Technical Signals for VN-Index

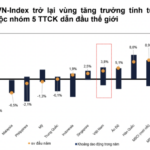

During the trading session on the morning of June 3, 2025, the VN-Index rose alongside an increase in trading volume, indicating a positive investor sentiment.

However, the MACD indicator has been narrowing its gap with the Signal line in recent sessions. If it triggers a sell signal in the coming days, there could be a potential short-term downside risk.

Technical Signals for HNX-Index

On June 3, 2025, the HNX-Index witnessed a surge, successfully breaching the Fibonacci Retracement 61.8% level (equivalent to the 226-229 point region), with expected trading volume surpassing the 20-day average by the session’s end, reflecting investors’ optimism.

Nevertheless, the index is retesting the SMA 200-day resistance amid a Bearish Divergence formation by the Stochastic Oscillator in the overbought zone. Should the indicator trigger a sell signal and fall from this region in upcoming sessions, the downside risk will escalate.

TCB – Vietnam Technological and Commercial Joint Stock Bank

TCB’s share price has surpassed its previous peak to reach an all-time high (based on adjusted data).

Trading volume witnessed a substantial increase and is projected to exceed the 20-day average by the afternoon session’s conclusion.

The MACD indicator underwent a strong reversal, averting a perilous sell signal, thus suggesting limited short-term risk.

VND – VNDIRECT Securities Corporation

On the morning of June 3, 2025, VND’s share price simultaneously formed two bullish candlestick patterns: Rising Window and White Marubozu.

Additionally, the trading volume surpassed the 20-session average in the morning itself, reflecting optimistic and vibrant investor sentiment.

The MACD indicator continues its upward trajectory after providing a buy signal in mid-May 2025, further bolstering the ongoing short-term recovery.

The near-term target is the 20,000-21,000 zone.

Technical Analysis Department, Vietstock Consulting

– 12:08, June 3, 2025

“MBS Director: Official Word on Tariffs Needed for Market Boom”

The stock market remains jittery over news of tariffs, trade tensions, monetary policy, and currency issues.

The Stock Market Boom: A Surge in Stock Prices

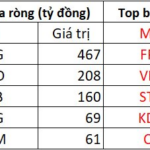

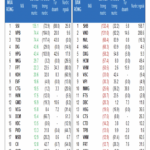

The VN-Index surged past 1340, thanks to a robust rebound from large-cap stocks, but the spotlight this morning belonged to the securities group. Dominating market liquidity, 5 out of the top 10 stocks traded were from the securities sector, and foreign investors’ net purchases also favored these securities stocks.