The Vietnamese stock market experienced a volatile trading session with narrow ranges. The main index fluctuated around the reference mark before closing in the red. At the end of the session on June 4th, the VN-Index dipped slightly by 1.51 points to 1,345.74. Liquidity declined, with the matched order value on HoSE reaching approximately VND 20.9 trillion.

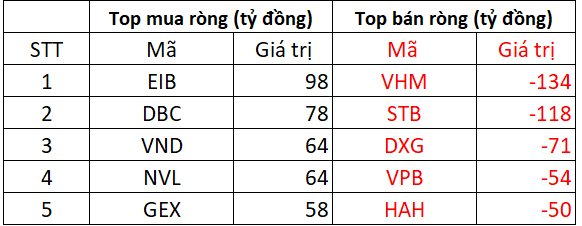

In this context, foreign investors’ transactions balanced out with a net sell of about VND 49 billion in the entire market. Specifically:

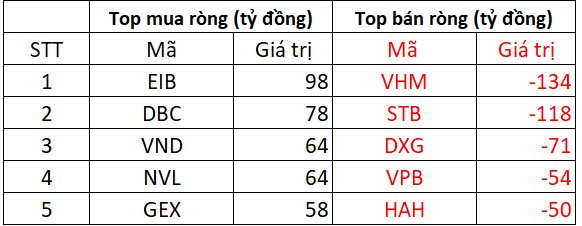

On HoSE, foreign investors net sold a slight VND 9 billion

In the selling side, VHM and STB stocks witnessed the strongest net sell by foreign investors in the market, with values of VND 134 billion and 118 billion, respectively. DXG, VPB, and HAH stocks also faced significant selling pressure, with values ranging from VND 50 to 71 billion.

On the opposite side, EIB witnessed the strongest net buy in the entire market with a value of VND 98 billion. DBC also attracted net buying of about VND 78 billion. Additionally, NVL, VND, and GEX were net bought with values ranging from VND 58 to 64 billion per stock.

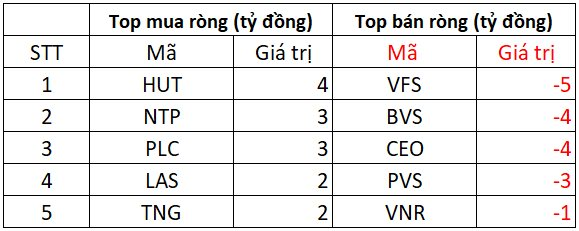

On HNX, foreign investors net bought nearly VND 6 billion

In the buying side, stocks such as HUT, NTP, PLC, LAS, and TNG were net bought by foreign investors in today’s session, with values ranging from VND 2 to 4 billion.

Conversely, VFS, BVS, PVS, and CEO stocks faced the strongest net sell in the range of VND 3 to 5 billion. VNR was also net sold by about VND 1 billion.

On UPCOM, foreign investors net sold approximately VND 46 billion

Regarding net bought stocks, MCH was net bought with a value of VND 1 billion. GDA, VEA, KCB, and HBC were also net bought with a few hundred million VND each.

On the selling side, ACV was net sold for VND 34 billion. HNG, MML, and MPC were net sold for a few billion VND each.

Market Tug-of-War: The Ongoing Battle Unveiled

The VN-Index witnessed a slight dip with a tug-of-war session, coupled with below-average trading volume. A throwback is currently unfolding as the VN-Index has recently breached a strong resistance level of 1,320-1,340 points. Notably, the MACD indicator has been narrowing its gap with the Signal line in recent sessions. Should this indicator flash a sell signal in the upcoming periods, the risk of a short-term correction may emerge.

The Money Vacuum: Small Caps Suck In Cash, Weighing Down Indexes

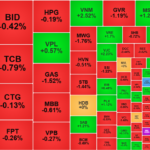

The HoSE exchange witnessed a significant drop in liquidity today, falling by approximately 9% from the previous day, equating to a loss of over VND 2,000 billion. Amidst this decline, the VNSmallcap basket stood out as the sole exception, experiencing a slight uptick in liquidity. The representative index of this basket also outperformed the broader market, with numerous stocks reaching their ceiling prices.

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.