The workshop focused on building an ecosystem for finance that meets international standards for environmental, social, and governance (ESG) criteria. With an estimated investment need of $68.75 billion by 2030 for green projects, 64% of which is expected to come from international sources, the event highlighted the role of green bonds, green credits, and sustainability-linked loans.

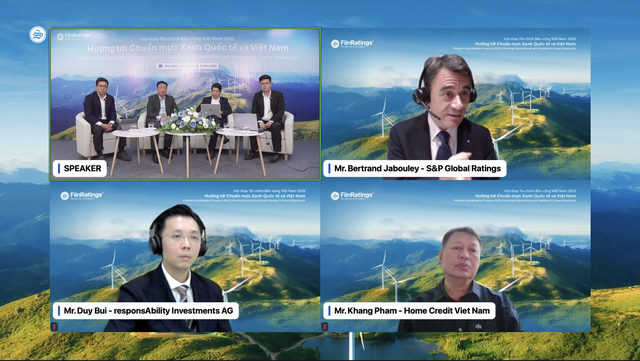

The speakers offered diverse perspectives on the current state and solutions for sustainable finance. Mr. Bertrand Jabouley, Head of Sustainable Finance for the Asia-Pacific region at S&P Global Ratings, emphasized the importance of clear regulations and economic incentives: “Clear regulations are like a referee setting out the rules of the game for market participants.” He also suggested that Vietnam could learn from the experiences of Singapore and Hong Kong, where governments subsidize the cost of ESG evaluations, propose carbon taxes, or provide grants to balance profits between forest conservation and oil palm cultivation.

Mr. Jabouley also stressed, “Sustainable development is not just about carbon. I talk a lot about carbon because it’s the market’s main focus, but we also need to pay attention to other elements like water and nature.” The representative from S&P Global Ratings further recommended that governments issue green bonds to boost the market.

At the workshop, Mr. Nguyen Quang Thuan, CEO of FiinRatings, announced their international cooperation with S&P Global Ratings to conduct ratings for several issuers in Vietnam, including banks, non-bank organizations, and green investors. Mr. Thuan emphasized that the upcoming green taxonomy system will standardize green projects, support businesses in accessing international capital, and encourage unlisted companies to actively participate in the capital market to mobilize sustainable finance.

Mr. Vu Chi Dung, Head of the Legal and Foreign Affairs Department of the State Securities Commission of Vietnam, underscored the importance of transparency: “Information disclosure is mandatory, not only for domestic issuing organizations but also for international investors. This is the basis for monitoring the use of capital raised from bonds, especially green bonds.” He cautioned that the biggest hurdle remains in the legal aspect, particularly the lack of a comprehensive legal framework for green bonds.

Another challenge, as pointed out by Mr. Bui Quang Duy, Deputy Head of Investment at responsAbility, pertains to establishing a climate strategy that is truly committed to and supported by senior management. Despite Vietnam being the second-largest market in responsAbility’s $6 billion portfolio, measuring green impact and technical limitations in environmental reporting remain obstacles.

The speakers also acknowledged that the cost of issuing green bonds remains a significant barrier, as businesses have to bear additional expenses for independent assessments, periodic reporting, and ensuring the proper use of funds, on top of regular issuance costs.

However, looking ahead, Mr. Nguyen Tung Anh, Head of Sustainable Finance Services at FiinRatings, remained optimistic: “Regarding green bonds in 2025, I am very positive as banks are gaining more experience and expertise in implementing green programs. In the coming months, we may see more social loans, social bonds, and smaller social loans.”

“IPH Tower Achieves Prestigious LEED Platinum Certification.”

In April 2025, IPH Office Tower and The Loop Mall were proudly awarded the prestigious LEED v4.1 Platinum certification – the highest rating in the global green building assessment system by the U.S. Green Building Council (USGBC).

“Go Green, Grow Together”

“Vietcap Securities kicks off its community-driven initiative, Go Green Go Up, offering investors a unique opportunity to engage in meaningful activities. We believe in coupling financial freedom with environmental responsibility, and through this project, we aim to showcase how every transaction can make a positive impact on our planet.”