The VN-Index closed at 1,336 points on June 2nd, marking a 0.28% increase or 3.7 points.

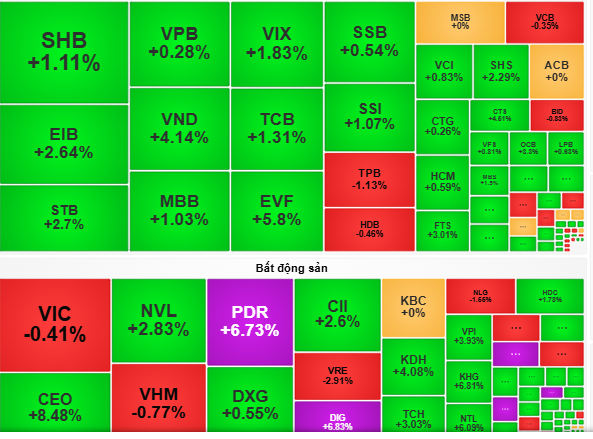

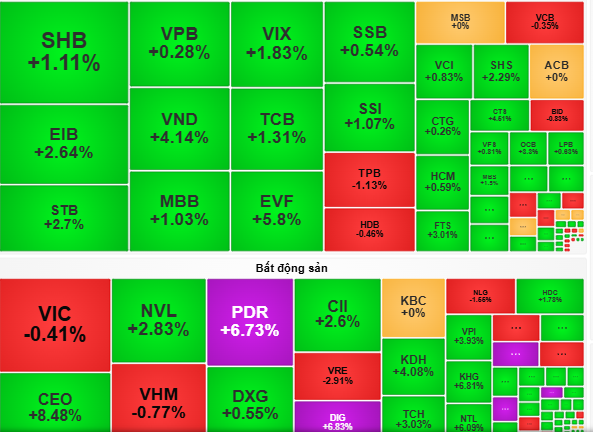

On June 2nd, Vietnam’s stock market opened with a slight downward trend, with the VN-Index hovering around the 1,330-point support level throughout the morning. Money continued to be polarized, focusing on mid-cap stocks in the real estate, securities, and construction industries.

However, buying pressure from these groups was not strong enough to lift the overall index in the face of adjustment pressure from large-cap stocks.

In the afternoon session, the market gradually improved due to increased buying interest in banking and rubber stocks, narrowing the VN-Index’s loss.

At the close, the VN-Index ended at 1,336.7 points, up 3.7 points or 0.28%.

According to Dragon Vietnam Securities (VDSC), liquidity on June 2nd decreased compared to the previous session, indicating that selling pressure has eased. Money is still supporting the market, and the VN-Index is expected to re-challenge the 1,345-point resistance level in the coming sessions.

VCSB Securities believes that money is circulating between industries rather than being withdrawn for profit-taking, reflecting a positive market sentiment. The VN-Index is expected to fluctuate steadily around the 1,330-1,340 support zone.

“Investors should maintain their holdings in stocks that are attracting money flow, avoiding buying at high prices. At the same time, consider allocating capital to stocks that have successfully tested support zones. Notable industries include real estate, banking, electricity, and public investment,” advised VCSB Securities.