At the Vietnam Investment Forum 2025 on the afternoon of June 3rd, during the discussion “Macro Policy Changes Are Redrawing the Investment Map,” experts evaluated the impact of the US’s new tax policy on the global and Vietnamese economies.

US Tax Policy Creates Dual Uncertainty

Assoc. Prof. Dr. Pham The Anh, Economics Expert, Head of the Economics Department, National Economics University

|

Assoc. Prof. Dr. Pham The Anh, Economics Expert, Head of the Economics Department, National Economics University, pointed out two channels through which US tax policies could significantly impact Vietnam.

The first is the trade and investment channel. Vietnam’s growth model has relied heavily on exports and foreign investment, especially in the processing and manufacturing industries. When the US imposes stringent tax policies, particularly on industrial products, it reduces import demand and creates significant uncertainty for businesses with supply chains linked to the US market.

This uncertainty leads many foreign investors to postpone new investment plans or expand production, especially in industries at risk of high tariffs. Although there has been no recorded capital outflow from Vietnam, the trend of investment delay and caution is evident.

The second channel is the financial market. Apart from affecting trade, tax policies can also cause an increase in commodity prices in the US in the short term (about 1-2 months), leading to inflationary pressure. This forces the US Federal Reserve (Fed) to maintain high-interest rates to control prices.

High-interest rates in the US not only directly impact global capital flows but also affect financial markets, including Vietnam, especially when trying to maintain a stable exchange rate.

Assoc. Prof. Dr. Pham The Anh also noted that to assess the specific impact on each industry and sector, we need to wait for the final negotiation results between the US and its trading partners. However, in his personal opinion, he believes that the trend of influence will particularly affect labor-intensive industries and those dependent on exports, which currently attract a lot of FDI into Vietnam.

Hoping for a Successful Tax Negotiation to Open New Opportunities for the Economy

Mr. Pham Hong Hai – CEO of Orient Commercial Joint Stock Bank (OCB)

|

Mr. Pham Hong Hai – CEO of Orient Commercial Joint Stock Bank (HOSE: OCB) stated that changes in US monetary policies, especially the Fed’s interest rate hikes or increased issuance of government bonds, are putting pressure on emerging markets, including Vietnam.

When the Fed raises interest rates, the attractiveness of the US dollar and financial assets in the US increases, causing global capital flows to shift away from emerging markets, which are perceived as riskier.

Mr. Pham Hong Hai believes that in the long term, the position of the US dollar as a global reserve currency may decline. Although the US maintains its dominance in the international financial system, a budget deficit of about $2 trillion each year puts US finances at risk.

In the context of geopolitical and trade policy fluctuations, many countries are seeking to reduce their dependence on the US dollar and promote the use of their currencies in international payments. This strategic opportunity for emerging markets like Vietnam to rise is presented if they can seize the global shift.

Regarding the domestic context, Mr. Hai assessed that the State Bank of Vietnam (SBV) is facing a challenging equation: ensuring macroeconomic stability while maintaining growth in the face of rising global interest rates.

Lowering interest rates to stimulate the economy would mean putting pressure on the exchange rate. However, if the Vietnamese dong depreciates significantly, Vietnam will be seen as using the exchange rate for competitive trade, which major partners like the US do not favor.

Mr. Hai expressed his hope that Vietnam would continue to maintain macroeconomic stability and, more importantly, negotiate effectively with the US on trade, thereby opening up new opportunities for domestic businesses and the economy.

What Are the Opportunities for Domestic Businesses?

Dr. Phan Duc Hieu – Member of the Economic Committee of the XV National Assembly

|

According to Dr. Phan Duc Hieu – Member of the Economic Committee of the XV National Assembly, domestic businesses are currently facing new opportunities but also confronting unpredictable risks, especially from global policy fluctuations such as US tax policies and post-COVID-19 economic uncertainties. Many businesses shared that they dare not make plans beyond six months because the business environment is changing too quickly and is difficult to predict.

In response to this situation, there are positive institutional shifts domestically, notably the vigorous investment public investment reform and the amendment of a series of laws related to the business environment, such as the Law on Investment, the Law on Bidding, the Law on PPP, and the Law on Innovation… Among these, Resolution 198 of the Government is expected to expedite key projects through mechanisms such as designated bidding and restricted bidding…

Another significant resource comes from over 2,000 unfinished investment projects. If the bottlenecks in procedures, legal issues, or capital are resolved, this will be a tremendous boost for domestic growth and may even be more effective than solely focusing on attracting new FDI.

Additionally, a range of tax support policies are under consideration, such as abolishing the business license tax, granting tax exemptions for 1-3 years, and allowing a 200% deduction for research and development (R&D) expenses when calculating corporate income tax…

However, the core issue remains the speed and determination of implementation. Dr. Hieu mentioned that the National Assembly has requested the Government to complete many reform contents in 2025-2026. If these policies are implemented according to the roadmap, businesses will have more confidence to expand their investments, restore production, and contribute to making the private sector a true driving force for the economy.

– 16:59 06/03/2025

The Average Vietnamese Income Script Achieves $28,370 Annually

According to experts, for Vietnam to join the ranks of high-income countries, there needs to be a period where its GDP growth reaches double digits (over 10%). This is an unprecedented threshold, an ambitious goal, yet not an impossible one. An ambitious scenario targets an 11-12% annual GDP growth rate during the 2025-2035 period, elevating per capita income to $28,370 by 2045.

“Dollar and Yuan Dance to Different Tunes: A Tale of Contrasting Fortunes.”

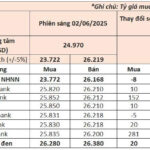

“As of 8:30 a.m. on June 2nd, the USD exchange rate at Vietcombank and BIDV was set at 23,850-23,210 VND/USD for buying and selling, respectively. This marks an increase of 20 VND in both buying and selling rates compared to the morning of May 30th, indicating a slight strengthening of the USD against the VND in the interbank market.”

The Ultimate Cash Flow Property: Shattering Records, Shophouse Swan Lake at Hoang Huy New City

“Swan Lake is an exceptional real estate investment opportunity that defies the norms of traditional property investments. With its dual potential for residential and business use, it offers a unique proposition that stands out in the market. This development is designed to surpass expectations, providing a truly versatile asset that unlocks the limits of conventional cash flow properties.”

“Dollar and Yuan Continue Their Ascent: What’s Driving the Rally?”

The USD exchange rate at Vietcombank and BIDV is currently quoted at 25,830-26,190 VND/USD (buy-sell), with Vietcombank increasing by 50 VND and BIDV by 40 VND in both buying and selling rates compared to the morning of May 29th.