According to a recent analysis report by ACBS, Vietnam’s Total Service and Technical Engineering Corporation (PTSC – code PVS) is expected to have a massive workload backlog of over VND 100,000 billion (USD 4 billion) from now until 2027. This figure is more than four times the revenue of this oil and gas “giant” in 2024.

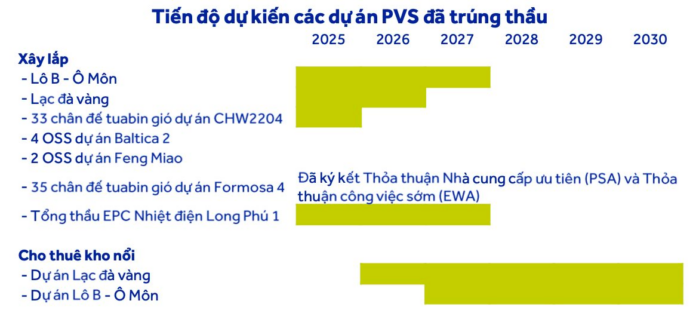

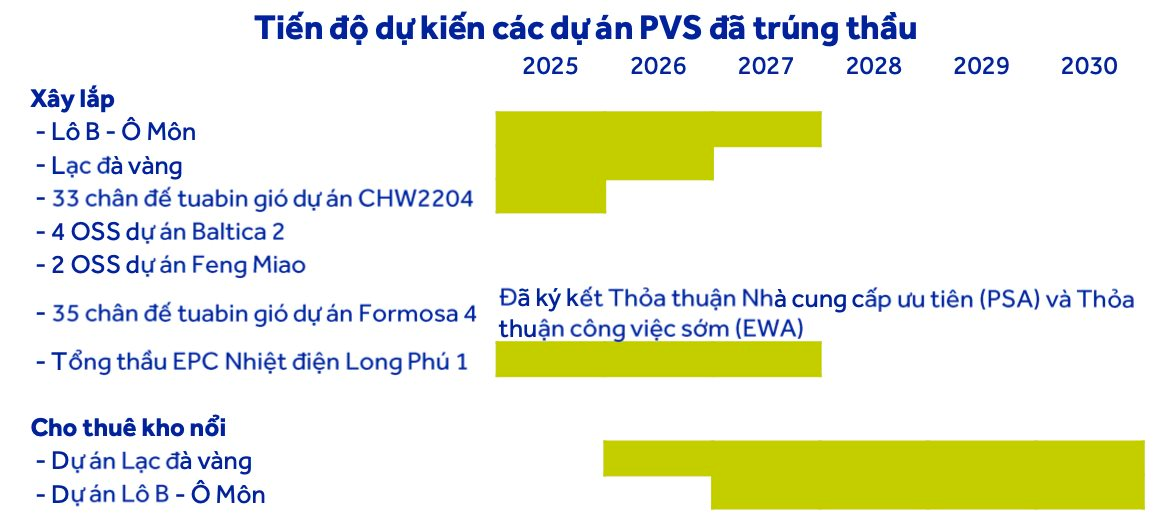

In the Oil and Gas Construction segment, ACBS estimates PVS’s backlog to reach USD 2 billion. The largest contribution comes from the construction contract for the Lot B – O Mon project, where a consortium involving PVS and other companies won three construction packages worth USD 1.2 billion and is participating in the EPC#4 package worth USD 400 million. Additionally, they have the Lac Da Vang project construction contract valued at USD 400 million. PVS is also involved in other potential projects like Cam Tau and Su Tu Trang phase 2B…

In the Offshore Wind Power segment, the backlog is estimated at approximately USD 800 million. In 2025, PVS is expected to deliver a total of 33 wind turbine foundations for the CHW2204 project, with a contract value estimated by ACBS at between USD 250 and 300 million. PVS has also signed two new projects, Baltica 2 and Feng Miao, in which they will provide four offshore substations (OSS) for a total estimated value of USD 300 million. Moreover, PVS is likely to win the bid to supply 35 wind turbine foundations for the Formosa offshore wind power project, valued at approximately USD 300 million.

In the Onshore Construction segment, the Long Phu 1 thermal power project, with a total investment of about VND 30,000 billion (USD 1.2 billion), was planned for restart and completion before 2027 by PVN, and PVS acts as the EPC general contractor. In addition, PVS has the opportunity to win contracts for other thermal power projects through joint ventures, such as Nhon Trach 3&4 and O Mon 3 thermal power plant with an investment value of VND 417,800 billion…

In the Floating Storage and Offloading (FSO) rental business, in December 2024, the joint venture between PVS and Yinson (Malaysia) won the bid for the FSO supply project for the Lac Da Vang project, valued at USD 416 million, with a 10-year term and a 5-year extension option starting from Q4/2026. At the 2025 Annual General Meeting of Shareholders, PVS also announced the FSO supply contract for the Lot B – O Mon project, worth USD 480 million, with a 14-year term and a 9-year extension option, starting from the end of 2027. Upon completing the investment and deployment plan, PVS will own a fleet of up to eight vessels providing FSO services.

ACBS expects an improvement in PVS’s construction margins in the coming period. According to this analysis team, in 2025, the gross profit margin will see a positive impact from the recognition of revenue from large oil and gas construction contracts. Additionally, PVS has stated that the gross profit margin for offshore wind power is comparable to that of the oil and gas segment. However, the company is currently recording significant expenses related to investments in these projects (mechanical equipment, painting workshops…)

Strong Cash Position and Consistent Dividend Payouts

According to ACBS, PVS is among the companies with the highest cash-to-capitalization ratio on the stock exchange. As of Q1/2025, PVS had over VND 16,500 billion in cash and cash equivalents and short-term investments, while financial borrowings stood at less than VND 1,700 billion as of Q1/2025. Net cash amounted to approximately VND 14,800 billion, higher than PVS’s capitalization (VND 14,500 billion). It is worth noting that this stock has seen a significant increase recently.

The robust cash position enables PVS to comfortably pay dividends to shareholders. The 2025 Annual General Meeting of Shareholders approved a cash dividend payout of 7% (VND 700 per share). With nearly 478 million shares outstanding, PVS plans to spend about VND 335 billion on dividends for 2024. Thus, from 2013 until now, the company has never forgotten to distribute cash dividends to shareholders, with rates usually ranging from 5% to 12%.

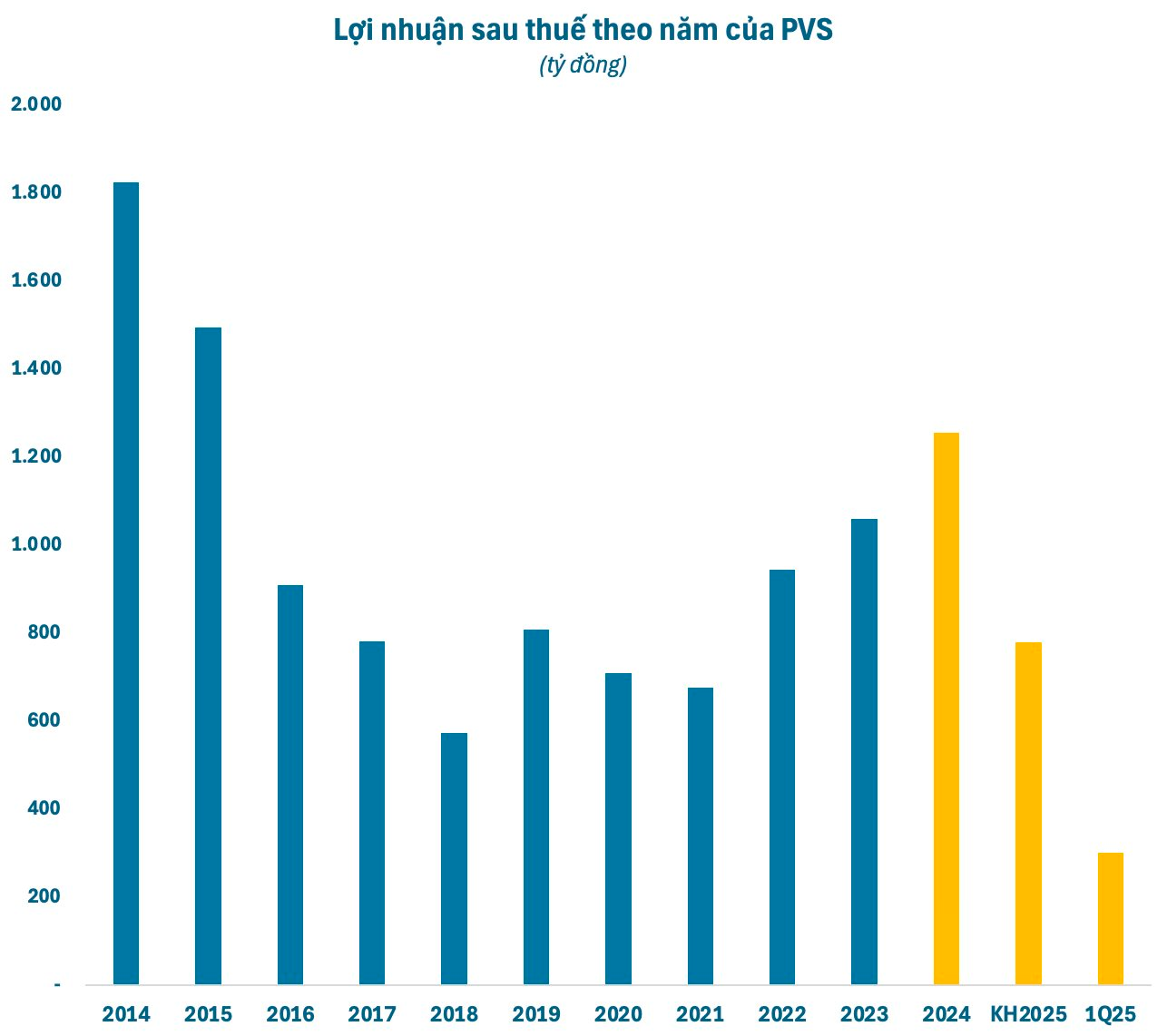

Regarding the 2025 business plan, PVS set consolidated revenue and after-tax profit targets of VND 22,500 billion and VND 780 billion, respectively, down 10% and 38% compared to the actual results of 2024. However, it should be noted that PVS has a “habit” of setting conservative targets, and the actual results often exceed the plan significantly.

In the first quarter of 2025, PVS recorded consolidated revenue of nearly VND 6,014 billion, up 62% over the same period last year. After deducting expenses, the company’s after-tax profit was nearly VND 300 billion, slightly lower than the previous year. With these results, PVS has achieved 27% of its revenue target and 38% of its profit target for the year.

The Ultimate Beachfront Residence: Marriott Hotel and Condo Complex in Danang’s “Kilometer Zero” Sets a New Price Record, Potentially Reaching 280 Million VND per Square Meter

Located at 58 Bach Dang, the 45-story M Landmark building is the first central Danang project to launch this year. With its prime location and impressive height, it’s set to become an iconic landmark in the city’s skyline. Offering a range of exclusive amenities and a prestigious address, this project is a highly anticipated addition to Danang’s thriving real estate market.

“Civil Servants Wrongfully Disciplined: Proposed Regulations Mandate an Apology and Reinstatement of Benefits.”

The Ministry of Home Affairs has proposed an amendment to the decree on disciplinary action for officials, civil servants, and public employees. This proposal includes a provision that requires an apology and the restoration of benefits for any wrongfully disciplined civil servants.

What GDP Growth Rate Does Vietnam Need to Attain to Surpass a Per Capita GDP of $28,500 and Join the High-Income Country Group by 2045?

On June 3, the National University of Economics in collaboration with the Central Policy and Strategy Committee organized a policy dialogue seminar on the topic: “Orientation and Solutions for High and Sustainable Economic Growth towards 2045”. At the seminar, experts discussed growth scenarios and solutions for Vietnam to achieve its economic development goals.