On June 16, Hanoi Battery Joint Stock Company (stock code: PHN) will finalize the list of shareholders to implement the first 2025 interim cash dividend payment at a 20% rate, equivalent to VND 2,000 per share. The payment is expected to be made from June 24, 2025.

With 7.25 million listed and circulating shares, Hanoi Battery will distribute approximately VND 14.5 billion in interim dividends to its shareholders.

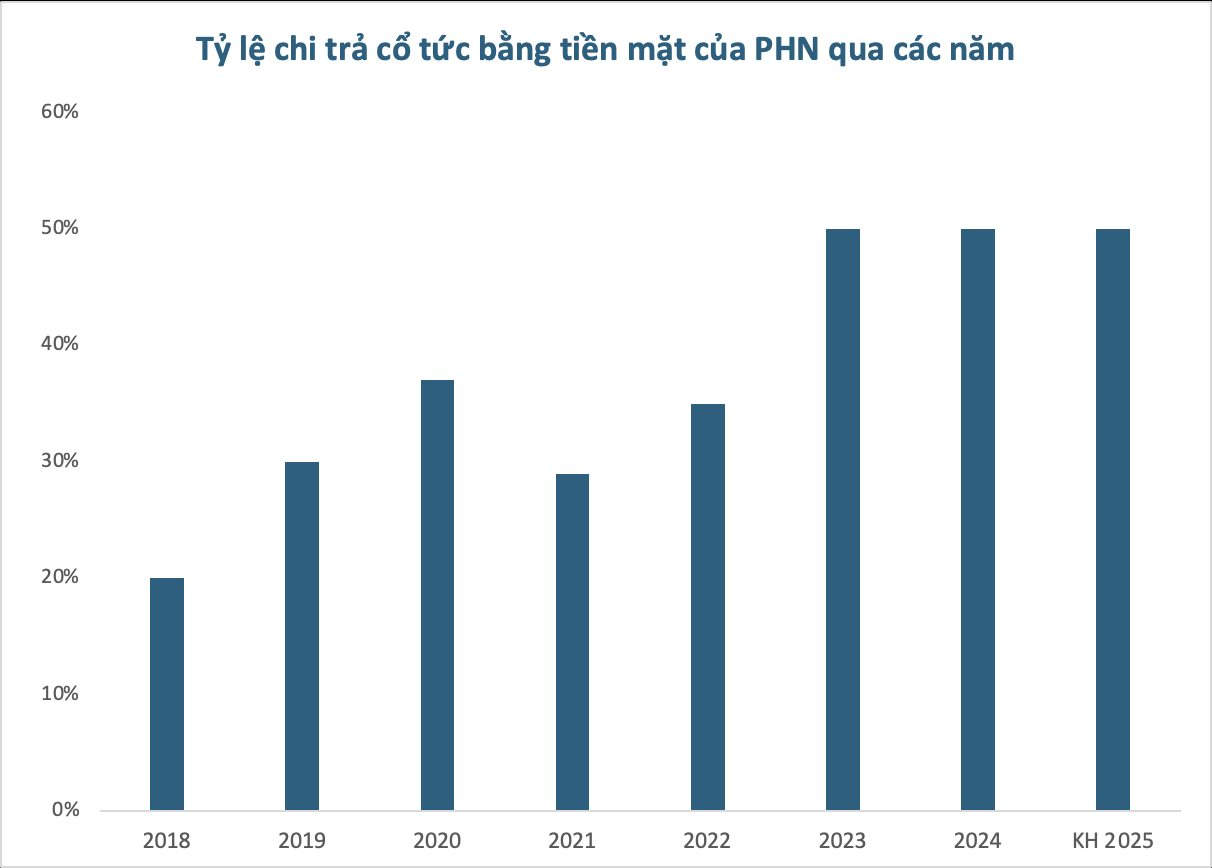

At the annual general meeting of shareholders held in April, PHN shareholders also approved a 50% dividend plan for 2025.

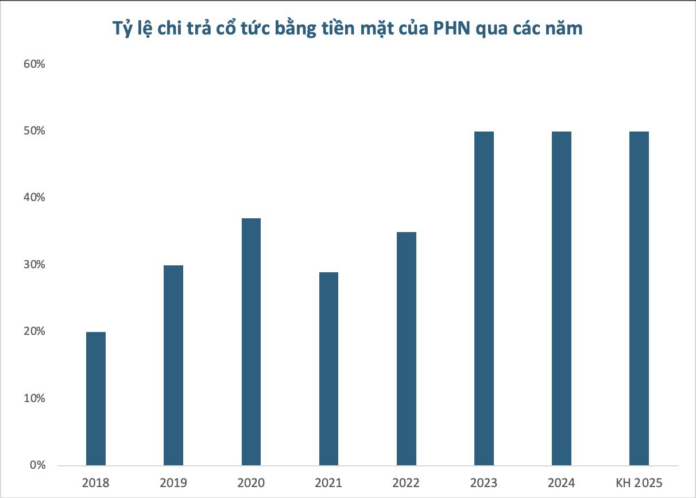

Hanoi Battery is a well-known enterprise to investors, with a long history in the battery manufacturing industry under the once-popular Rabbit Battery brand. The company has a consistent track record of paying cash dividends to its shareholders. Since its listing in 2019, Hanoi Battery has never missed a year of dividend distribution, with rates ranging from 20% to 37%. Most recently, in 2024, the dividend rate reached 50%.

In terms of business performance, for 2025, Hanoi Battery set a revenue plan of VND 491 billion and a pre-tax profit of over VND 54 billion, representing a 6% increase and a 26% decrease, respectively, compared to the previous year’s results.

In the first quarter of 2025, revenue decreased by 11% year-on-year to VND 115 billion. After deducting expenses, the company reported a pre-tax profit of nearly VND 15 billion, a 46% drop compared to the same period last year. With these results, the Rabbit Battery brand owner has achieved nearly 27% of its full-year profit target.

On the market, PHN shares closed at VND 72,000 per share on June 3.

“HPG Finalizes the Release Date for its 1.28 Billion Dividend Shares”

The last registration date is June 27th, and the ex-rights trading date is June 26th. Following this issuance, Hoa Phat’s chartered capital will surge to VND 76,755 billion.