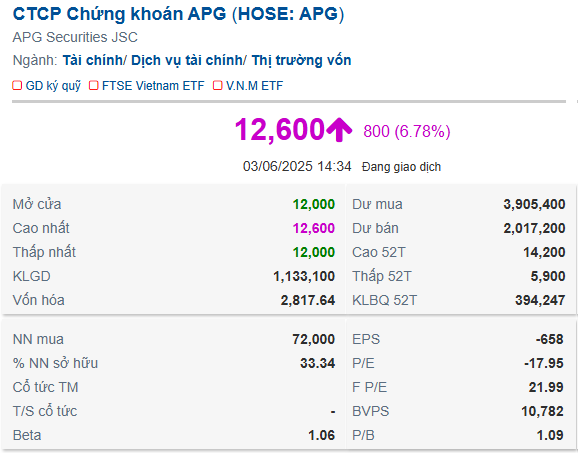

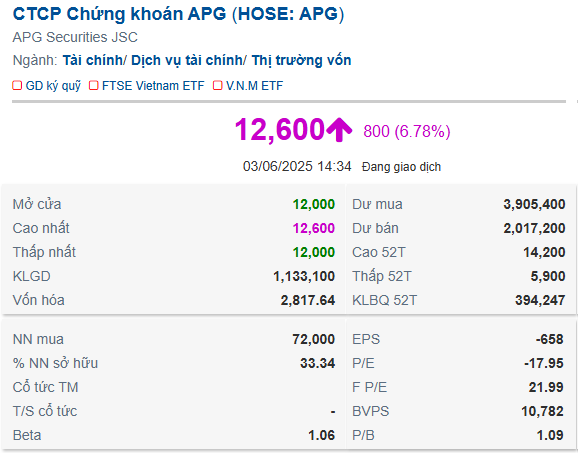

APG Surges to Daily Limit on June 3rd, 2025 – Source: VietstockFinance

|

APG’s Shares Witness “Huge” Trading Volume on June 3rd, 2025 – Source: VietstockFinance

|

“Huge” Trading Volume: This significant trading activity occurs as PANDO 1 INVESTMENT PTE. LTD., a Singapore-based investment fund, has registered to purchase 40 million APG shares from May 20th to June 18th, 2025. The fund aims to increase its ownership from 5.25% to 23.14%, equivalent to 51.74 million shares. The stated purpose of this transaction is portfolio restructuring.

Connection to APG Insider: PANDO 1 is an organization related to APG insider, Mr. Ong Tee Chun, who serves as a member of APG’s Board of Directors and is also the fund’s director. Mr. Chun does not directly own any shares in APG and was recently elected to the Board during the 2025 Annual General Meeting of Shareholders on April 25th, after the resignation of two Board members.

Recent Acquisition by PANDO 1: Prior to this, the foreign fund became a major shareholder of APG on April 14th, 2025, by acquiring an additional 850,400 shares, increasing its ownership to 5.25%.

Opposite Move by APG’s Chairman: On the other hand, Mr. Nguyen Ho Hung, Chairman of APG’s Board of Directors, has registered to sell 6 million APG shares, equivalent to nearly 90% of his current holdings. This move is expected to reduce his ownership from 3.03% to 0.35%, or 783,803 shares.

Potential Connection to PANDO 1’s Acquisition: Interestingly, Mr. Hung’s planned share sale is also scheduled for May 20th to June 18th, 2025, indicating a possible private agreement with PANDO 1.

APG’s Strong Recovery in 2025: In the market, APG’s shares have demonstrated a robust recovery since their January 2025 lows. As of the current daily limit price of 12,600 VND per share, APG has surged by 86% year-to-date. Since late March, APG has consistently recorded large trading volumes from foreign investors.

| APG’s Share Price Recovery in 2025 |

|

|

APG’s Ambitious Business Plan for 2025: For the year 2025, APG sets ambitious targets with a revenue goal of 300 billion VND and a profit target of 120 billion VND. During the 2025 Annual General Meeting of Shareholders, Vice Chairman Huynh Minh Tuan attributed the significant adjustments in the plan to positive market outlook and the initial results of the company’s restructuring process. Additionally, APG’s collaboration with a strategic partner will provide advantages in terms of capital, further boosting confidence in the company’s aggressive business plan.

Strategic Partnership and Foreign Shareholder: Mr. Tuan also emphasized the importance of APG’s strategic partnership and the presence of a foreign shareholder, which are integral to the company’s ecosystem of financial investment and asset management.

APG’s Q1 2025 Financial Performance: In the first quarter of 2025, APG’s operating revenue reached nearly 25 billion VND, an 18% decrease year-over-year. However, profit before tax increased significantly by 75% to over 11 billion VND due to higher profits from loans and receivables, coupled with reduced losses from financial assets.

Recent Changes in Key Personnel: APG has recently announced important personnel changes, effective from the beginning of June 2025. Notably, Mr. Huynh Minh Tuan has been appointed as the Authorized Person for Information Disclosure, replacing Mr. Nguyen Thanh Nghi.

Mr. Huynh Minh Tuan’s Background: Mr. Tuan is a well-known figure in the securities industry, currently serving as the Chairman of FIDT, a company specializing in investment advisory and asset management services.

Huy Khai

– 14:48 03/06/2025

Stock Market Blog: Unexpected Euphoria Returns, Don’t Miss the Boat by Selling Too Soon!

The market surged unexpectedly today, fueled by a rally in stock securities. Although unable to lead the score, this momentum positively influenced investors’ psychology. Those who took profits are now hesitant, feeling the psychological pressure of missing out on potential gains.

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

Market Pulse June 2nd: Energy Sector Surges, VN-Index Recaptures Green Territory

The trading session concluded with the VN-Index climbing 3.7 points (+0.28%), reaching 1,336.3. Meanwhile, the HNX-Index witnessed a rise of 2.95 points (+1.32%), ending at 226.17. The market breadth tilted towards gainers, as 438 stocks advanced against 323 decliners. Similarly, the VN30 basket saw a slight dominance of greens, with 16 gainers, 13 losers, and 1 stock remaining unchanged.