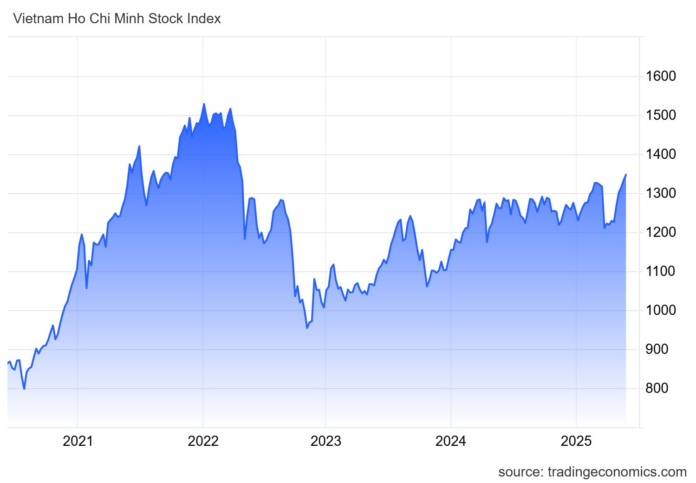

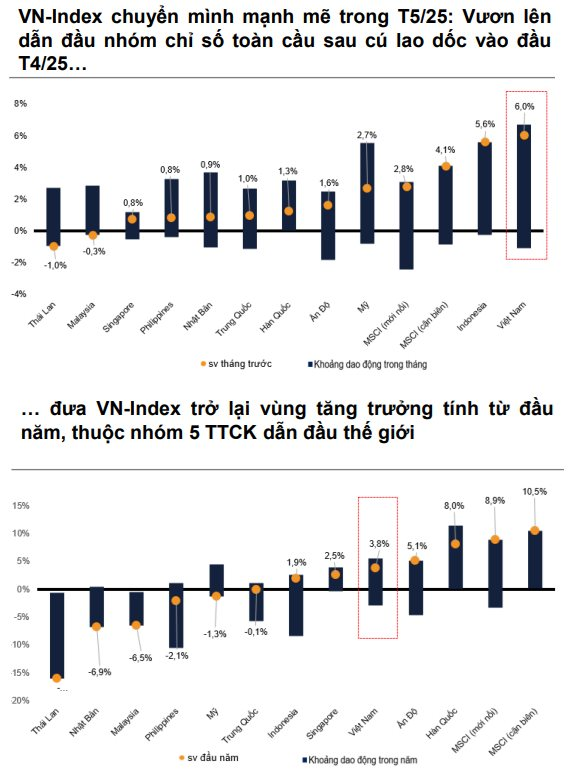

The Vietnamese stock market continues its upward trajectory. The VN-Index closed the trading session on June 3rd with a gain of 10.95 points, reaching 1,347.25 points—the highest level in over three years. Strong cash flow into the market pushed liquidity on the HoSE up by 23% compared to the previous session, with a matching value of VND 22,890 billion.

Looking at the broader picture, since bottoming out at 1,090 points in April 2025, Vietnamese stocks have staged an impressive recovery, surging nearly 260 points as bottom-fishers jumped in and trade tensions eased.

A Host of Securities Companies and Experts Forecast an Optimistic Outlook for the VN-Index

The Vietnamese stock market is gradually weathering the storm. After the shock of trade tariffs, the VN-Index rebounded strongly, prompting optimistic assessments from analytical organizations. Numerous securities companies and experts have offered brighter perspectives, predicting that the index could reach the 1,500-point milestone as investor sentiment improves and cash flow returns.

As a prime example, the latest strategic report from VNDirect Securities Company presents three scenarios for the stock market in 2025, targeting a VN-Index of 1,400 points in the base case. In an optimistic scenario, the VN-Index could surpass 1,500 points and close at 1,520 points if Vietnam successfully negotiates with the US to reduce countervailing duties below 20% or drastically cuts interest rates to boost economic growth.

According to VNDirect’s analysis team, the recent robust recovery has brought the P/E ratio of the stock market back to around 12.9 times, similar to the beginning of the year. However, VNDirect believes this valuation remains attractive as it is discounted by approximately 16% compared to the 10-year average. Despite the challenges posed by US countervailing duty policies, the analysts anticipate EPS growth for listed companies on the HOSE to reach 12-17% in 2025, depending on tariff scenarios.

Sharing a similar viewpoint, Maybank Securities Vietnam (MSVN) asserts that the progress in de-escalating trade tensions continues to support market valuations. “Amid increasingly clear prospects for US-Vietnam trade negotiations, we believe that negative external factors will gradually subside and be counterbalanced by the government’s determination to support and the agility of listed companies,” the report states.

Consequently, the MSVN analysis team upwardly adjusted their profit forecast for the overall market and VN-Index target by 5-10%.

MSVN revised its VN-Index target to 1,300 points (base case), 1,500 points (best-case scenario) , and 1,050 points (worst-case scenario). Overall market profit is projected to increase by 7.7-7.8% in the base case, surge by 15-15.7% in the best-case scenario, and contract in the negative scenario.

Similarly, expert Phan Dũng Khánh, Investment Advisory Director at Maybank Investment Bank, conveyed his optimistic outlook for the Vietnamese stock market during a recent talk show.

“I am highly optimistic that the market peak of around 1,500 points achieved about three years ago can be reached this year in a positive scenario. In the event of certain delays, this level will likely be attained next year,” said the Maybank expert.

According to Mr. Khánh, Resolution 68 and recent policies have established that the private sector will be one of the main pillars of Vietnam’s economy. Now that the policies are in place, effective implementation will be the most critical factor, serving as a significant boost.

In addition to policies focusing all resources on economic development, aiming for an expected growth rate of 8% and double digits from next year onward, the potential upgrade in the latter part of this year creates a harmonious combination of “heaven, earth, and humans.” This trifecta encourages investors to anticipate a return to the historical peak of around 1,500.

Another perspective comes from Mr. Nguyễn Việt Đức, Digital Business Director at VPBank Securities Company (VPBankS), who believes that once the tariff issue is resolved, the market will turn positive. Furthermore, the VPBankS expert anticipates considerable upside potential for the VN-Index, projecting it to reach the 1,900–2,000-point range.

Multiple Boosts for the Vietnamese Stock Market

In reality, the Vietnamese stock market has received several boosts recently, significantly enhancing investor sentiment.

Firstly, Vietnam promptly reacted to and endeavored to mitigate the impact of countervailing duty policies. Initial concerns about high tariffs have been assuaged as negotiations progressed with a high level of consensus on principles, approaches, orientations, and negotiation plans, setting a positive tone for subsequent rounds of talks.

Additionally, domestic economic stimulus policies, including increased public spending and support for the private sector as outlined in Resolution 68-NQ/TW 2025, have provided a significant boost to the stock market.

Another positive factor stems from the new KRX technology system, which officially came into operation in early May 2025 after years of anticipation. This development not only significantly enhances the chances of Vietnam being upgraded to emerging market status by FTSE in September but also paves the way for the future implementation of the Central Counterparty Clearing (CCP) system and day trading.

In a recent move, the State Bank of Vietnam issued Circular No. 03/2025/TT-NHNN, providing regulations on opening and using VND accounts for indirect foreign investment activities. The circular will take effect from June 16, 2025. According to BSC, the realization of this circular and the Omnibus Trading Account (OTA) solution implemented by VSDC will greatly facilitate foreign investors’ participation in Vietnam’s stock market, fostering the country’s journey toward an upgrade.

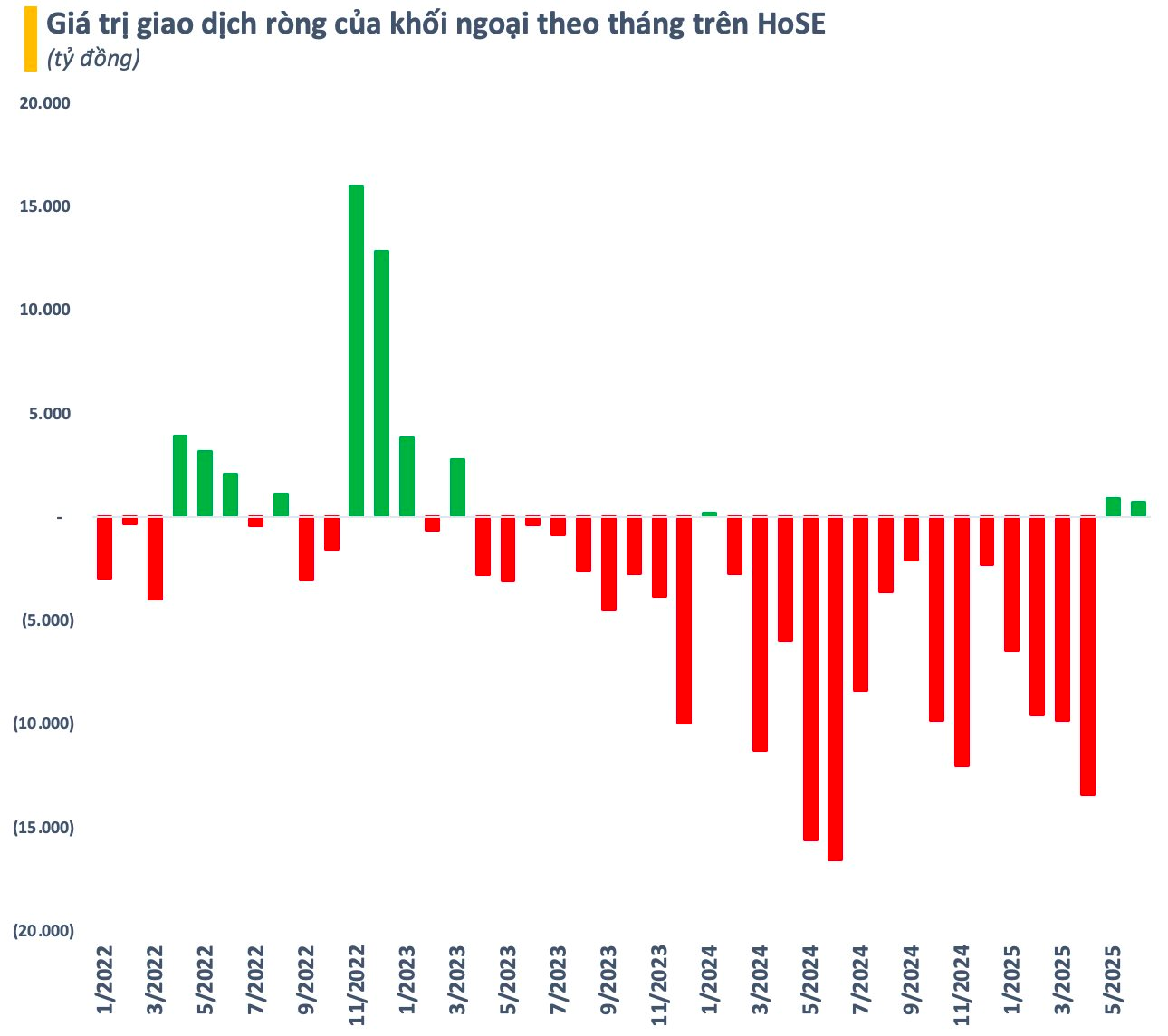

Investor confidence in the prospect of an upgrade is further bolstered by the return of foreign capital inflows into the Vietnamese stock market. After net buying a modest VND 900 billion in May, foreign investors continued to net buy in the early days of June, with a value of about VND 700 billion on the HoSE.

According to several assessments, foreign capital typically arrives early, approximately 6-12 months before an expected upgrade. If the roadmap proceeds as hoped, Vietnam’s stock market could be elevated to emerging market status by FTSE and MSCI in 2025 and 2026, respectively. Thus, this period can be viewed as a golden opportunity for foreign capital to ride the wave of the anticipated upgrade.

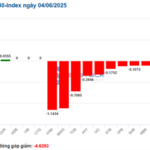

Technical Analysis for June 4: Prolonged Polarization

The VN-Index and HNX-Index moved in opposite directions during the morning session, with volumes dipping, indicating a cautious sentiment among investors.

“Small and Mid-Cap Stocks Soar: Real Estate Takes the Lead”

The lackluster performance of blue-chip stocks once again dampens the momentum of VN-Index’s peak. While the breadth of the index remains favorable, the gainers are predominantly mid and small-cap stocks, with a surprising surge in the real estate sector.

Market Pulse for June 4th: Caution Prevails, PVS and PVD Duo Maintains Positive Momentum

The cautious sentiment among investors resulted in a mixed performance for the market’s key indices, which hovered around the reference marks. As of 10:30 am, the VN-Index witnessed a slight dip of 1.17 points, hovering around the 1,346 mark. Conversely, the HNX-Index displayed resilience, climbing by 1.09 points to trade at approximately 230 points.