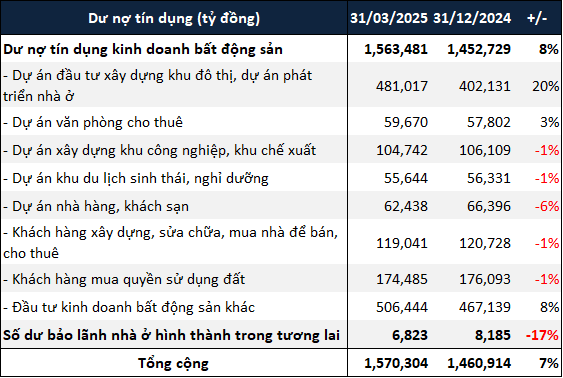

According to data from the Ministry of Construction, total credit outstanding for real estate business activities in the first quarter of 2025 exceeded VND 1.57 quadrillion, a 7% increase from the fourth quarter of 2024. The largest portion of this debt was in other real estate business activities, amounting to more than VND 506 trillion, an 8% increase. The strongest growth was in credit for urban area construction and housing development projects, with over VND 481 trillion, a 20% surge.

|

Credit outstanding for real estate business activities

Source: Ministry of Construction. Compiled by the author

|

Meanwhile, the total debt of 102 real estate enterprises listed on the stock exchanges (HOSE, HNX, and UPCoM) at the end of March 2025 increased by nearly 5% from the beginning of the year, surpassing VND 319 trillion.

|

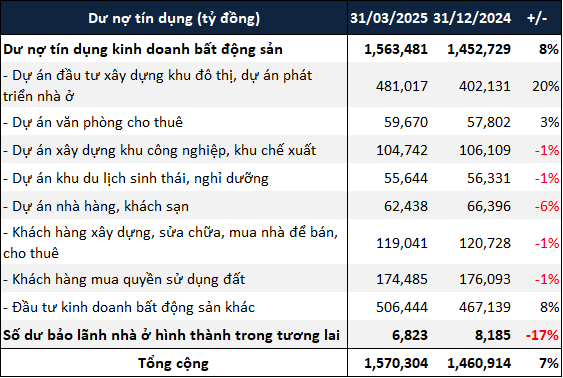

20 real estate enterprises with the largest debt in the first quarter of 2025 (in trillion VND)

Source: VietstockFinance

|

Vinhomes Joint Stock Company (HOSE: VHM) remained the industry leader in terms of debt, with nearly VND 88 trillion, an increase of 8%. The largest portion of the company’s debt structure was related to issued bonds, amounting to nearly VND 39.5 trillion, followed by bank loans of over VND 37.1 trillion.

Nova Land Investment Group Joint Stock Company (HOSE: NVL) ranked second in the industry with more than VND 59.2 trillion in debt, a decrease of 4%. Similar to VHM, NVL’s debt structure was dominated by bond issues, totaling nearly VND 30.5 trillion. In a notice in mid-May 2025, NVL stated that despite being in the recovery phase, negotiations for debt settlement and restructuring remained risky and challenging. Therefore, the company currently lacks the financial capacity to repay its debts. Most of the loans and bond debts will be addressed from the end of 2026 to 2027.

Not long after this announcement, NVL planned to seek shareholder approval for the issuance of additional shares to swap debt as required by a major shareholder. However, the number of shares to be issued has not yet been determined. Accordingly, Novaland intends to issue shares to swap debt with some shareholders who have sold secured assets to repay loans and bonds to Novaland, including two major shareholders: NovaGroup Joint Stock Company and Diamond Properties Joint Stock Company.

* [Novaland proposes to issue shares to swap debt](https://vietstock.vn/2025/05/novaland-muon-phat-hanh-co-phieu-hoan-doi-no-202505241042426997.htm)

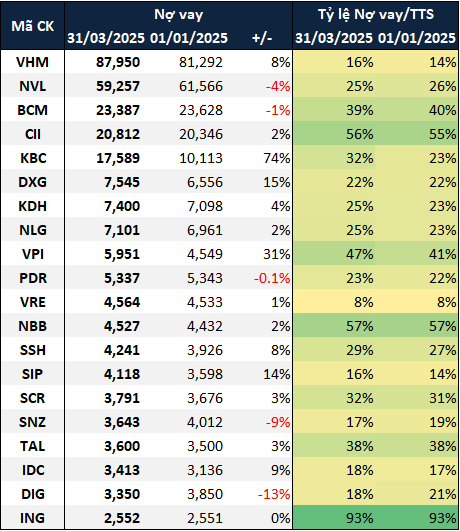

If relative value is considered, HUDLAND Real Estate Investment and Development Joint Stock Company (HNX: HLD) is the industry leader with an 85% increase in debt over three months, surpassing VND 1.2 trillion. This increase was mainly due to a loan agreement signed between HLD and the Hanoi Branch of the Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV Hanoi Branch) on December 4, 2024. The total credit limit guarantee is over VND 1.4 trillion, used to pay for the costs of implementing the project to build a new residential area in Binh Giang district, Hai Duong province (commercial name Hud Binh Giang).

|

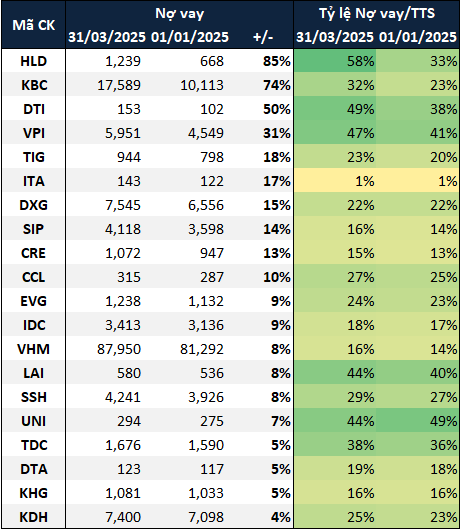

20 real estate enterprises with the highest increase in debt in the first quarter of 2025 (in trillion VND)

Source: VietstockFinance

|

Kinh Bac Urban Development Corporation – JSC (HOSE: KBC) ranked second with a 74% increase in debt in the first quarter, reaching nearly VND 17.6 trillion. The main reason for this increase was a significant rise in the long-term bank loan value from VND 8.7 trillion to over VND 16.1 trillion, an increase of 85%.

Specifically, KBC incurred a long-term loan of nearly VND 12.4 trillion from Vietnam Prosperity Joint Stock Commercial Bank (VPBank), with an interest rate of 10.8% per annum, maturing on March 31, 2033, and interest payable every six months. The collateral is the property right generated from the Trang Cat urban area and service project and KBC’s equity contribution.

Another notable enterprise is Van Phu Real Estate Investment and Development Joint Stock Company (HOSE: VPI), which also experienced a 31% increase in debt, reaching nearly VND 6 trillion. Similar to KBC, the additional debt of VPI was mainly in long-term bank loans.

At the 2025 Annual General Meeting of Shareholders, General Director Trieu Huu Dai stated that VPI would implement the New Tech project in District 7, Ho Chi Minh City, in 2025. The project covers an area of over 9,000 square meters and comprises two 35-story towers with 602 apartments for residence and 136 commercial service apartments. The project was acquired by VPI through a transfer, and the transfer procedures and legal processes have been completed. The company has held a groundbreaking ceremony and plans to commence construction in the second quarter of 2025. In the first quarter of 2025 consolidated financial statements, the New Tech project recorded construction in progress of nearly VND 772 billion as of March 31, 2025.

* [Van Phu (VPI) takes over a thousand-billion-dong apartment project in District 7?](https://vietstock.vn/2025/05/van-phu-vpi-thau-tom-mot-du-an-can-ho-nghin-ti-tai-quan-7-202505241103141067.htm)

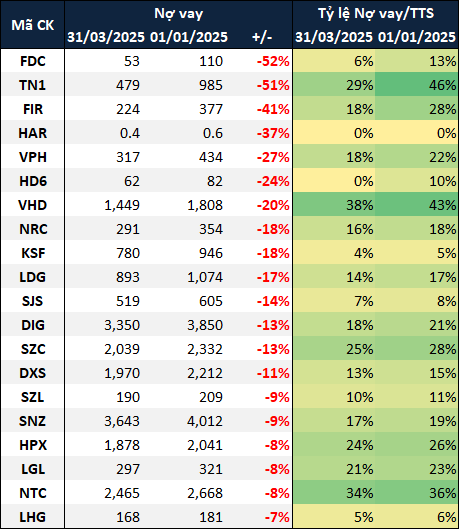

On the opposite end, several enterprises recorded decreases in debt. Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company (HOSE: FDC) witnessed the most significant reduction of 52%, leaving only VND 53 billion in debt at the end of the first quarter of 2025. Specifically, the company eliminated short-term debt and had only long-term debt of VND 53 billion. This loan was between FDC and the Thu Duc Branch of the Vietnam Export Import Commercial Joint Stock Bank (Eximbank Thu Duc Branch).

The collateral is an office building attached to the land use right and all property rights arising from the project at 28 Phung Khac Khoan, District 1, Ho Chi Minh City. This project has been leased by FDC since the first quarter of 2025, generating unrealized revenue of VND 148 billion, nearly five times higher than at the end of 2024.

|

20 real estate enterprises with the largest decrease in debt in the first quarter of 2025 (in trillion VND)

Source: Vietstock Finance

|

Following FDC is Rox Key Holdings Joint Stock Company (HOSE: TN1) with a 51% decrease in debt, amounting to VND 479 billion, due to the full repayment of a VND 490.8 billion bond issue that matured on March 15, 2025. The bond had a term of 36 months, with an interest rate of 10% per annum in the first year and the reference interest rate + 3% per annum in subsequent years. Notably, the company has no bank loans, and its debt originates entirely from bond issuances.

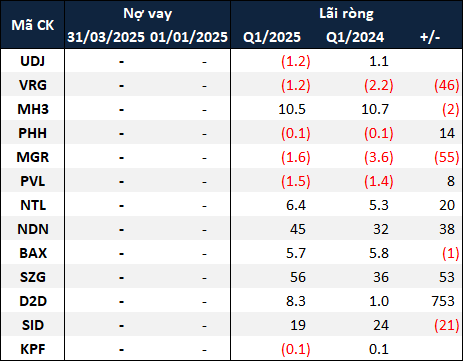

Apart from enterprises with fluctuating debt, 13 businesses recorded no debt from the beginning of the year. Despite the absence of debt pressure, 6 out of 13 enterprises reported losses in the first quarter of 2025.

|

13 real estate enterprises with zero debt as of March 31, 2025 (in trillion VND)

Source: VietstockFinance

|

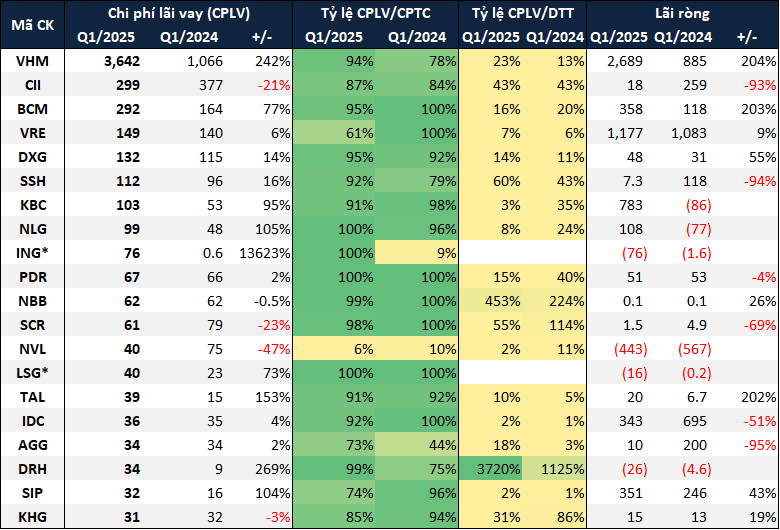

Interest expense increased by more than 88%

Despite only a nearly 5% increase in outstanding debt, the interest expense of the 102 real estate enterprises in the first quarter of 2025 surged by more than 88% over the same period, exceeding VND 5.7 trillion.

VHM recorded the highest interest expense in the industry, with more than VND 3.6 trillion, 3.4 times higher than in the same period. Despite the sharp increase in interest expense, the company still made a net profit of nearly VND 2.7 trillion in the first quarter, more than three times higher than in the previous year. This remarkable performance was mainly driven by the handover of projects such as Vinhomes Royal Island and Vinhomes Ocean Park 2-3.

On the other hand, despite a 47% decrease in interest expense to VND 40 billion, NVL still recorded a net loss of VND 443 billion due to the absence of contract violation compensation of nearly VND 331 billion, which was received in the same period last year (only VND 3 billion received in the first quarter of 2025).

|

20 enterprises with the highest interest expense in the first nine months of 2024 (in trillion VND) *Enterprises with zero net revenue in the first quarter of 2025

Source: VietstockFinance

|

Ha Le

– 10:00 06/04/2025

The Ultimate Urban Oasis: Why Top Developers are Betting Big on Hanoi’s “Island”

The island projects share a key feature: well-planned and integrated transportation infrastructure. This strategic development facilitates seamless connectivity to the heart of the city, offering residents and visitors alike convenient access to all that the urban center has to offer.

Unlocking New Opportunities: Real Estate Businesses Anticipate Expanded Land Reserves and International Capital with Resolution 68

“At the recent seminar ‘Unblocking Institutional Bottlenecks – Unleashing Private Resources’ hosted by VTV, Ms. Nguyen Thanh Huong, Investment Director of Nam Long Group, emphasized that since the issuance of Resolution 68-NQ/TW, there has been a turning point, boosting businesses’ confidence, especially when dealing with international partners.”

The Capital of New Victories: Empowering Strategic Partnerships

On May 31, 2025, Khai Minh Land, a proud member of the Khai Hoan Land and Gamuda Land conglomerate, announced its continued strategic collaboration by becoming the official distributor of the SpringVille project. This marks a significant step forward in solidifying the enduring partnership between the two companies.