As per Point a, Clause 1, Article 32 of the amended Securities Law, effective from January 1, 2025, a public company must meet the condition that at least 10% of its voting shares are held by a minimum of 100 retail investors.

When a company fails to meet the criteria of a public company, it loses its public status and is no longer eligible for listing on the HOSE, HNX, or Upcom exchanges.

However, according to Article 109, except for equitized enterprises, organizations applying for listing must have a minimum of 15% of voting shares held by at least 100 non-major shareholders; in cases where the registered capital of the organization is VND 1,000 billion or more, the minimum ratio is 10% of voting shares.

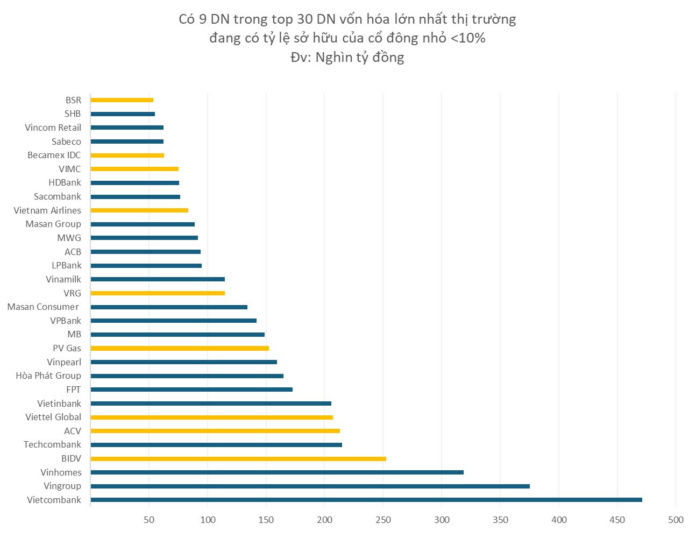

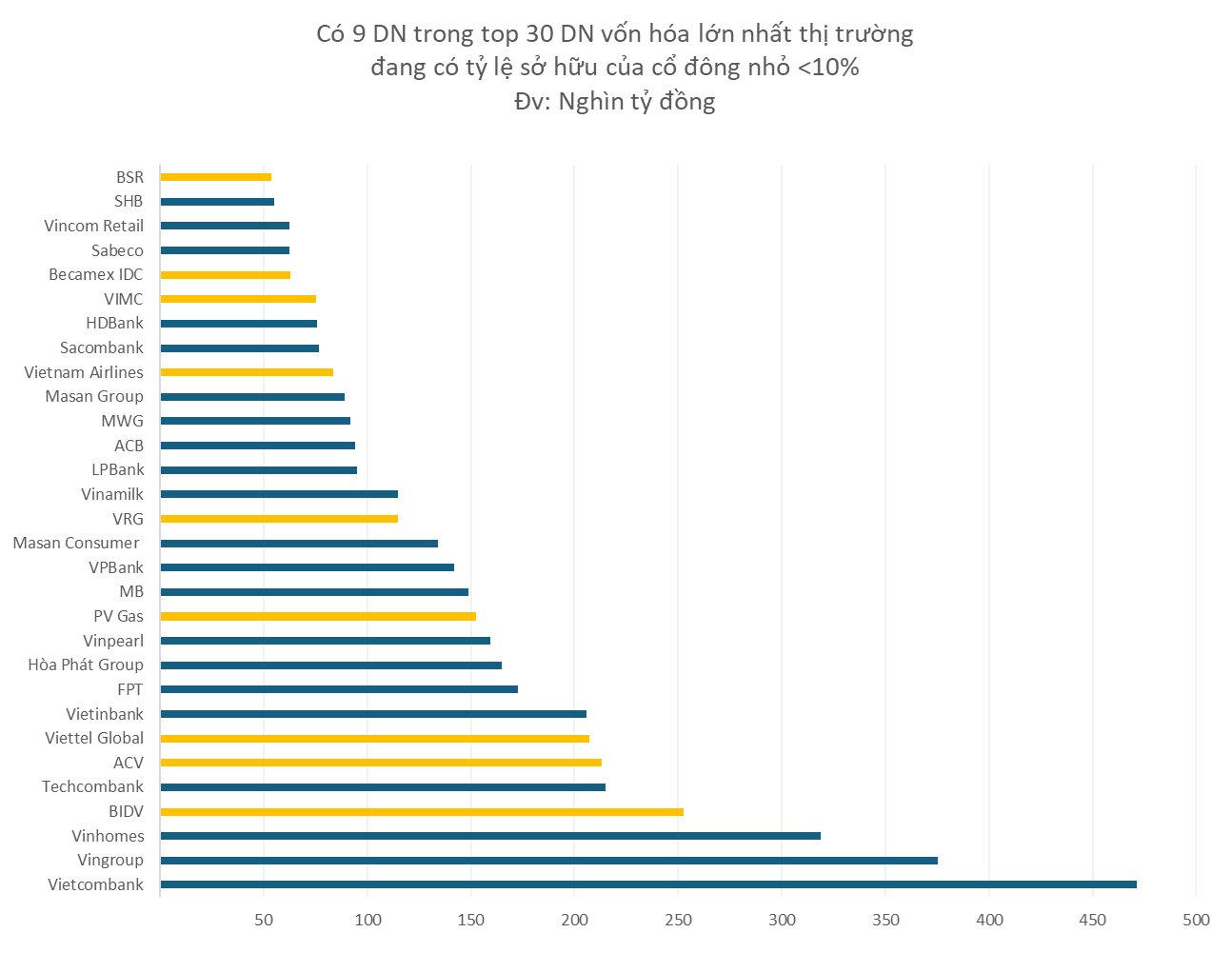

In the current Vietnamese stock market, there are 15 large enterprises whose retail investor ownership ratio is less than 10%, and over 90% of the share capital is held by 1-3 major shareholders. Among them, 12 enterprises have a market capitalization of over USD 1 billion, including 9 enterprises in the Top 30 largest enterprises in the market.

On the HOSE and HNX exchanges, there are 9 enterprises whose retail investor ownership ratio is less than 10%.

The largest among them is BIDV (79.7% of the share capital owned by the State Bank and 14.8% owned by KEB Hana Bank), PV GAS (95.8% owned by PetroVietnam), Vietnam Rubber Group (96.8% owned by the Ministry of Finance), Vietnam Airlines (55.1% owned by the Ministry of Finance, 31.1% by SCIC, and 5.6% by ANA Holdings), and Binh Son Refining and Petrochemical Company (92.1% owned by PetroVietnam)…

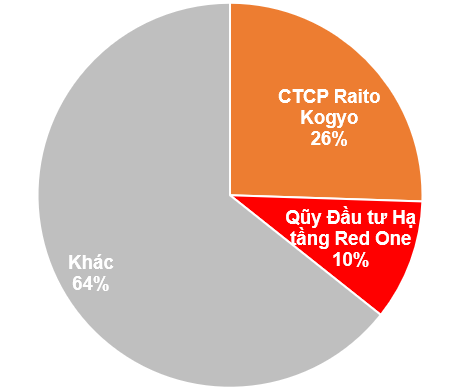

On the Upcom exchange, there are 6 enterprises in this category, the largest being ACV (95.4% owned by the Ministry of Finance), Viettel Global (99.01% owned by Viettel), Vietnam Maritime Corporation (99.5% owned by the Ministry of Finance), FPT Telecom (50.2% owned by SCIC and 45.7% by FPT), and Vietnam Center for Promotion of Trade Fairs (83.32% owned by VinGroup, 10% by the Ministry of Culture, Sports and Tourism, and 4.7% by VinHomes)…

At some Annual General Meetings in 2025, shareholders raised questions about the risk of delisting for enterprises that do not meet the public company ownership ratio requirement.

According to Binh Son Refining and Petrochemical Company (BSR), one of the key proposals is for PetroVietnam (PVN) to consider partial divestment to meet this requirement. At the same time, BSR is actively seeking strategic investors.

PVN has had preliminary discussions with several interested partners, especially investors from the Middle East. BSR expects to attract partners who can provide both financial support and crude oil supply for upcoming investment projects.

Regarding PV GAS (GAS), the Chairman of the Board of Directors stated that the draft Law on State Capital Management – expected to be passed in the near future – will exempt state-owned enterprises undergoing capital restructuring from the delisting regulation during the transition period. If so, this would also apply to Vietnam Airlines (HVN).

Meanwhile, the Industrial Investment and Development Corporation (Becamex IDC, BCM code) has announced plans to organize a public auction of 300 million BCM shares at a starting price of VND 69,600 per share, with expected minimum proceeds of VND 20,880 billion.

After the auction, the state ownership ratio is expected to decrease from 95.4% to about 74%. Due to unfavorable market conditions, Becamex has temporarily postponed the offering and has not announced a new auction date.

Some state-owned enterprises that have undergone equitization, such as the Vietnam Center for Promotion of Trade Fairs (VEF), are exempt from Article 109.

In 2024, several enterprises lost their public company status and left the stock exchanges due to non-compliance with the retail investor ownership ratio, including Vietnam Electric Cable Corporation (CAV, 96.27% owned by GELEX), Tra Vinh Power Company (DTV, 66.29% owned by REE Corporation, 20.43% by IPA Investment Fund, and 7.13% by Galax NH Investment), and Hanoi Electric Machinery Manufacturing (HEM)…

The $6.5 Billion Company: Addressing Delisting Concerns and Market Uncertainty

The amended Securities Law poses a delisting threat to GAS as it fails to meet the requirement of having at least 10% of voting shares held by a minimum of 100 retail investors. This regulatory hurdle underscores the importance of shareholder diversity and small investors’ role in a company’s compliance and long-term success.

“PCG Plunges to Historic Lows as Investors Bail Out Ahead of Delisting”

In the month leading up to its forced delisting, PCG’s stock price plummeted, hitting rock bottom at 2,200 VND per share – the lowest since its IPO. The company is mired in crisis with its financial statements rejected by auditors, obscure transactions, and consistent losses over the past three years.