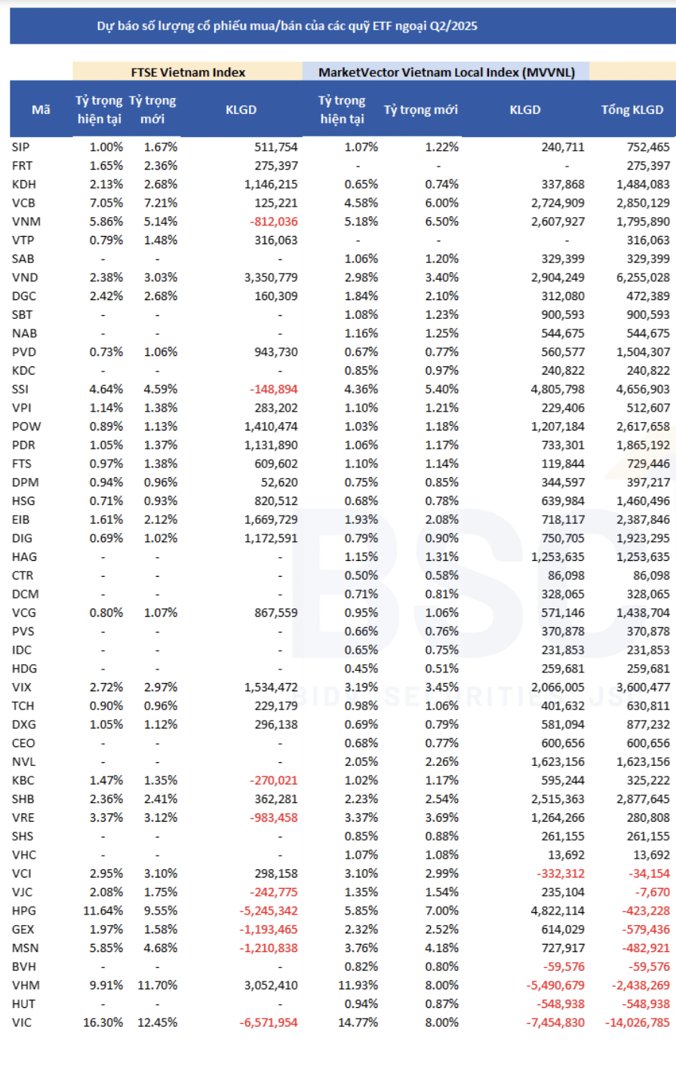

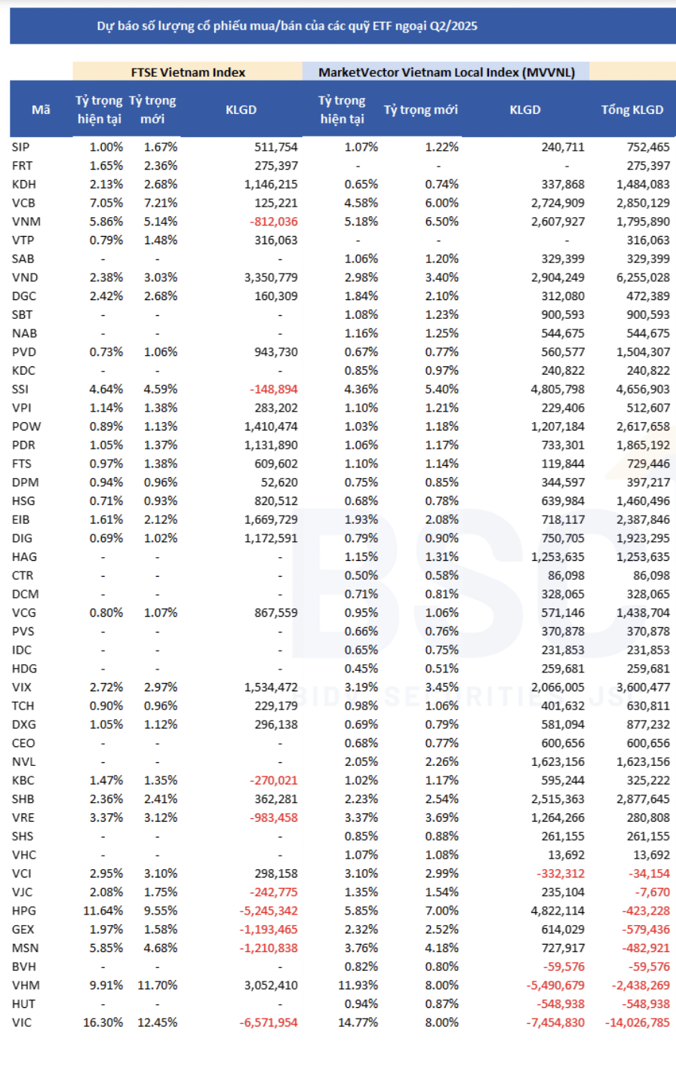

The upcoming review of the FTSE Vietnam Index and MarketVector Vietnam Local Index is expected to bring significant changes in constituent weights, despite no alterations in their compositions. BSC predicts no changes in the constituents of both the FTSE Vietnam Index and MarketVector Vietnam Local Index during this review. However, there will likely be considerable adjustments in stock weights.

Notably, BSC highlights that SIP is hovering just above the minimum trading value threshold set by the FTSE Vietnam Index, risking potential exclusion. Moreover, the substantial price increases of real estate giants VIC, VHM, and VRE in Q2 2025 may lead to several other stocks failing to meet the minimum capitalization requirements. These stocks include DIG, DPM, FTS, HSG, PDR, PVD, TCH, VCG, VPI, and VTP.

Regarding the MarketVector Vietnam Local Index, HDG is in a precarious position, sitting just above the accumulated capitalization threshold for stocks in the basket.

According to BSC’s projections, FTSE ETF will significantly purchase VND (3.3 million shares), followed by VHM (3 million shares), EIB (1.6 million shares), VIX (1.5 million shares), and POW (1.4 million shares). On the selling side, VIC will face the most significant pressure, offloading 6.5 million shares, followed by HPG with 5.2 million shares. Approximately 1.2 million shares of MSN and GEX are also expected to be divested.

For the VNM ETF, BSC anticipates substantial sales of VIC (7.4 million shares) and VHM (2.4 million shares), along with exits from HUT, MSN, GEX, and HPG, each in the hundreds of thousands of shares. In contrast, the VNM ETF is predicted to increase its purchases of securities and banking stocks. VND is given top priority with 6 million shares, followed by SSI (4.6 million shares) and VIX (3.6 million shares). Additionally, 2.8 million shares each of the banking stocks SHB and VCB will be added to the portfolio. POW (2.6 million shares), KDH (1.4 million shares), and VCG (1.4 million shares) are also on the buying list.

Source: BSC Securities JSC

|

Thien Van

– 11:08 04/06/2025

The Dynamic Duo of Stocks: Unveiling the Potential Sell-Off by Vietnam’s Oldest ETFs in June’s Restructuring

The BSC predicts that two ETFs could buy millions of securities, while the Vingroup duo might face significant selling pressure.

Market Pulse June 2nd: Blue Chips Dive, VN-Index Down Over 8 Points

The heavy pressure from the pillar group is causing the VN-Index to gradually lose momentum in the late morning session. By the mid-session break, the VN-Index had dropped 0.62%, settling at 1,324.4 points. In contrast, the HNX-Index climbed 0.66% to reach 224.69 points. The market breadth was negative, with 353 declining stocks against 306 gainers.