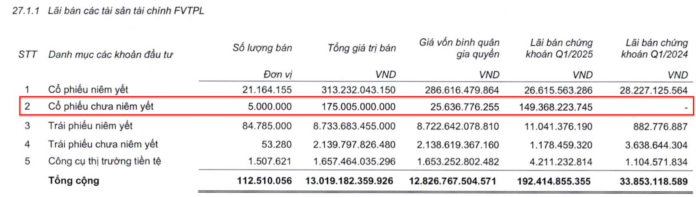

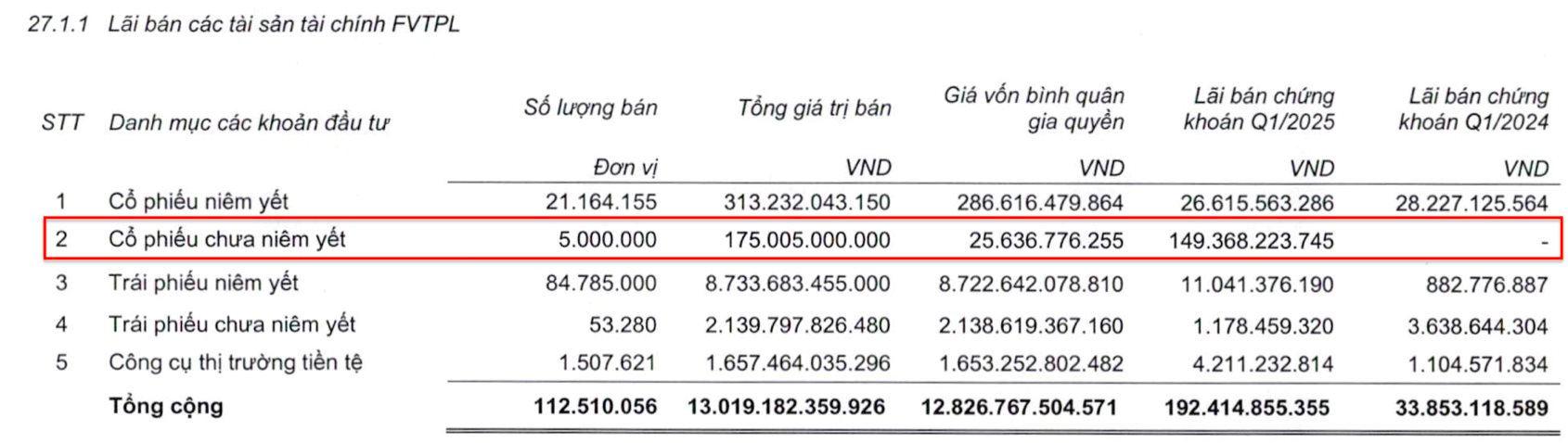

According to VietinBank Securities’ (VietinBank Securities – code CTS) Q1/2025 financial report, the company sold 5 million unlisted shares at VND 175 billion, equivalent to an average of VND 35,000/share.

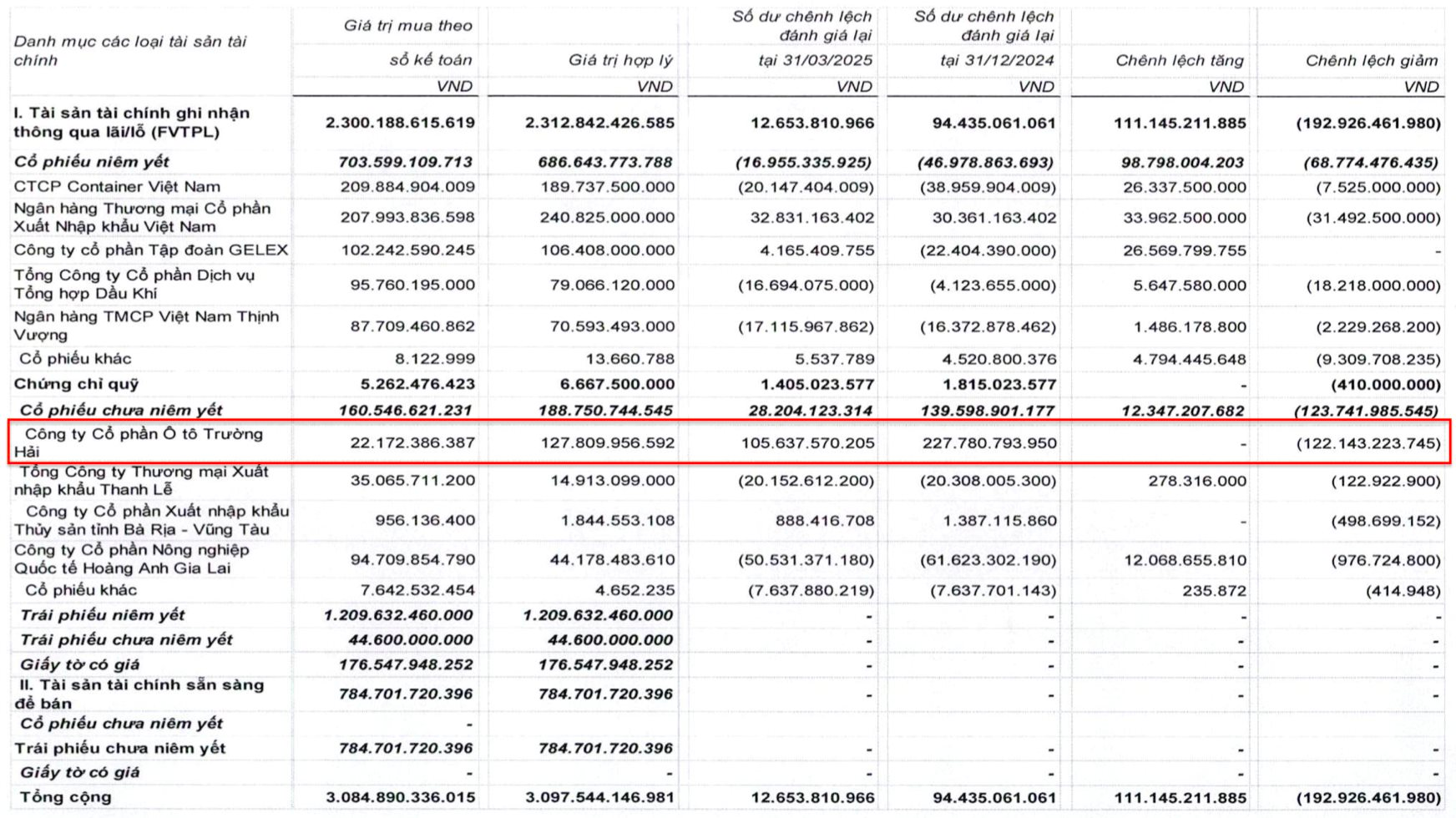

This sale likely involved THACO shares, as it was the only unlisted stock in CTS’ portfolio that changed its initial price compared to the beginning of the year. With this transaction, THACO was valued by CTS at approximately VND 107 trillion (~USD 4.3 billion).

Source: Q1/2025 Financial Statements of CTS

This is not the first time CTS has sold THACO shares. In Q2/2023, CTS also offloaded over 4.7 million shares of the corporation at approximately VND 140 billion, or VND 30,000/share. THACO’s valuation at that time was about VND 91.5 trillion (~USD 3.7 billion). From 2023 to 2025, CTS valued THACO at around VND 100 trillion (~USD 4 billion).

This valuation is significantly lower than Mr. Tran Ba Duong’s expectations in the capital raising plan for investing in the North-South High-Speed Rail Project (with a scale of over USD 60 billion). Specifically, in Mr. Duong’s letter, aside from loans, THACO intends to raise capital through:

(1) Selling shares of member companies within the ecosystem, bringing THACO’s ownership together with that of Mr. Tran Ba Duong and his family to 51%;

(2) Offering shares to increase THACO’s charter capital, with Mr. Tran Ba Duong and his family holding 51% (as evidenced by the agreement for Jardine Cycle & Carriage (JC&C) to purchase shares at 20 times THACO’s consolidated profit in 2027);

(3) Using a large portion of the annual post-tax profit (estimated at VND 15 trillion/year) to contribute capital to the project if necessary.

THACO, led by Mr. Tran Ba Duong, is aiming for a P/E ratio of 20 for the corporation by 2027, which corresponds to a valuation of VND 300 trillion (~USD 12 billion). This figure is about three times higher than CTS’ valuation.

What does THACO’s ecosystem encompass?

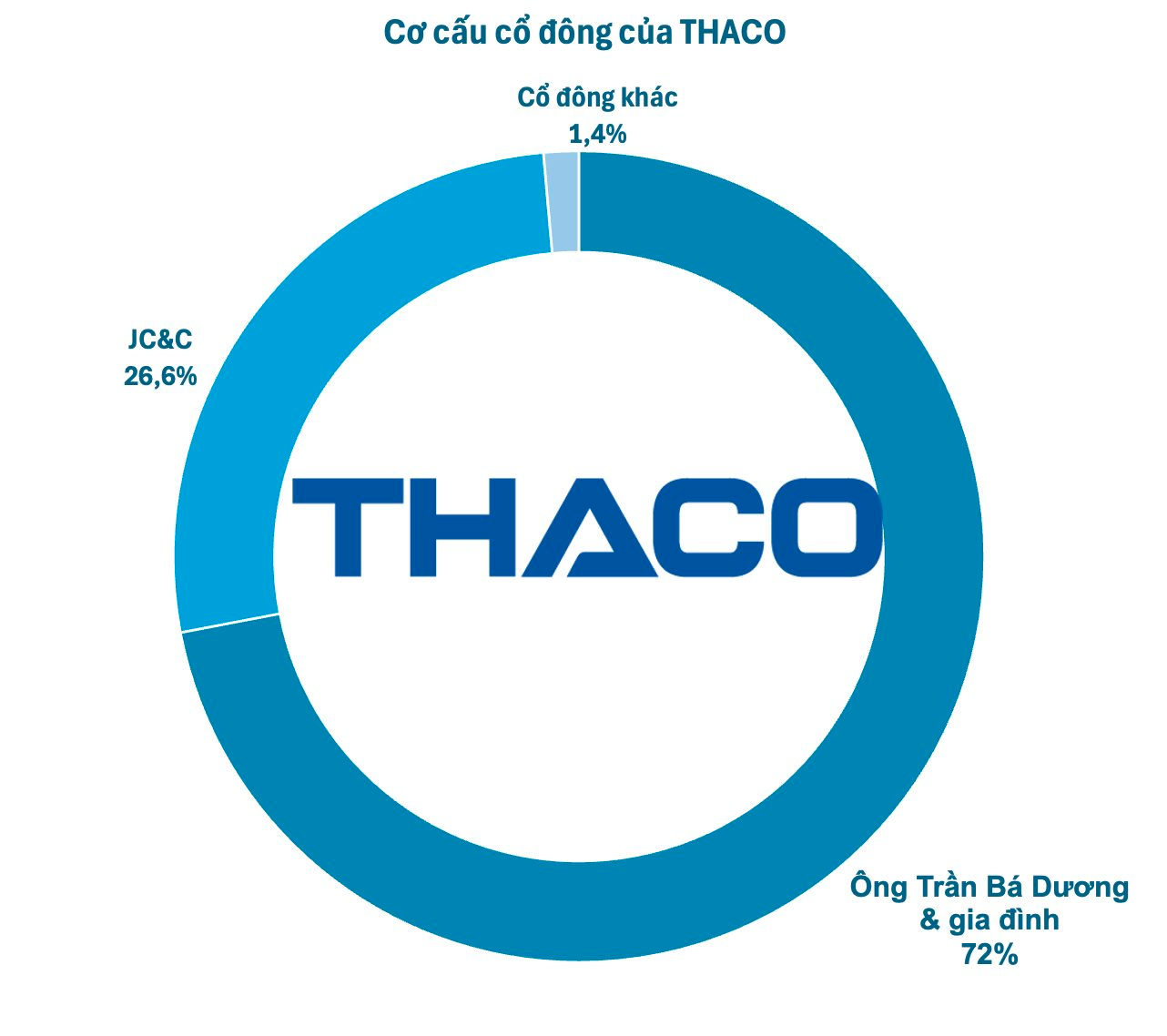

THACO is currently a diversified conglomerate with a charter capital of VND 30,510 billion (equivalent to 3,051 million shares). Mr. Tran Ba Duong and his family hold 72% of the shares, while strategic shareholder JC&C owns 26.6%. The remaining 1.4% belongs to other shareholders, who are employees of the company.

Mr. Tran Ba Duong’s THACO ecosystem comprises numerous businesses spanning various sectors, including industrial manufacturing and mechanics, logistics and seaports, infrastructure investment, trade and services, and high-tech agriculture and forestry.

THACO AUTO specializes in importing, manufacturing, assembling, distributing, retailing, and providing repair services for automobiles and motorcycles. THACO INDUSTRIES operates in the field of mechanical engineering and supporting industries. THADICO is responsible for investing in the development of industrial parks, urban areas, real estate, and transportation infrastructure. THILOGI offers integrated logistics services. THACO AGRI focuses on integrated, circular, and organic agricultural production. THISO is engaged in the development of commercial and service-related business lines.

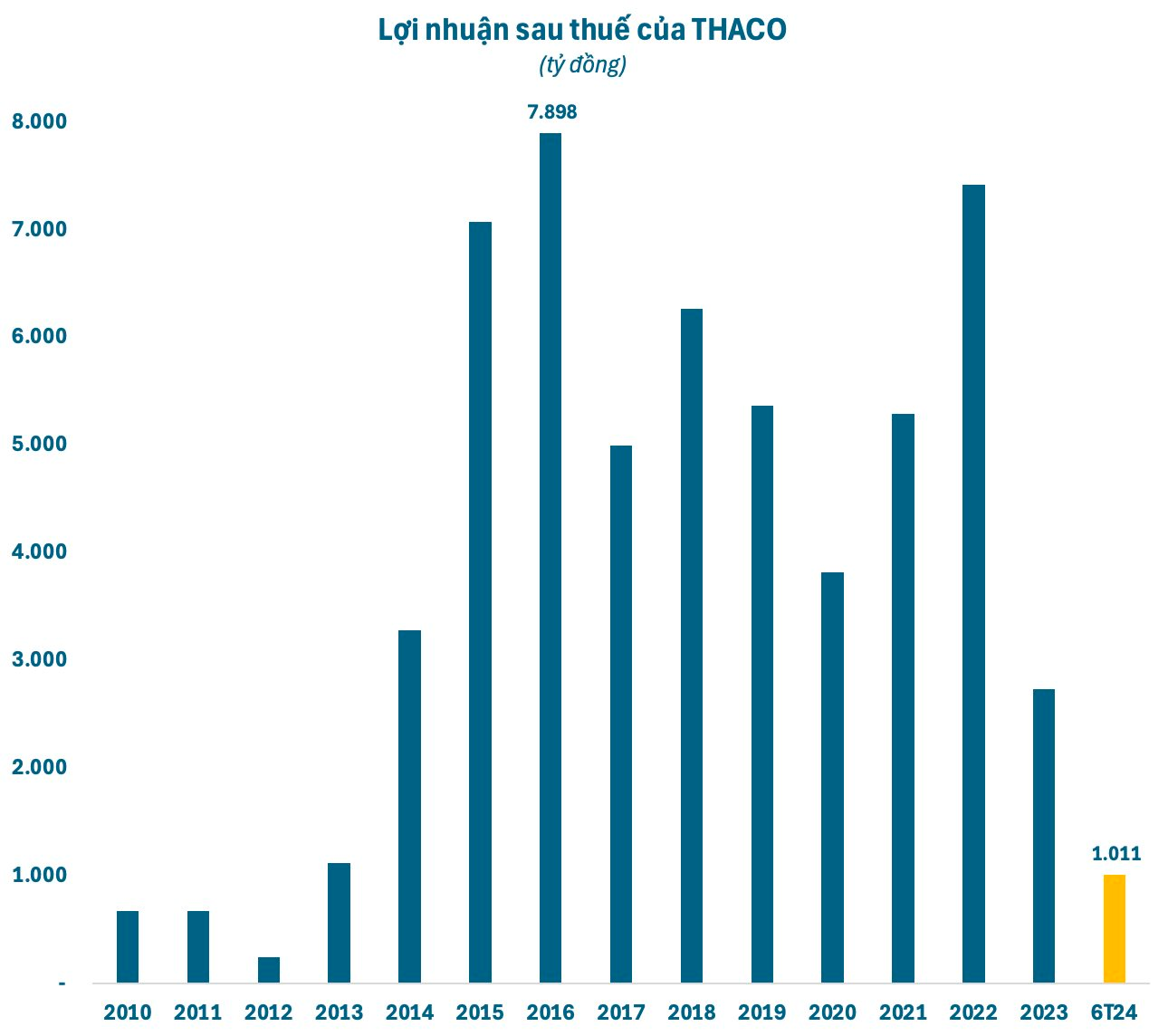

In 2023, THACO recorded a post-tax profit of VND 2,734 billion, representing a 63% decrease compared to the figure of VND 7,420 billion in 2022. This decline was mainly due to challenges in the automotive market, characterized by intensifying competition and weakened purchasing power resulting from global and domestic economic fluctuations. In the first half of 2024, THACO’s post-tax profit reached VND 1,011 billion, a 6% drop compared to the same period last year.

Looking back at historical financial performance, even during the booming period of 2015-2016, THACO’s annual profit never exceeded VND 8 trillion. Therefore, THACO needs to exert more efforts in the coming years to attain the projected profit of VND 15 trillion/year as mentioned by Mr. Tran Ba Duong in the capital raising plan for the North-South High-Speed Rail Project.

As of June 30, 2024, THACO’s owner’s equity stood at approximately VND 54,260 billion (~USD 2.2 billion), with consolidated total assets surpassing VND 187 trillion (~USD 7.5 billion). The debt-to-equity ratio was 2.45 times, higher than the previous period, indicating the corporation’s debt obligations amounted to VND 132,937 billion. Notably, as of the end of June 2024, the outstanding bond debt exceeded VND 14,100 billion.

An Open Letter from Billionaire Tran Ba Duong: THACO’s Proposal to Invest in the High-Speed North-South Railway Project Valued at US$61.35 Billion

Chairman of THACO’s Board of Directors, Tran Ba Duong, has reached out to shareholders, partners, and employees regarding the company’s proposal to invest in the North-South High-Speed Rail Project. This move showcases THACO’s sense of responsibility and determination to contribute to Vietnam’s key national infrastructure projects.

“Proposed High-Speed Rail Project Worth Over $61 Billion: Just How Big is THACO?”

As of June 30, 2024, THACO’s total assets stood at nearly VND 187,200 billion, but the company also carried a substantial debt burden of almost VND 133,000 billion. According to THACO’s bond payment report for the first half of 2024, the company has four bond issues outstanding with a total face value of VND 15,080 billion.

The Coffee Connoisseur: Brewing a Robot-Inspired Cafe Experience

The newly opened Besoverse Cosmic Cafe in Ho Chi Minh City is a stellar addition to the vibrant culinary scene, bringing a unique dining experience to locals and tourists alike. As a proud member of the Thiso family, a Thaco Group subsidiary, Besoverse Cosmic Cafe embodies a passion for culinary excellence and a commitment to creating memorable moments for its guests.

“Chairman Tran Ba Duong: Thaco Aspires to be the Auto Manufacturing Hub for International Brands”

On September 21, at a Conference of the Government’s Standing Committee with enterprises on solutions to contribute to the country’s socio-economic development, many private enterprises offered their insights and initiatives to collaboratively foster the nation’s economic and social growth. Mr. Tran Ba Duong, Chairman of Thaco, put forward proposals to promote the development of the auxiliary industry.