Technical Signals for VN-Index

In the morning trading session of June 4, 2025, the VN-Index declined after reaching a new 52-week high and forming a small-bodied Doji candle, indicating investor indecision.

Currently, the index remains above the Middle Bollinger Band, while the ADX indicator weakens and stays below 20. This suggests that a likely sideways trend with alternating up and down sessions may persist in the near term.

Technical Signals for HNX-Index

On June 4, 2025, the HNX-Index continued its upward trajectory and formed a Three White Candles pattern, breaking above the 20-day SMA. This indicates persistent investor optimism.

Additionally, the MACD indicator rises further and widens the gap with the Signal line, generating a buy signal that reinforces the ongoing uptrend.

DBC – Vietnam Dabaco Group Joint Stock Company

The DBC stock price surged and formed a White Marubozu candle during the morning session of June 4, 2025.

Trading volume spiked to its historical high, reflecting strong inflows into this stock. The MACD indicator underwent a sharp bullish crossover, issuing a buy signal. The near-term target is the range of 31,000-32,500.

DIG – Construction Development Investment Corporation

On the morning of June 4, 2025, the DIC stock price extended its gains and formed a Three White Candles pattern.

Moreover, trading volume surpassed the 20-session average in the first half of the day, reflecting optimistic and active trading sentiment. The MACD indicator continues its ascent after crossing above zero, further supporting the ongoing short-term recovery.

Technical Analysis Team, Vietstock Consulting

– 12:01, June 4, 2025

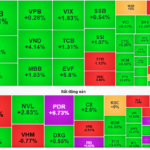

“Small and Mid-Cap Stocks Soar: Real Estate Takes the Lead”

The lackluster performance of blue-chip stocks once again dampens the momentum of VN-Index’s peak. While the breadth of the index remains favorable, the gainers are predominantly mid and small-cap stocks, with a surprising surge in the real estate sector.

Market Pulse for June 4th: Caution Prevails, PVS and PVD Duo Maintains Positive Momentum

The cautious sentiment among investors resulted in a mixed performance for the market’s key indices, which hovered around the reference marks. As of 10:30 am, the VN-Index witnessed a slight dip of 1.17 points, hovering around the 1,346 mark. Conversely, the HNX-Index displayed resilience, climbing by 1.09 points to trade at approximately 230 points.

Tomorrow’s Stock Market Outlook: VN-Index Fluctuating Around 1,330 – 1,400 Points

The stock market analysts predict a positive investor sentiment with expectations that the VN-Index will find equilibrium at 1,330-1,340 points.