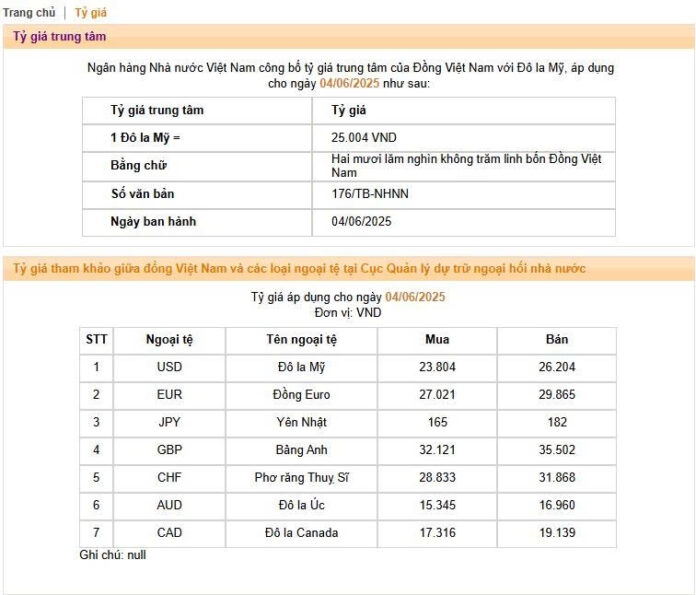

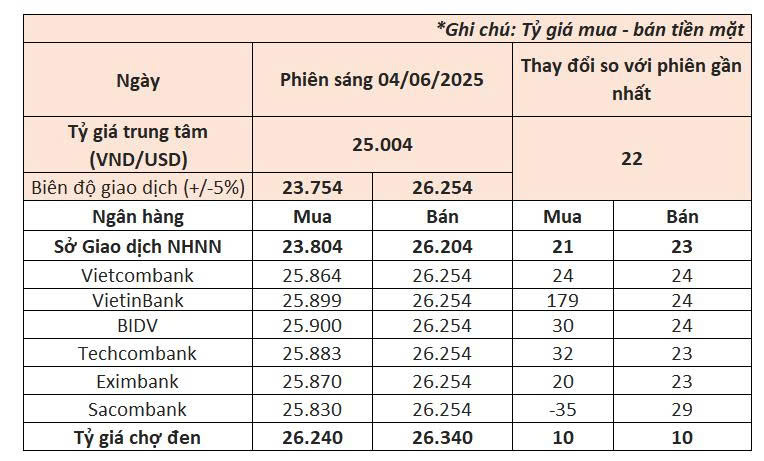

The State Bank of Vietnam has announced the USD/VND central exchange rate at 25,004 VND/USD on June 4th, an increase of 22 VND compared to the previous day’s trading session. This is the first time the central rate has surpassed the 25,000 VND mark since the implementation of the new mechanism in early 2016.

With a permitted trading band of 5%, commercial banks can now transact at rates between 23,754 and 26,254 VND per USD.

The State Bank of Vietnam’s Trading Centre has also made corresponding adjustments, raising the buying and selling rates to the range of 23,804–26,204 VND/USD.

This morning, commercial banks continued to push USD/VND rates to the ceiling.

As of 10:00 am, Vietcombank, the largest foreign currency trader in the system, quoted buying and selling rates of 25,864 and 26,254 VND/USD, respectively—an increase of 24 VND from the previous session’s close. BIDV also raised its rates, with the buying rate increasing by 30 VND to 25,858 and the selling rate rising by 24 VND to 26,218 VND/USD.

VietinBank, facing a selling rate ceiling, significantly increased its buying rate by 179 VND to trade at 25,899–26,254 VND/USD.

Private banks surveyed have also uniformly raised their selling rates to the maximum permitted level of 26,254 VND/USD, representing an increase of about 20–30 VND from the previous day’s close.

In the interbank market, the USD/VND exchange rate ended the June 3rd session at 26,053 VND/USD, a 23 VND increase from June 2nd.

In the black market, the USD also trended upwards. As of 10:00 am today, the buying and selling rates were quoted at 26,240 and 26,340 VND/USD, respectively, a 10 VND increase from the previous day’s rates.

The USD/VND rate hitting the ceiling and reaching an all-time high occurs against the backdrop of a slight recovery in the greenback in the international market, although it remains at its lowest level in three years. The US Dollar Index (DXY), which measures the strength of the greenback against a basket of major currencies, currently hovers around 99.3 points after gaining 0.5% on June 3rd.

Currently, the USD is down 4.5% from its April 2nd level when President Donald Trump began announcing tariffs, causing foreign investors to flee the US stock and bond markets.

Speaking at the VietnamBiz and Vietnam Moi’s Vietnam Investment Forum 2025 – Mid-Year Update on June 3rd, Mr. Pham Hong Hai, CEO of Orient Commercial Joint Stock Bank (OCB), attributed the weakening of the USD to President Trump’s tariff policies. However, the State Bank of Vietnam faces a challenging situation as it must maintain exchange rate stability while also lowering interest rates to support economic growth.

According to Mr. Hai, due to the current global trade uncertainties, many countries are seeking to shift their trade payments away from the US dollar to reduce their dependence on this currency. Nevertheless, in the context of Vietnam’s current situation, the State Bank faces a delicate balance between maintaining macroeconomic stability and lowering interest rates to boost economic growth.

“In theory, lowering interest rates puts pressure on the exchange rate. We also do not want the VND to depreciate too much, as we do not want to be labeled as using exchange rate manipulation to stimulate exports. This is a very difficult problem for Vietnam at present,” said Mr. Hai.

According to MBS Securities, the rise in the USD/VND exchange rate despite the greenback’s weakness in the international market can be attributed to the State Treasury continuing to buy USD from commercial banks, limiting the supply of foreign currency. Additionally, businesses’ demand for foreign currency has increased due to global trade uncertainties.

Moreover, the deep cuts in VND interbank interest rates have caused the interest rate differential between VND and USD to turn sharply negative, putting further pressure on the exchange rate.

MBS experts forecast that the USD/VND exchange rate will fluctuate within the range of 25,500–26,000 VND/USD in 2025. They anticipate that the US dollar will recover due to expansionary fiscal policies, high interest rates, and America’s trade protectionism. These factors are expected to strengthen the US dollar’s value in 2025.

Unpredictable tariff policies from the US are also expected to create challenges for Vietnam’s exports and FDI attraction in the coming time and may exert pressure on the country’s foreign reserves, which are already modest after the sale of over $9 billion in 2024.

However, positive macroeconomic factors such as the trade surplus ($3.79 billion), FDI disbursement ($6.74 billion), and strong growth in international tourist arrivals (up 23.8% year-on-year) are expected to continue supporting the VND.

Save with Hong Leong Vietnam – Enjoy Luxurious Getaways

From May 19th to July 31st, 2025, Hong Leong Bank Vietnam (“Hong Leong Vietnam”) has partnered with Anantara Vacation Club to launch an exclusive promotion, “Privilege of Savings”, offering luxurious vacation prizes to show appreciation to their valued customers who have trusted the bank with their financial planning and long-term savings goals.

The Ultimate Trading Stock Has Arrived

The VN-Index closed today’s session (June 3rd) at a year-to-date high of 1,347 points. The stock market witnessed a robust rally across securities as investors circulated rumors about the market upgrade progress. A notable highlight was the massive transaction by foreign funds, with over 37 million shares traded through a block deal in APG.