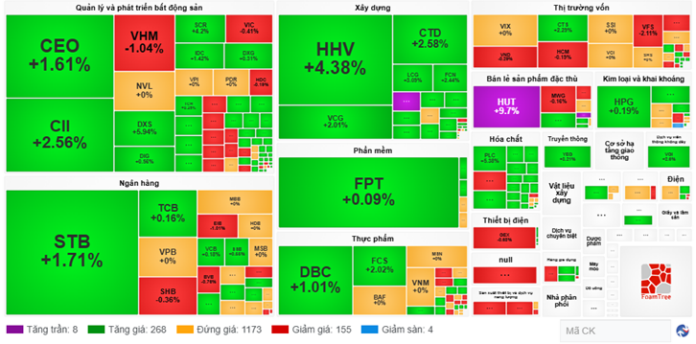

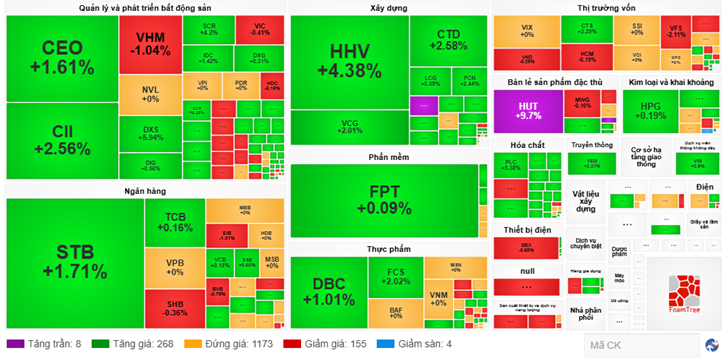

The market heatmap showed a predominance of green, with standout performances from real estate stocks such as CEO, up 1.61%, CII rising by 2.56%, DXS with a 5.94% gain, and SVR climbing by 4.2%. In the banking sector, STB increased by 1.71%, TCB gained 0.16%, and VCB saw a modest increase of 0.18%. Construction stocks also fared well, with HHV up 4.38%, CTD rising 2.58%, LCG gaining 3.09%, and FCN increasing by 2.44%. The positive momentum extended to the food sector, with DBC and FCS posting gains of 1.01% and 2.02%, respectively.

The market also witnessed a quick surge in stocks reaching the upper circuit breaker, notably HUT and HTN.

|

Green Predominates in the Market Heatmap

Source: VietstockFinance

|

Asian markets opened mixed, with notable declines in the All Ordinaries, Nikkei 225, and Shanghai Composite indices, while the Hang Seng and Singapore Straits Times indices posted gains.

In the US market overnight, the Dow Jones declined as private sector hiring in the US hit its lowest level in over two years, raising concerns about the potential impact of trade policy uncertainty on the American economy.

At the close of trading on June 4th, the Dow Jones Industrial Average fell 91.90 points, or 0.22%, to 42,427.74. This ended a four-day winning streak for the index. Meanwhile, the S&P 500 edged up 0.01% to 5,970.81, and the Nasdaq Composite climbed 0.32% to 19,460.49.

– 09:42 05/06/2025

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.