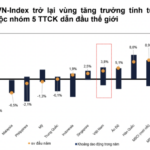

The Vietnamese stock market witnessed another vibrant trading session, with the VN-Index surging by nearly 11 points (+0.82%) to reach almost 1,350 points, the highest in over three years. Since the tariff-induced low recorded on April 9th, the index has climbed by more than 250 points, equivalent to approximately 23%.

Consequently, the market capitalization on the HoSE also increased by over 1.2 million billion VND from its low, reaching nearly 5.8 million billion VND. Combining all three exchanges, Vietnam’s stock market has added nearly 1.5 million billion VND in less than two months. It is noteworthy that this figure includes the market capitalization of Vinpearl (VPL), which debuted in mid-May with a valuation of over $5 billion.

The past two months have been one of the most prosperous periods for the Vietnamese stock market in recent years. The market’s robust upward trajectory is supported by several factors, including (1) a stream of positive news, (2) attractive valuations, and (3) the return of foreign investors, among others.

Following the tariff shock in early April, the Vietnamese stock market experienced a rare steep decline. However, tensions quickly eased, and positive news regarding negotiation efforts among parties started to emerge, gradually improving investor sentiment.

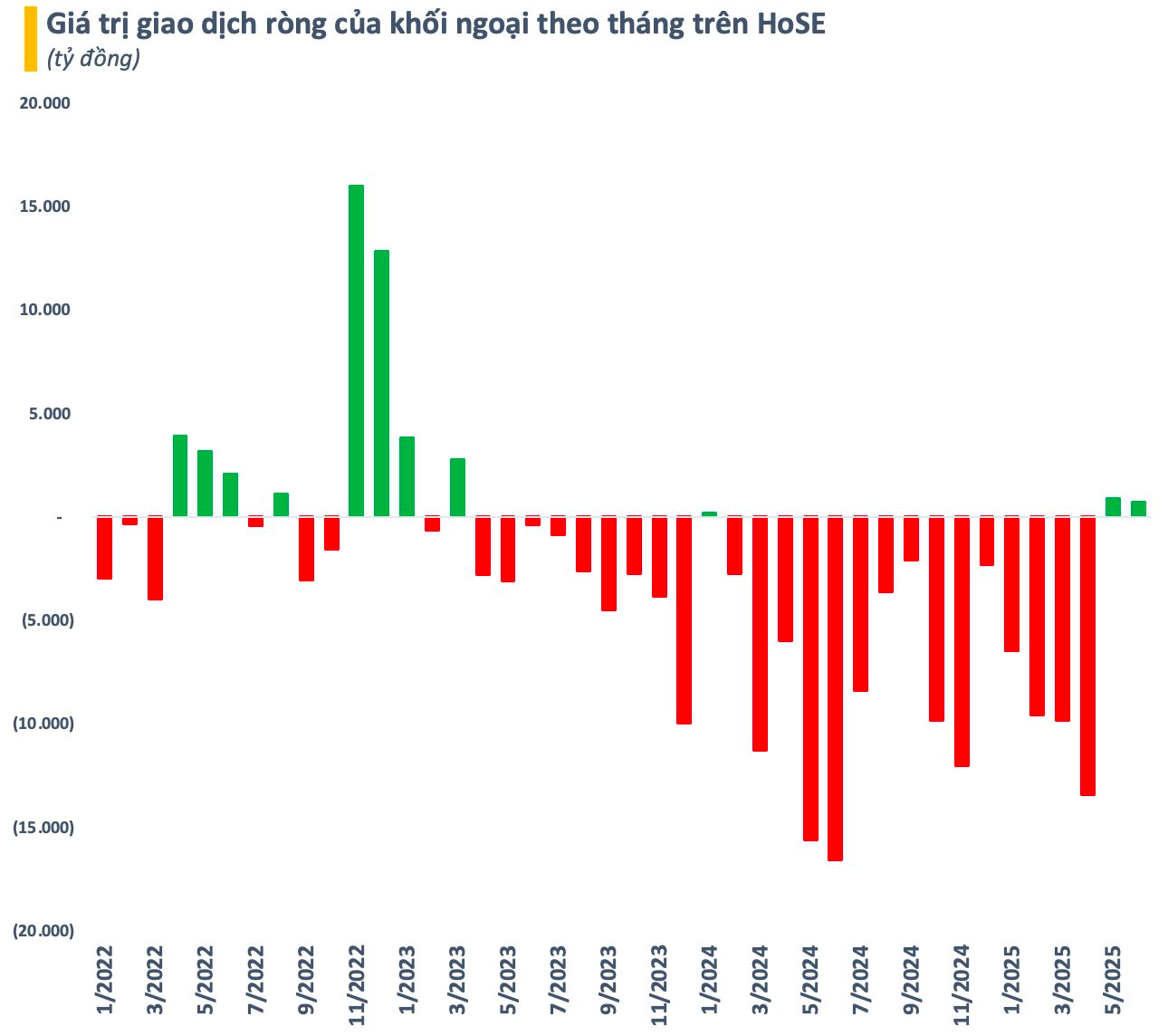

A substantial amount of bottom-fishing funds flowed into the market as stock valuations and numerous stocks became appealing. Foreign investors also showed signs of halting their selling spree in May, turning to net buyers with a slight net purchase of nearly 900 billion VND, ending their prolonged selling streak. This trend is expected to continue in the coming months as foreign investors have already net bought approximately 700 billion VND on the HoSE in the first few days of June.

The shift in foreign investor sentiment occurs amidst growing clarity around the prospects of an upgrade for the Vietnamese stock market since the official launch of KRX in early May. The regulatory body and market participants are diligently working towards implementing mechanisms such as the Central Counterparty (CCP) and intraday trading.

According to assessments by various analytical units, there is a strong likelihood of Vietnam being upgraded by FTSE as early as September 2025. Meanwhile, with MSCI, the process might take longer due to issues related to foreign ownership limits. Considering that foreign capital tends to arrive early, approximately 6-12 months ahead of the official upgrade, this could be an opportune time to ride the wave.

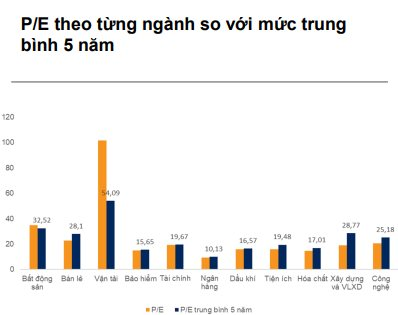

In reality, the market’s strong recovery hasn’t led to overvaluation. While the VN-Index has returned to around 12.9 times, similar to the beginning of the year, a recent VNDirect report suggests that this valuation remains attractive as it is still discounted by about 16% compared to the 10-year average. The analytical team anticipates earnings per share (EPS) growth of 12-17% in 2025 for listed companies on the HoSE, depending on tariff-related scenarios.

VNDirect maintains three scenarios for the market in 2025, with the base case targeting VN-Index at 1,400 points. In the optimistic scenario, the VN-Index could surpass the 1,500-point mark and close at 1,520 points if Vietnam successfully negotiates with the US to reduce retaliatory tariffs below 20% or drastically cuts interest rates to boost economic growth.

According to VNDirect, short-term fluctuations are inevitable. However, this presents a strategic opportunity for investors to restructure their portfolios and take profits from stocks that have surged while shifting focus to sectors that remain attractively valued and have not fully recovered to pre-April 2nd levels.

Foreign Block Buys a Two-Year Record, VN-Index Emerges as the World’s Top-Performing Market

The VN-Index surged an impressive 6.0%, positioning Vietnam as the top-performing market in May. This remarkable performance can be attributed not only to positive signals from global trade agreements but also to strong intrinsic momentum.

The Stock Market Boom: A Surge in Stock Prices

The VN-Index surged past 1340, thanks to a robust rebound from large-cap stocks, but the spotlight this morning belonged to the securities group. Dominating market liquidity, 5 out of the top 10 stocks traded were from the securities sector, and foreign investors’ net purchases also favored these securities stocks.