VNG Corporation (VNZ on UPCoM) has released its Annual General Meeting documents for 2025. The meeting is scheduled to be held on June 21st in Ho Chi Minh City.

For 2025, VNG aims to pursue a strategy of sustainable growth, selective investment, with a focus on technology and artificial intelligence (AI) as its key strategic axis.

The company will continue to diversify its products and services, expand its domestic and international markets, and restructure its organizational model to improve governance and operations across the Group.

VNG sets its 2025 plan with a revenue target of VND 10,773 billion, a 16.2% increase compared to the previous year. The company expects a net loss of VND 561 billion, a significant reduction from the VND 1,081 billion loss in 2024.

Illustrative image

It is worth noting that VNG has experienced three consecutive years of losses. In 2022, this “tech unicorn” recorded a loss of VND 1,077.1 billion, followed by another loss of VND 2,101 billion in 2023.

In the first quarter of 2025, VNZ’s consolidated financial statements showed a slight decrease in revenue, reaching VND 2,232 billion. However, cost-cutting measures helped reduce the after-tax loss to VND 15 billion, with an after-tax loss attributable to the parent company of nearly VND 5 billion.

Regarding profit distribution, VNG proposed no dividend payment for 2024. The company also plans to continue its ESOP program for 2025, issuing shares to employees at a rate of 1.43% of the total outstanding shares, with an estimated additional 418,807 shares at a price of VND 30,000 per share. These shares will be restricted from transfer for one year, expected to be implemented from Q3 2025.

As of June 3rd, VNZ shares are trading at VND 345,000 per share. The 2025 ESOP shares are estimated to be issued at a price 91.3% lower than the market price.

Previously, on March 5, 2025, VNG had implemented the 2024 ESOP share issuance of 640,974 shares. According to the company, as of the release of the 2025 Annual General Meeting documents, the issuance has been completed, and they are finalizing procedures to report the results to the State Securities Commission of Vietnam.

In terms of personnel changes, VNG proposes to dismiss Mr. Vo Sy Nhan from the position of Board Member. Mr. Nhan had previously submitted his resignation from the position of Chairman of the Board for personal reasons on November 22, 2024. Mr. Nhan, born in 1975, joined VNG in December 2022.

Additionally, the company also plans to dismiss Mr. Pham Van Do La from the position of Supervisory Board Member. Mr. Do La was elected at the 2024 Annual General Meeting and had submitted his resignation on March 12, 2025.

On the other hand, VNG also intends to elect new Board Members for the term 2025-2030. The candidates for the Board of Directors include Mr. Le Hong Minh, Mr. Vuong Quang Khai, Ms. Christina Gaw, and Mr. Edphawin Jetjirawat. It is proposed that the Board Members will not receive any remuneration for 2025.

The candidates for the Supervisory Board are Mr. Hoang Anh, Mr. Vu Thanh Long, and Mr. Ngo Vi Hai Long. The remuneration for the Supervisory Board is set at VND 240 million per year, which will remain unchanged until further notice.

Two Insider Shareholders, Including Chairman Bui Thanh Nhon, Successfully Sell Nearly 3.5 Million NVL Shares.

On May 30, 2025, Diamond Properties successfully offloaded over 3.23 million NVL shares, while Cao Thi Ngoc Suong, wife of Chairman Bui Thanh Nhon, sold 221,133 shares.

The Ultimate Penmanship: Crafting a Captivating Title

“The Penultimate Stroke: Unveiling the Intricacies of a 17-Million Share Trade”

The Vietnam Investment Group Joint Stock Company intends to sell 17 million VAB shares of VietABank through a matched or negotiated deal. This move is designed to comply with the Law on Credit Institutions 2024, which stipulates that institutional shareholders cannot own more than 10% of a bank’s charter capital.

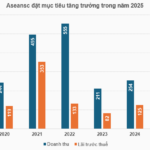

Aseansc Aims for Over $13 Billion in Profits in 2025, Elects Two New Board Members

The annual general meeting (AGM) of Asean Securities Joint Stock Company (Aseansc) unveiled ambitious plans for the year 2025. The Board of Directors proposes to achieve a revenue of VND 323 billion and a pre-tax profit of VND 131 billion, marking a significant 27% and 5% increase, respectively, from the previous year’s performance. To ensure a complete board, the assembly will also elect two new members to the Board of Directors, filling vacancies from expiring terms.