market breadth tilted slightly towards the advancers, with 353 gainers versus 290 decliners.