Saigon Real Estate Joint Stock Corporation (Saigonres, stock code: SGR, listed on HoSE) has announced insider trading activities.

According to the announcement, Mr. Pham Thu, Chairman of Saigonres’ Board of Directors, has registered to transfer 9.8 million SGR shares. The transaction is expected to take place from June 9, 2025, to July 7, 22025, through matched orders and put-through transactions.

If the transaction is successful, Mr. Pham Thu’s ownership in Saigonres will decrease from over 27.8 million shares to over 18 million shares, reducing his stake from 39.84% to 25.82%.

Previously, on May 7, 2025, Mr. Pham Thu successfully purchased nearly 9.9 million SGR shares out of the 20 million shares he registered to buy in the company’s private placement offering. The reason for not completing the full transaction was due to the instability of the stock market.

As a result of this recent transaction, Mr. Pham Thu’s ownership in Saigonres increased from nearly 18 million shares to over 27.8 million shares, raising his stake from 29.94% to 39.84%.

Illustrative image

On the same day, May 7, 2025, Saigonres concluded its private placement offering of 20 million shares at a price of VND 40,000 per share. However, the company only successfully sold nearly 9.9 million shares to Mr. Pham Thu, while the remaining over 10.1 million shares were canceled due to non-payment by registered investors.

Following the offering, Saigonres’ chartered capital increased to nearly VND 698.8 billion.

In terms of business performance, according to the consolidated financial statements for the first quarter of 2025, Saigonres recorded net revenue of nearly VND 23.5 billion, a 13.5% increase compared to the same period last year. After deducting taxes and expenses, the company reported a net profit of over VND 18.9 billion, compared to a net loss of nearly VND 13.6 billion in the previous year.

As of March 31, 2025, Saigonres’ total assets increased slightly by VND 14.3 billion from the beginning of the year to nearly VND 2,266.7 billion. Inventories accounted for VND 419.3 billion, or 18.5% of total assets, while short-term receivables were recorded at over VND 989.7 billion, representing 43.7% of total assets.

On the liabilities side, total liabilities stood at nearly VND 1,273 billion, a slight decrease of VND 4.5 billion from the beginning of the year. Borrowings and finance leases amounted to over VND 440.2 billion, constituting 34.6% of total liabilities.

The Foreign Turn: Heavy Selling in Two Blue-chip Stocks

The foreign transactions balanced out with net selling of approximately VND 49 billion across the market.

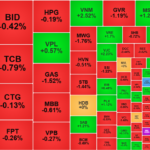

The Money Vacuum: Small Caps Suck In Cash, Weighing Down Indexes

The HoSE exchange witnessed a significant drop in liquidity today, falling by approximately 9% from the previous day, equating to a loss of over VND 2,000 billion. Amidst this decline, the VNSmallcap basket stood out as the sole exception, experiencing a slight uptick in liquidity. The representative index of this basket also outperformed the broader market, with numerous stocks reaching their ceiling prices.