Sao Ta’s 2-month revenue up 54%

FMC Chairman: We may exit the US in the worst-case scenario, it’s not easy to export to China

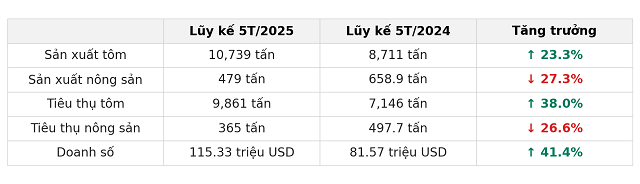

According to the recently published business report, in May 2025, Sao Ta recorded a revenue of 21 million USD, a 39% increase compared to the same period last year. This number could even be higher as some exports to the US under the DDP (Delivered Duty Paid) terms have not yet been recognized under Vietnamese accounting standards. Shrimp consumption volume reached 1,781 tons, up 28%.

Earlier, in April, the company witnessed a 46% revenue growth to nearly 24 million USD. Shrimp consumption volume for the period was close to 2,000 tons, up 37%.

For the first two months of the second quarter, total revenue reached almost 45 million USD, a 41% increase compared to the same period last year. Total shrimp consumption volume was 3,742 tons, up over 31%.

In the first five months of the year, Sao Ta’s shrimp consumption volume exceeded 9,860 tons, a nearly 38% increase. Revenue surpassed 115 million USD, a 41% increase, despite a significant decline in agricultural produce.

The Vietnam Association of Seafood Exporters and Producers (VASEP) stated that since April 2025, after the US announced a plan to temporarily suspend the 46% tax for 90 days, seafood exporters have accelerated shipments to this market to avoid the risk of higher taxes after July 9th.

Shrimp exports to the US in April even increased by 25%. However, shipping activities started to slow down after May 20th due to policy, cost, and market fluctuations, affecting the total trade value for the month.

Source: Author’s compilation

|

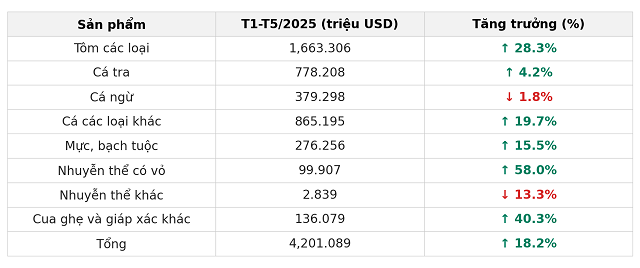

Shrimp is a bright spot in seafood exports

According to VASEP, the total export turnover of the industry in May 2025 reached 851 million USD, only a 2.7% increase, the lowest since the beginning of the year. However, shrimp remained a bright spot, bringing in 363 million USD, up 12.4% and accounting for over 42% of the total export value.

Meanwhile, tra fish and tuna exports decreased by 17.3% and 23.2%, respectively, as many enterprises proactively adjusted their shipment schedules to avoid the July 9th tax milestone. Some have shifted their focus to the European and Asian markets, which have high technical requirements but less volatile trade policies.

In the first five months, shrimp export turnover reached 1.66 billion USD, a 28% increase, while tra fish exports rose slightly by 4.2%, reaching 778 million USD.

VASEP stated that under the impact of tariff risks, many seafood businesses have restructured their market plans towards diversification. Exports to the CPTPP bloc (Japan, Canada, Mexico) maintained good growth with a total turnover of 224 million USD in May (up 7.9%) and over 1.15 billion USD in the first five months (up 24%). Japan, in particular, witnessed a breakthrough with 836 million USD, a 546% increase compared to the same period last year.

China and Hong Kong were also strong growth markets, with revenue of nearly 185 million USD in May and over 900 million USD in the first five months, corresponding to increases of 22.3% and 48.6%, respectively.

Source: Author’s compilation

|

New bacteria threaten shrimp supply

In addition to trade pressures, the domestic shrimp industry also faces the threat of disease outbreaks. In an article published on the Company’s website on May 5th, Chairman Ho Quoc Luc stated that PDD bacteria – a strain that causes up to 90% mortality in the early stages of shrimp farming – has appeared in Vietnam after being detected in China, India, and Thailand in recent years.

The shrimp disease outbreak coincides with unpredictable weather patterns. The early rains cause fluctuations in environmental factors such as salinity, pH, and alkalinity in shrimp ponds, affecting the shrimp’s resistance. As a result, the success rate of shrimp farming decreases, costs increase, and the supply of raw materials for processing is limited.

May is usually the time for the new shrimp farming season, with abundant supply. However, the prices of marketable shrimp have remained high, reflecting a shortage of supply. Processing enterprises, therefore, face challenges as they have to focus on completing orders before the US imposes new taxes.

“Shrimp losses have discouraged farmers from stocking ponds,” said Mr. Luc. Data from feed producers shows that most consumption is concentrated on shrimp under 6 weeks old, indicating a high rate of post-stocking mortality. “The high prices of marketable shrimp are mainly due to low supply, putting processing enterprises in a difficult position.”

– 09:42 04/06/2025

The Billion-Dollar Species: Vietnam’s Treasure Trove of Exotic Exports.

The product is one of Vietnam’s key exports and a cornerstone of its thriving economy. With a rich history and a unique, distinctive flavor, this good has become a global favorite. Grown and crafted with care, it embodies the essence of Vietnam’s diverse and vibrant culture, offering a taste of its vibrant landscapes and rich heritage.

Seafood Exports Surpass $10 Billion: Unveiling the 2 Star Products

The seafood industry has witnessed impressive growth in exports, inching closer to the significant milestone of $10 billion annually. This remarkable journey can be largely attributed to the stellar performance of two key players: shrimp and catfish. As the industry surges ahead, these two aquatic powerhouses have emerged as the primary contributors to its success, solidifying their status as the backbone of this thriving sector.

Seafood Exports on Track to Hit $10 Billion Landmark

With the current growth trajectory, Vietnam’s seafood industry is on track to achieve its target of $10 billion for the full year 2024, marking an impressive 11.5% increase from 2023. Shrimp and catfish will remain the key drivers, with projections of reaching $4 billion and $2 billion, respectively.

Seafood Exports for the First Ten Months Reached $8.3 Billion, with Key Products Showing Strong Growth

The seafood industry is swimming towards success, with October’s achievements pushing the 10-month tally to a remarkable $8.33 billion in export turnover. This impressive figure marks a 12% increase compared to the same period last year, showcasing the sector’s resilience and growth. Key products such as shrimp, pangasius, and tuna have all witnessed positive growth trajectories, contributing to the industry’s overall triumph.