As the market break hits, the market breadth witnessed 348 declining stocks, including 13 hitting the floor. On the flip side, there were 328 gainers, including 16 that rose to the ceiling. The remaining 932 stocks stayed flat.

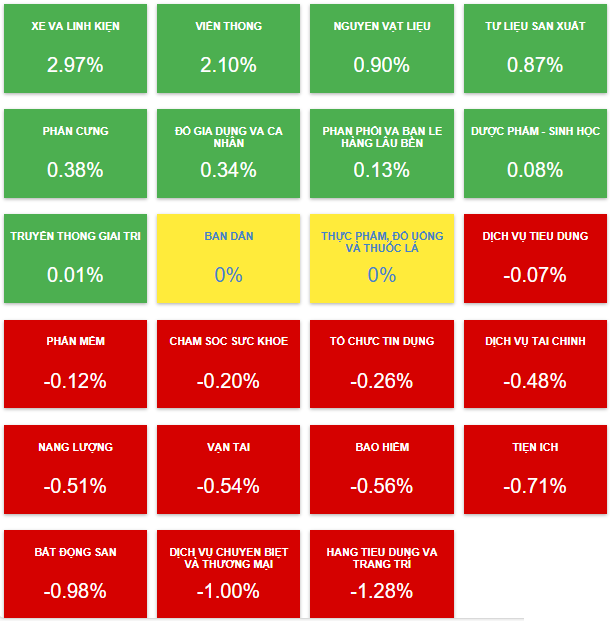

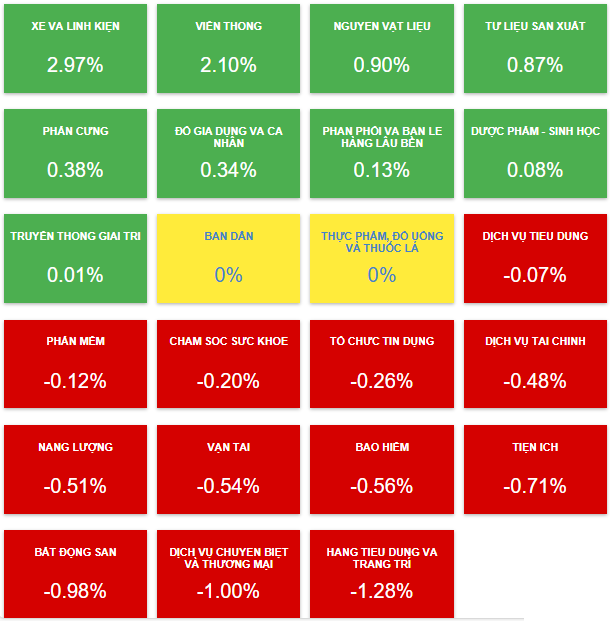

Sector-wise, 12 sectors witnessed losses, led by consumer and decorative goods, which fell by 1.28% due to GEE‘s 2.56% decline and GEX‘s 2.3% drop. This was followed by specialized services and commerce, which fell by 1%, mainly due to a 1.37% decrease in VEF.

However, the most notable aspect was the decline in large-cap sectors such as real estate, securities, and banking, which had a negative impact on the index.

Source: VietstockFinance

|

Within the real estate sector, the decline was 0.98%, with widespread losses. The most notable were the VIC trio, which fell by 1.33%, VHM by 1.56%, and VRE by 1.11%. In addition, a series of familiar names also declined, including NVL by 1.41%, TCH by 1.25%, NLG by 2.13%, DXG by 1.88%, and PDR by 1.63%… On the contrary, DXS stood out with a ceiling price.

For the industrial real estate group, gains prevailed, with BCM up 0.33%, KBC up 0.96%, SIP up 1.16%, IDC up 0.24%, and SZC up 1.68%…

In the securities sector, the decline was 0.48%, with notable losses for VND, down 1.16%, VIX down 1.42%, SHS down 1.45%, VDS down 1.24%, and VFS down 2.11%…

Similarly, the banking sector witnessed a 0.26% decline, with notable stocks such as VCB down 0.18%, BID down 0.42%, TCB down 0.48%, and CTG down 0.52% having a significant impact on the market.

Foreign investors temporarily net sold over VND332 billion in the morning session, notably net selling VIX and STB stocks, each with a scale of nearly VND55 billion. On the buying side, MSN led with a similar scale.

10:45 AM: Sudden pressure pushes VN-Index into the red

Contrary to the positive start, the VN-Index soon faced significant pressure and quickly turned red. As of 10:40 AM, the index was down 5.77 points to 1,339.97, dragged down by large-cap sectors such as real estate, banking, and securities.

Within the real estate sector, the VinGroup trio of VHM, VIC, and VRE witnessed notable declines, impacting the market. VIC and VHM were the top two contributors to the VN-Index‘s loss, accounting for approximately 0.7 points.

Additionally, other real estate stocks also faced selling pressure, with DXG down 1.56%, PDR down 1.63%, VPI down 2.04%, TCH down 1.75%, HDC down 1.15%, NLG down 1.73%, and ITC even hitting the floor.

The banking sector also exerted pressure, with TCB down 0.8%, SHB down 0.36%, EIB down 1.62%, and CTG down 0.52%… Similarly, the securities sector saw many stocks decline, including VIX down 1.06%, SSI down 0.41%, and VND down 1.16%…

The market also witnessed declines in other large-cap stocks, notably FPT and HPG.

The nearly 6-point drop in the index was partly offset by some large-cap stocks, such as STB, MSN, and MWG, along with many stocks that managed to stay in positive territory. Without these stocks, the index would have lost more ground.

Opening: Green Dominates, Real Estate and Construction Sectors Cheerful

As of 9:30 AM, the indices opened in positive territory, with the VN-Index up 0.16 points to 1,345.9, the HNX-Index up 0.73 points to 231.56, and the UPCoM-Index up 0.65 points to 99.66. The market witnessed 276 advancing stocks, outnumbering the 159 declining ones. Total trading volume across the market reached 97 million shares, equivalent to a turnover of nearly VND1,985 billion.

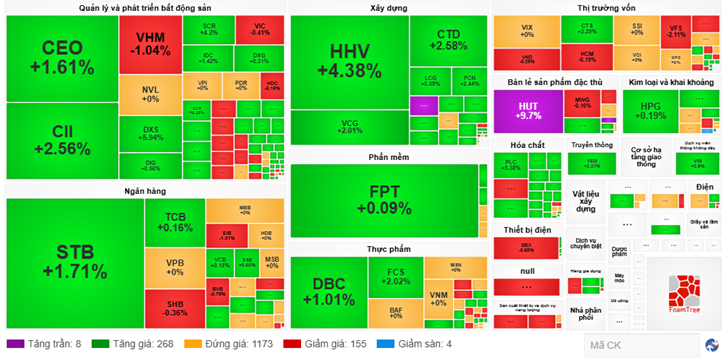

The market heat map showed a predominance of green, with notable gains in the real estate sector, such as CEO up 1.61%, CII up 2.56%, DXS up 5.94%, and SVR up 4.2%… In the banking sector, STB rose 1.71%, TCB gained 0.16%, and VCB climbed 0.18%… The construction sector also saw gains, with HHV up 4.38%, CTD up 2.58%, LCG up 3.09%, and FCN up 2.44%. Additionally, the food sector continued its positive momentum, with DBC up 1.01% and FCS up 2.02%…

The market even witnessed stocks quickly hitting the ceiling in the early minutes, including HUT and HTN.

|

Green Predominates the Market Heat Map

Source: VietstockFinance

|

Asian markets opened mixed, with notable declines in the All Ordinaries, Nikkei 225, and Shanghai Composite indices, while the Hang Seng and Singapore Straits Times indices posted gains.

In the US market overnight, the Dow Jones fell after private sector hiring in the US hit a more than two-year low, raising concerns that trade policy uncertainty may be weighing on the US economy.

At the close of the session on June 4, the Dow Jones lost 91.90 points (or 0.22%) to 42,427.74. This ended the index’s four-day winning streak. Meanwhile, the S&P 500 inched up 0.01% to 5,970.81, and the Nasdaq Composite added 0.32% to 19,460.49.

– 12:05 06/05/2025

“Equity Liquidity Crunch: Small-Cap Stocks Feel the Pinch”

The market continues to show no signs of breaking through, despite the VN-Index hovering around the 1340-point mark. The main culprit is the largest bloc of blue-chip stocks turning southward. Meanwhile, overall liquidity has also taken a significant hit, and opportunities are now scarce outside a handful of mid-to-small-cap stocks.

Market Tug-of-War: The Ongoing Battle Unveiled

The VN-Index witnessed a slight dip with a tug-of-war session, coupled with below-average trading volume. A throwback is currently unfolding as the VN-Index has recently breached a strong resistance level of 1,320-1,340 points. Notably, the MACD indicator has been narrowing its gap with the Signal line in recent sessions. Should this indicator flash a sell signal in the upcoming periods, the risk of a short-term correction may emerge.

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.

The Money Vacuum: Small Caps Suck In Cash, Weighing Down Indexes

The HoSE exchange witnessed a significant drop in liquidity today, falling by approximately 9% from the previous day, equating to a loss of over VND 2,000 billion. Amidst this decline, the VNSmallcap basket stood out as the sole exception, experiencing a slight uptick in liquidity. The representative index of this basket also outperformed the broader market, with numerous stocks reaching their ceiling prices.