The lackluster performance of blue-chip stocks once again tempered the VN-Index’s “peak-breaking” momentum, preventing a significant surge. While the breadth of the index remained favorable, the gainers were predominantly mid-cap and small-cap stocks, with a surprising focus on the heated real estate sector.

The VNREAL index, representing the HoSE real estate sector, is down 0.38%, but this doesn’t accurately reflect the trading activity within the group. VIC declined by 0.61%, VHM fell by 1.55%, and VRE remained unchanged with notable influence. Meanwhile, numerous small-cap real estate stocks continued to trade with enthusiasm.

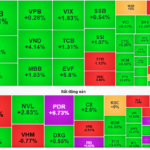

CRE and DXS reached their daily limit-up circuit breakers despite moderate trading volumes. CRE hit a seven-month high, and DXS is heading towards a five-month peak. Other stocks, such as QCG, SCR, DRH, CCL, and DIG, surged by over 3%. The group of HPX, HQC, KHG, HAR, ITC, CEO, DXG, and LDG also witnessed gains of more than 2%. Naturally, it would be unrealistic to expect all real estate stocks to perform uniformly. A few, like SJS, VPI, TDH, and VHM, experienced declines of over 1%, but these were in the minority.

In terms of liquidity, the real estate sector didn’t see many stocks with substantial trading volumes. DIG led the way with a turnover of 277.2 billion VND, a 3.71% price increase. NVL followed with 266.6 billion VND and a 1.06% price rise, while DXG recorded 215.6 billion VND and a 2.22% gain. Regarding their impact on the VN-Index, the rising real estate stocks had minimal effect, with DIG ranking 14th among the contributors to the index’s points.

Aside from small-cap real estate stocks, the mid-cap and penny stocks also witnessed numerous gainers. At the end of the trading session, the HoSE had a breadth of 157 gainers to 133 losers, with 83 stocks rising by more than 1%. The VN30 basket contributed only three stocks to this group: VJC, which climbed 2.56%; PLX, up 2.1%; and SAB, which gained 1.01%.

Mid-cap and small-cap stocks outside the real estate sector that witnessed notable gains and attracted significant trading interest included DBC, which hit the daily limit-up circuit breaker with a turnover of 725.4 billion VND; EIB, rising 5.18% with a turnover of 267.9 billion VND; GEX, climbing 2.92% with 261.8 billion VND in turnover; BAF, increasing 1.53% with a turnover of 207.8 billion VND; POW, up 1.76% with a turnover of 185 billion VND; EVF, gaining 2.78% with a turnover of 177.7 billion VND; PVD, climbing 2.09% with a turnover of 176 billion VND; and NKG, rising 1.12% with a turnover of 102.5 billion VND. The HoSE had approximately 40 stocks that witnessed gains of over 2%, all belonging to the mid-cap and small-cap categories.

Liquidity in these two stock categories was also a crucial supporting factor for the overall trading activity on the HoSE. Specifically, the total trading value on the exchange increased by 123 billion VND compared to the previous morning session, while the VN30 basket witnessed a decrease of nearly 638 billion VND in trading value. The liquidity of this blue-chip basket accounted for only 37.5% of the total exchange. Out of the 32 stocks on the HoSE that achieved trading values above 100 billion VND – constituting 66% of the exchange’s total matched trading value – only 12 belonged to the VN30 basket.

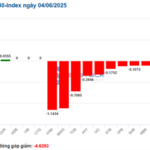

Blue-chip stocks had a muted performance this morning, with the VN30-Index even dipping 0.15% (-2.09 points) as 12 stocks advanced and 13 declined. The VN-Index was influenced by these large-cap stocks and also witnessed a slight decline of 0.05% (-0.64 points). Initially, the situation didn’t appear too dire, as the VN-Index reached its peak just a few minutes after the market opened, climbing nearly 3.9 points. The breadth of the VN30 basket reached 28 gainers at one point. However, the subsequent lack of supportive trading momentum caused most blue-chip stocks to slide downward. Statistics show that all 30 stocks in the basket retreated to varying degrees, with seven falling by more than 1% from their intraday highs.

The large-cap stocks struggled. VHM plunged by 1.55% from its reference price, while VIC reversed by 1.02% from its peak and fell below the reference price by 0.61%. BID, the market’s fourth-largest stock by capitalization, reversed by 1.25% to close 0.7% lower than its reference price. TCB also reversed by 0.95% and ended the day 0.63% lower. VCB, GAS, and MBB also showed signs of weakness. Even the stocks that remained in positive territory, such as CTG, HPG, MSN, and VPB, witnessed notable declines from their intraday highs.

Foreign investors were net sellers of blue-chip stocks on the HoSE, with a net selling value of 169.7 billion VND, while the total net selling value on the exchange was only 33.7 billion VND. This indicates that foreign investors were net buyers in the mid-cap and small-cap segments. Notable net sold stocks included VHM (-59.6 billion VND), STB (-59.3 billion VND), MWG (-56.1 billion VND), VPB (-53.9 billion VND), FPT (-30.4 billion VND), DXG (-44.2 billion VND), HAH (-32.5 billion VND), and VCI (-27.4 billion VND). On the net buying side, DBC (+78.1 billion VND), EIB (+53.4 billion VND), NLG (+41.2 billion VND), DIG (+33.7 billion VND), PVD (+31.2 billion VND), SHB (+29.5 billion VND), POW (+27.6 billion VND), MSN (+27.2 billion VND), VND (+26.3 billion VND), and NVL (+23.9 billion VND) stood out.

Market Pulse for June 4th: Caution Prevails, PVS and PVD Duo Maintains Positive Momentum

The cautious sentiment among investors resulted in a mixed performance for the market’s key indices, which hovered around the reference marks. As of 10:30 am, the VN-Index witnessed a slight dip of 1.17 points, hovering around the 1,346 mark. Conversely, the HNX-Index displayed resilience, climbing by 1.09 points to trade at approximately 230 points.

The Top Trending Stocks to Watch on June 3rd’s Open

“A deep dive into the recent stock market trends: Unveiling the top gainers and losers as per Vietstock’s statistical insights.”