Illustration

Oil Prices Reach a Two-Week High

Oil prices rose by 2% to a two-week high due to prolonged geopolitical tensions between Russia and Ukraine, as well as the likelihood of the US maintaining sanctions on both OPEC+ members, Russia and Iran, for an extended period.

On June 3rd, Brent crude oil prices closed at $65.63 per barrel, a 1.5% increase, while WTI oil prices rose by 1.4% to $63.41 per barrel.

Russia is a key member of OPEC+, which includes the Organization of the Petroleum Exporting Countries (OPEC) and its allies. In 2024, Russia was the world’s second-largest oil producer, only behind the United States.

Meanwhile, Iran, another OPEC member, has rejected America’s proposed nuclear deal, which could have eased sanctions on the major oil producer. Iran was the third-largest oil producer in OPEC in 2024, after Saudi Arabia and Iraq.

US Natural Gas Prices Remain at a Three-Week High

US natural gas prices rose by 1%, maintaining a three-week high, despite predictions of reduced demand and lower natural gas flows to liquefied natural gas (LNG) export plants over the next two weeks. This increase is attributed to lower production volumes in recent weeks.

The July 2025 natural gas futures on the New York Mercantile Exchange rose by 0.8%, or 2.8 US cents, to $3.722 per mmBTU, the highest since May 9, 2025.

Gold Prices Drop by Nearly 1%, Silver Remains Near a Seven-Month High

Gold prices dropped by nearly 1% after reaching a near four-week high. The decline was driven by a stronger US dollar and investor caution ahead of the phone call between US President Donald Trump and Chinese leader Xi Jinping.

Spot gold on the LBMA fell by 0.9% to $3,352.3 an ounce, having touched its highest since May 8, 2025, earlier in the session. Gold futures for August 2025 on the New York COMEX fell by 0.6% to $3,377.1 an ounce. Gold prices have increased by 28% so far this year.

The US dollar strengthened by 0.5% from its one-month low earlier in the session, making gold more expensive for foreign buyers.

Gold is considered a safe-haven asset during political and economic uncertainty and tends to thrive in low-interest rate environments.

Silver followed a similar trend, with spot silver down by 0.8% to $34.51 an ounce, though it remained near a seven-month high reached in the previous session.

Copper Prices Hold Firm

Copper prices remained steady despite uncertainty over US tariff policies, which overshadowed better-than-expected manufacturing activity in top consumer China.

Three-month copper on the London Metal Exchange rose by 0.1% to $9,622.5 a ton.

On the Comex, copper prices fell by 0.5% to $4,835.5 a pound after touching $4,949.5 in the previous session due to concerns about potential tariff increases.

The price increase was limited by data showing a contraction in China’s manufacturing activity for the first time in eight months and a stronger US dollar.

Dalian Iron Ore Prices Hit Near Two-Month Low, Steel Rebars Decline

Dalian iron ore prices fell to their lowest level in nearly two months due to concerns about potential tariff increases and weak manufacturing data from top consumer China.

The September 2025 iron ore contract on the Dalian Commodity Exchange fell by 1.14% to 695.5 yuan ($96.69) a ton. Earlier in the session, iron ore touched its lowest since April 10, 2025, at 690.5 yuan.

The July 2025 iron ore contract on the Singapore Exchange also declined by 1.13% to $94.15 a ton, after hitting its lowest since April 10, 2025, at $93.8 earlier in the day.

Trump’s proposed tariff increase to 50% on steel and aluminum imports has heightened global trade tensions and put pressure on global steel producers.

China’s manufacturing activity for May 2025 contracted for the first time in eight months, following official data reporting a decline for the second consecutive month.

On the Shanghai Futures Exchange, steel rebar prices fell by 1.18%, hot-rolled coil dropped by 1.04%, stainless steel decreased by 0.59%, while steel wire remained unchanged.

Japanese Rubber Prices Hit Over a One-Year Low

Japanese rubber prices fell to their lowest level in over a year due to weak demand for tire manufacturing in top consumer China and expectations of higher supply as the rubber-tapping season approaches.

The November 2025 rubber contract on the Osaka Exchange (OSE) dropped by 1.34%, or 3.9 yen, to 287 yen ($2.01) per kg. Earlier in the session, rubber touched 280 yen, its lowest since February 13, 2024.

Meanwhile, the June 2025 rubber contract on the Singapore Exchange rose by 0.6% to 158.5 US cents per kg.

Coffee Prices Decline

London robusta coffee prices fell by 1.5%, or $68, to $4,337 a ton, after touching a nine-and-a-half-month low of $4,235 earlier in the session.

ICE arabica coffee followed a similar trend, falling by 1% to $3,408.5 a pound.

Raw Sugar Prices Hit a Four-Year Low

Raw sugar prices on ICE dropped to a four-year low due to improved crop productivity in Asia, contributing to the recent downward trend.

The raw sugar contract on ICE was unchanged at 16.9 US cents per lb after touching a four-year low of 16.66 US cents earlier in the session.

Refined sugar on the London market, on the other hand, rose by 0.6% to $473.7 a ton.

Soybean and Corn Prices Climb, Wheat Falls

Soybean prices on the Chicago Board of Trade rebounded from a seven-week low, boosted by higher crude oil prices, which positively impacted soybean oil.

Chicago Board of Trade July 2025 soybeans rose by 0.7% to $10.4-3/4 a bushel, and July soybean oil gained 1.2% to 46.81 US cents per lb. Corn for July delivery rose by 0.25% to $4.38-1/2 a bushel, while wheat for the same month fell by 0.55% to $5.36 a bushel.

Malaysian Palm Oil Prices Climb

Malaysian palm oil prices rose, following higher vegetable oil prices on the Dalian Commodity Exchange and India’s decision to reduce the base import tax on crude vegetable oils.

The August 2025 palm oil contract on the Bursa Malaysia rose by 1.44%, or 56 ringgit, to 3,934 ringgit ($927.83) a ton.

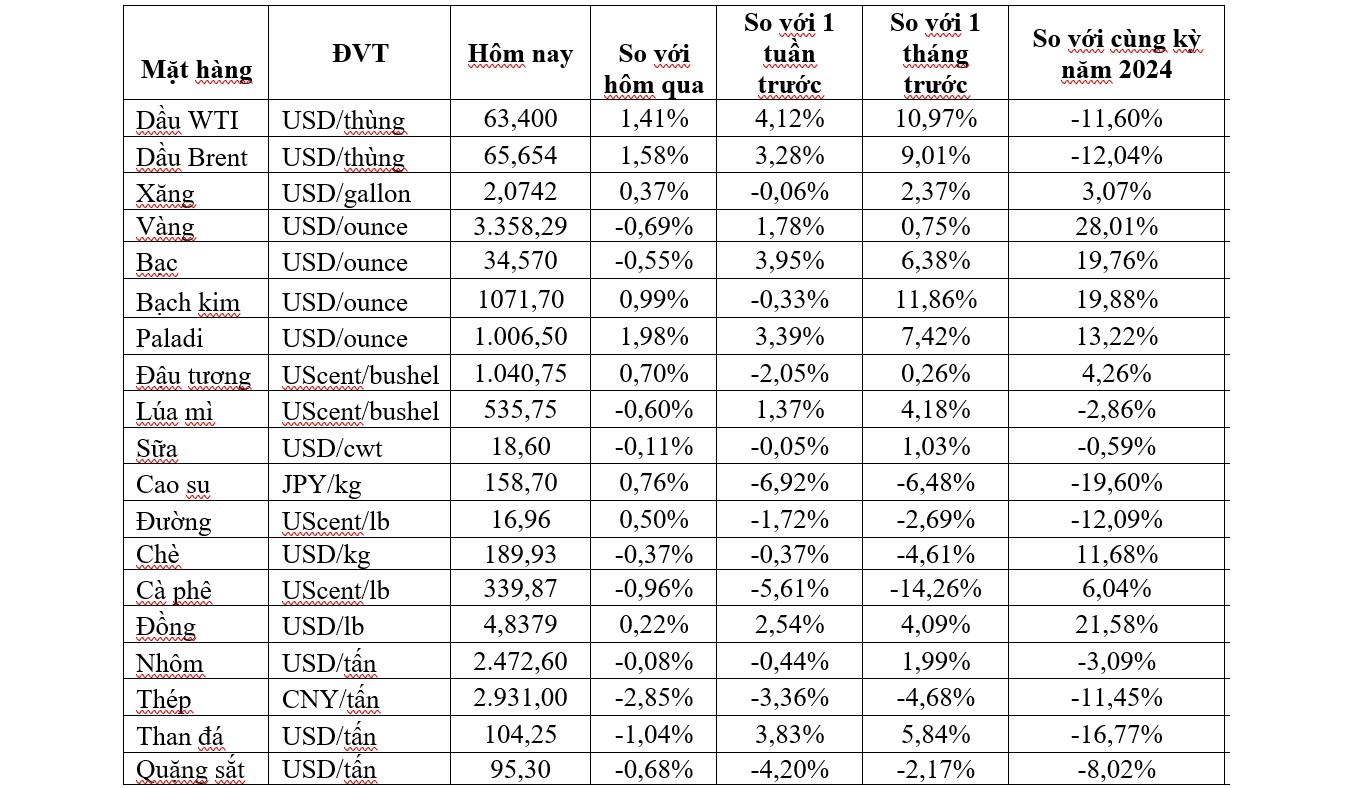

Key Commodity Prices as of June 4, 2025