With a distribution rate of 15% and over 210.5 million shares outstanding, SIP will issue nearly 31.6 million new shares as dividends, thereby increasing its charter capital from over VND 2,105 billion to approximately VND 2,421 billion.

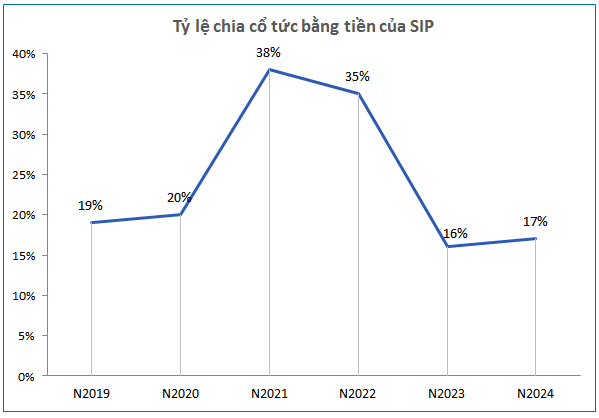

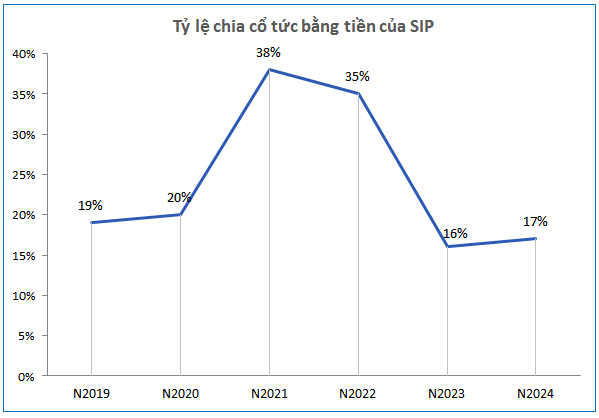

Previously, SIP had paid out nearly VND 358 billion in cash dividends for the fiscal year 2024, at a rate of 17%. Thus, upon completion of the aforementioned share issuance, the company will have fulfilled its 2024 dividend plan with a total rate of 32%.

Source: VietstockFinance

|

Despite 2024 being a record-breaking year for SIP in terms of profits, the cash dividend payout remains modest, only about half of that in the 2021-2022 period.

| SIP’s Financial Performance Over the Years |

For the fiscal year 2025, SIP has set a cautious business plan, targeting consolidated revenue of VND 5,657 billion and after-tax profit of nearly VND 833 billion, down 33% and 35%, respectively, from the previous year’s performance.

| SIP’s Quarterly Financial Results |

However, the results for the first quarter of 2025 were quite positive. SIP recorded a net profit of over VND 351 billion, up 43% from the previous year and the highest since the first quarter of 2021, achieving nearly 50% of its annual plan. Consolidated revenue was over VND 1,941 billion, a 6% increase, with the utility services segment for industrial parks alone contributing nearly VND 1,590 billion – accounting for over 80% of total revenue and a 7% rise from the previous year.

Source: VietstockFinance

|

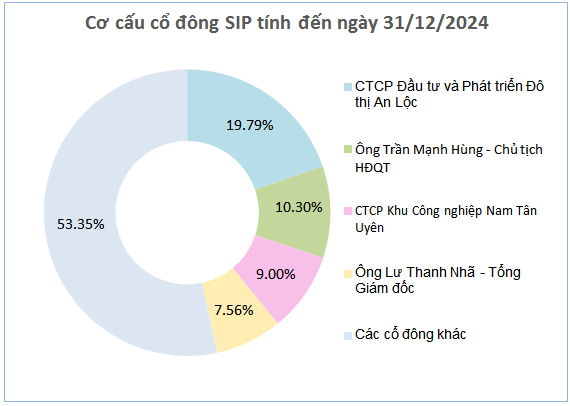

As of December 31, 2024, SIP‘s shareholder structure showed that 46.65% of its capital was owned by two institutional investors and two major individual shareholders, including Chairman of the Board Tran Manh Hung and General Director Lu Thanh Nha.

It is estimated that An Loc Urban Development and Investment Joint Stock Company – the largest shareholder with nearly 20% ownership – will receive over 6 million shares and nearly VND 71 billion in dividends for the fiscal year 2024. Meanwhile, the second-largest shareholder, Chairman Tran Manh Hung, is expected to receive approximately 3 million shares and VND 37 billion in cash.

– 11:14 06/05/2025

“Vingroup’s Windfall: A Whopping 7.2 Trillion VND Dividend Payout Results in a 435% Yield”

The parent company, Vingroup Joint Stock Company (coded VIC on the stock exchange, currently owning 83.32% of VEF’s capital), is set to receive a substantial dividend payout of over VND 6,000 billion from VEF.