On June 2, 2025, the Board of Directors of Vietnam Exhibition Fair Center Joint Stock Company (Stock Code: VEF) issued a resolution approving the plan to pay cash dividends to shareholders.

Specifically, a dividend of 135% of charter capital will be paid from undistributed post-tax profits up to December 31, 2024, equivalent to VND 13,500 per share.

An interim cash dividend of 300% of charter capital (VND 30,000 per share) will also be paid from 2025 post-tax profits.

The record date for determining eligible shareholders is June 13, 2025, and the expected payment date is July 4, 2025.

The source of funds for these dividends is the undistributed post-tax profit up to December 31, 2024, amounting to VND 2,346 billion, and the undistributed post-tax profit for the first quarter of 2025, amounting to VND 14,901 billion.

Based on the over 166.6 million circulating shares, VEF is estimated to need more than VND 7,247 billion in total for these two dividend schemes. Accordingly, its parent company, Vingroup Joint Stock Company (stock code VIC, currently holding 83.32% of VEF), could receive more than VND 6,000 billion in dividends from VEF.

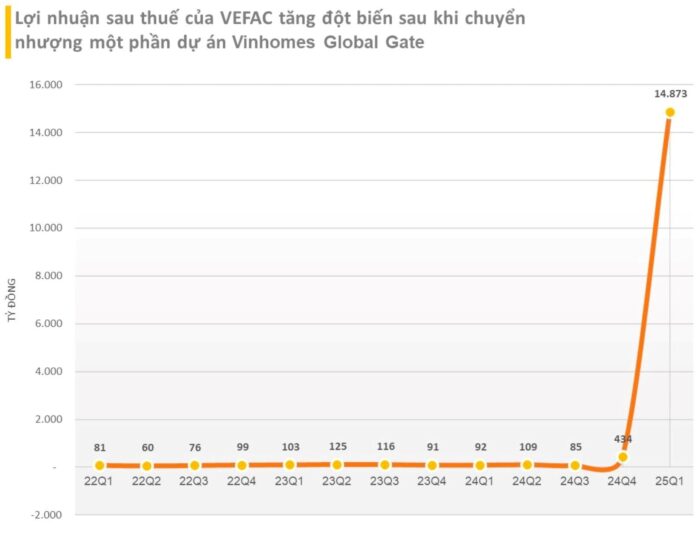

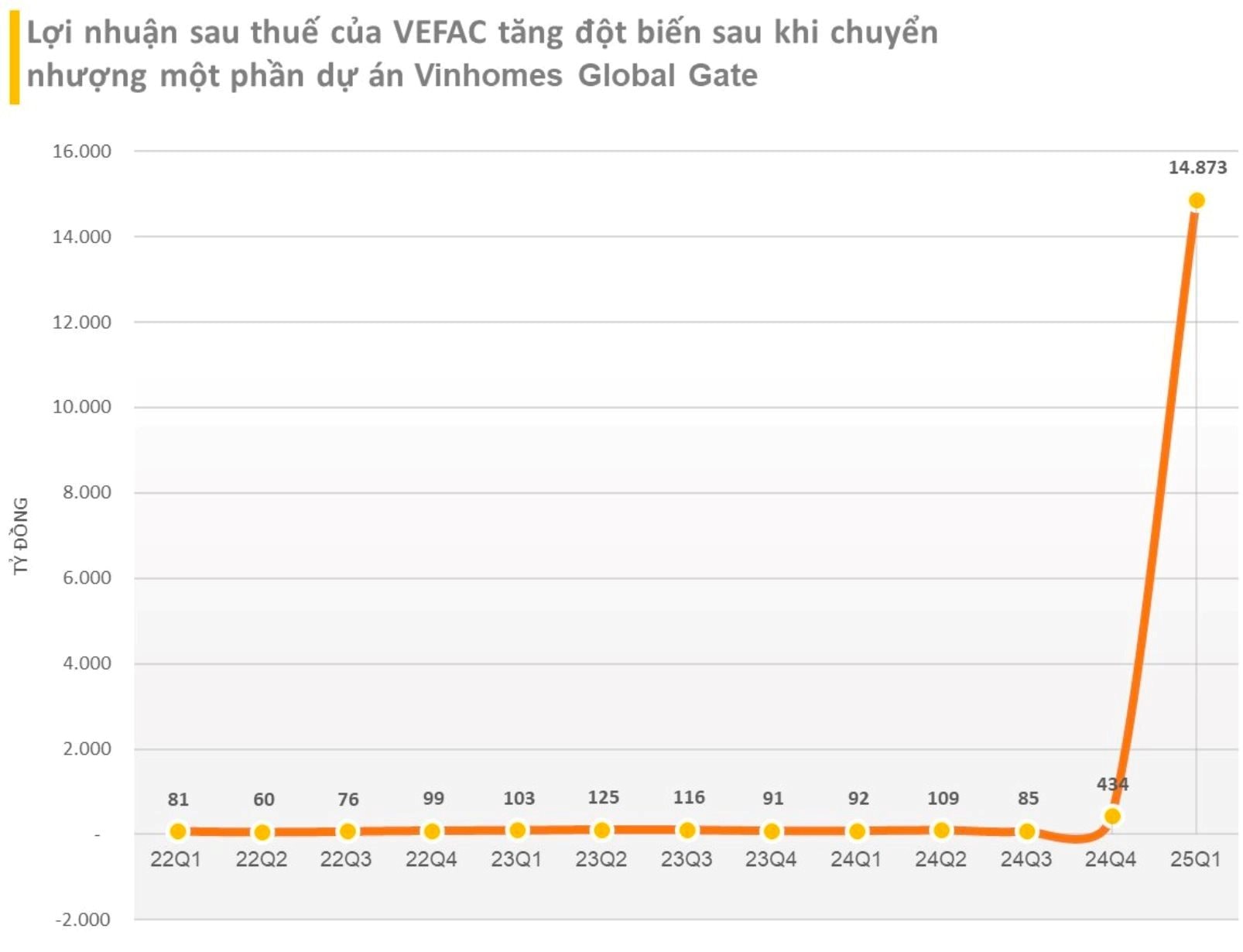

In terms of business performance, for the first quarter of 2025, VEF recorded a post-tax profit of over VND 14,873 billion, up 16,135% from the same period last year, which stood at just over VND 91.6 billion.

The significant increase in profit for the first quarter of 2025 compared to the same period last year is mainly due to the company recognizing revenue from the transfer of a part of the Vinhomes Global Gate project, amounting to VND 44,560 billion, and increased financial revenue from joint business activities.

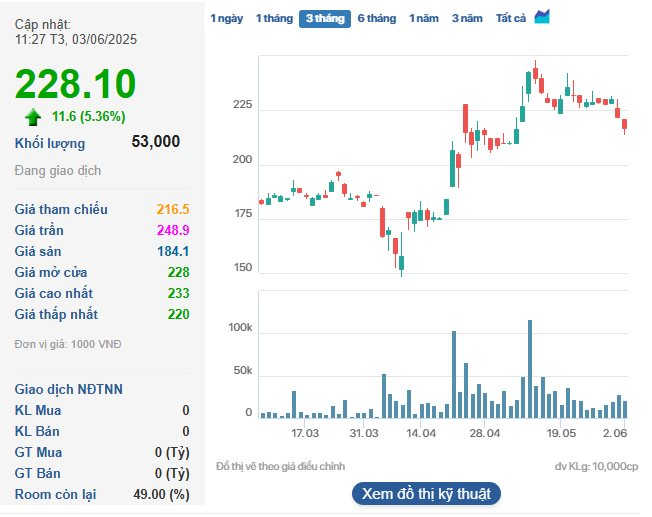

In the stock market, in the morning trading session of June 3, VEF shares increased by 5.36% to VND 228,100/share, with a matched volume of 53,000 units.

Profiting from the North-South Expressway: A Gasoline Retailer Soars with Record Dividends and a Skyrocketing Stock Price

The 24% dividend for 2024 is a remarkable feat and a record-breaker for the company, surpassing the planned 10% and accounting for nearly 79% of the year’s post-tax profits.

The Stock of a State-Owned Enterprise Surges Over 3,300% in a Year: Get Ready for a Record-High 24% Dividend Payout in June

The 2024 dividend payout is a record-breaking feat for the company, surpassing its initial projections by a significant margin.