According to a recent announcement by the Hanoi Stock Exchange (HNX), VinFast Trading and Production Joint Stock Company (VinFast) disclosed information regarding its bond interest and principal payments.

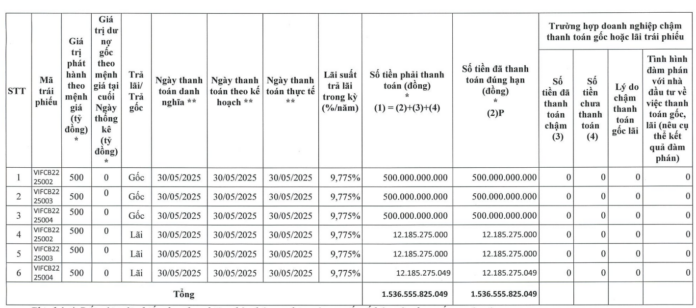

On May 26, 2025, VinFast repurchased VND 500 billion in principal and nearly VND 12 billion in interest of the VIFCB2225001 bond issue.

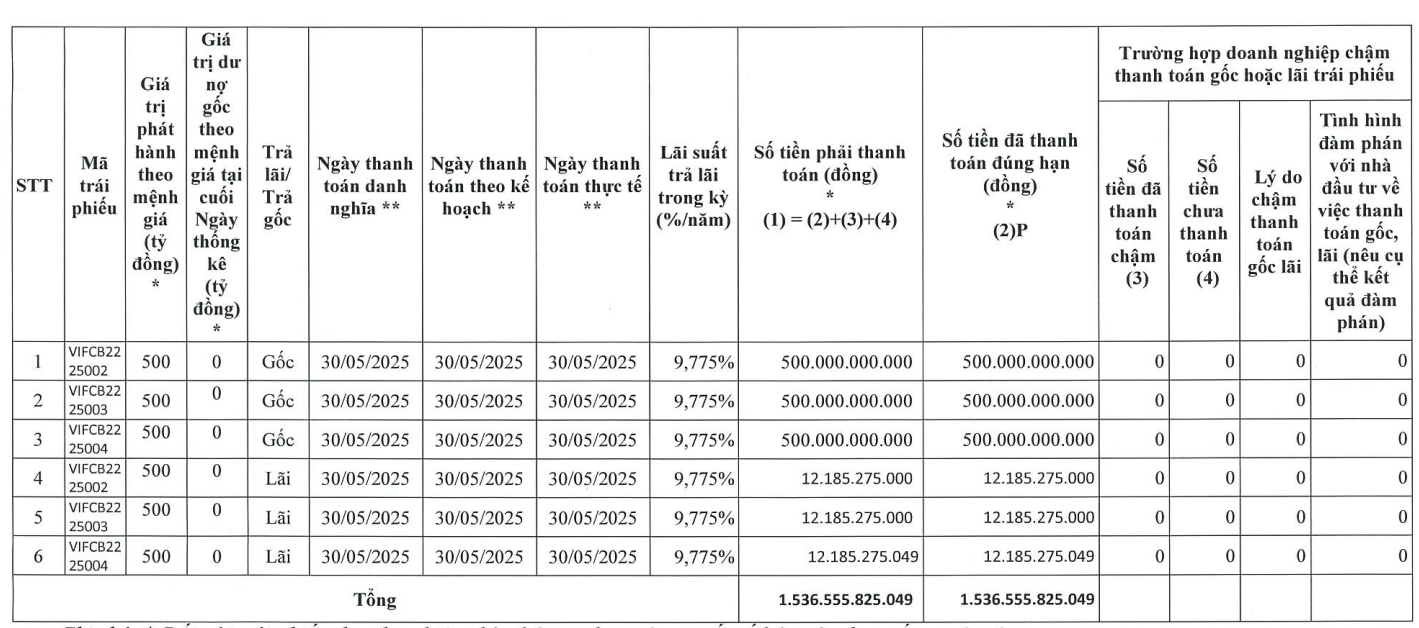

Subsequently, on May 30, 2025, the company repurchased a total of nearly VND 1,537 billion in principal and interest of three bond issues: VIFCB2225002, VIFCB2225003, and VIFCB2225004.

Source: HNX

Thus, within a few days at the end of May 2025, VinFast fully repaid nearly VND 2,050 billion of the above-mentioned four bond issues.

According to HNX information, these four bond issues were launched in May 2022, with a term of 36 months and an interest rate of 9.26% per annum.

In a related development, the Board of Directors of Vingroup approved the provision of a payment guarantee by the Group and the use of its assets to secure corporate bonds to be privately issued by VinFast in 2025, with a total face value of up to VND 5,000 billion.

The Board of Directors of Vingroup authorized the CEO – Legal Representative of the Group or his authorized representative to decide on the specifics of the guarantee and the number of assets corresponding to the bonds issued by VinFast, as well as to sign and execute the relevant agreements in accordance with the approvals of the Board of Directors and applicable laws.

Regarding business performance, as per the disclosure of key indicators for 2024, as of December 31, 2024, the company’s equity stood at VND 10,961 billion, a decrease of VND 4,291 billion compared to the previous year.

VinFast incurred a net loss of nearly VND 31,936 billion in 2024, compared to a net loss of VND 18,256 billion in 2023. The accumulated loss as of December 31, 2024, amounted to VND 129,786 billion.

As of the end of 2024, the company’s total liabilities were VND 202,011 billion. Bank loans improved from VND 42,594 billion to VND 39,277 billion, while debt from bond issuance decreased by VND 13,544 billion. In contrast, other payables increased significantly by 44% to VND 149,189 billion.

What Does Billionaire Pham Nhat Vuong Do During a 140% Vingroup Stock Surge?

During the tumultuous period when Vingroup’s stocks were in flux, billionaire Pham Nhat Vuong steered the ship with a series of pivotal moves.

The Billionaire’s Boom: How Pham Nhat Vuong’s Wealth Surged by $2.9 Billion in May, Matching BIDV’s Market Cap and Surpassing the Next 12 Individuals’ Combined Net Worth

As of Tuesday, June 3, 2025, Mr. Vuong’s net worth surpasses the market capitalization of several prominent Vietnamese businesses listed on the stock exchange. His wealth exceeds that of industry giants such as Hoa Phat, FPT Corporation, PV Gas, Masan Consumer, and Vinamilk. Furthermore, his assets surpass those of notable banks, including Techcombank, MB, VPBank, and ACB.

“Vingroup Leads the Pack: A Whopping 21X Surge in Private TPDN Issuance in April 2025”

According to FiinGroup, the private corporate bond market witnessed a resurgence in April, with issuance volume surging 21-fold compared to the previous month and a remarkable 119% increase year-over-year, predominantly driven by the real estate sector. Notably, Vingroup accounted for a significant portion of the new private bond issuance in April, maintaining high-interest rates of 12-12.5% per annum.

VinFast Supplier Conference: Aiming for 80% Localization, Targeting 1 Million Vehicles per Year

VinFast is proud to be partnering with almost 700 domestic businesses to source components, materials, and equipment for its manufacturing operations. This extensive network of local suppliers is a testament to VinFast’s commitment to supporting the Vietnamese economy and fostering a robust automotive industry in the country. By working closely with these businesses, VinFast is not just assembling cars but also building a strong foundation for the future of Vietnam’s automotive sector.