**HSC Seeks to Raise $160 Million Through Public Offering**

The State Securities Commission has just granted a certificate for public offering of shares to Ho Chi Minh City Securities Joint Stock Company (HSC – code HCM). Accordingly, HSC will offer nearly 360 million shares (equivalent to 50% of the total circulating shares) within 90 days from the validity of the certificate.

The plan for the share offering was approved by HSC’s Extraordinary General Meeting of Shareholders at the end of last year. The expected offering price is VND 10,000/share, equivalent to a mobilization of nearly VND 3,600 billion, which will be used to supplement capital for margin lending activities (70%) and proprietary trading (30%).

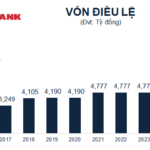

HSC currently has a charter capital of VND 7,200 billion. If the offering is successful, the securities company will increase its charter capital to VND 10,800 billion. As of the end of Q1/2025, margin debt reached VND 20,400 billion, slightly down from the beginning of the year and accounted for 197% of owner’s equity at the same time (VND 10,300 billion). Therefore, the capital-raising offering is urgent for HSC to have more room to expand lending activities.

In the market, HCM shares closed at VND 26,800/share on June 3, down nearly 6% from the beginning of the year. The corresponding market capitalization is about VND 19,000 billion.

On June 6, HSC will spend nearly VND 290 billion to pay the second dividend of 2024 with a rate of 4% (receiving VND 400/share) according to the list of shareholders as of May 14. Thus, HSC shareholders will receive a dividend for 2024 with a total rate of 9% (including the advance paid in February 2025).

Regarding the 2025 business plan, HSC targets revenue of VND 4,438 billion, up 34% over 2024. Operating expenses of the enterprise are expected to increase by 41% in 2025. Nevertheless, pre-tax profit for the year is still expected to increase by 24% over the previous year to VND 1,602 billion, and after-tax profit is also expected to increase by 23% to VND 1,282 billion.

For each business segment, HSC expects margin lending to contribute the most to revenue with VND 2,368 billion, expected to increase by 38% compared to 2024. Next is proprietary trading, expected to bring in VND 983 billion, and securities brokerage with VND 908 billion, up 47% and 7% respectively compared to the previous year.

The Ultimate Guide to Captivating Copywriting: Crafting Words That Enchant and Inspire Action

In Tuesday’s trading session, APG stock unexpectedly surged to its daily limit of 12,600 VND per share. The highlight of the session was a foreign-led block trade of over 37 million shares, worth nearly 408 billion VND, at an average price of 11,000 VND per share.

The Ultimate Stock Market Superstar: Unveiling the 4,100% Surge and a Record-Breaking 24% Dividend

Petrolimex Nghe Tinh Joint Stock Company (HNX: PTX) has been dubbed the ‘dark horse’ of the oil and gas industry, with its stock price soaring from a few hundred dong to a peak of 23,000 dong per share ahead of its exchange transfer. The company continues to surprise with its announcement of a record-high cash dividend of 24%, equivalent to nearly 80% of its 2024 post-tax profits.

“Unsuccessful Purchase Leads to Sale: Chairman’s Daughter Registers to Offload One Million HAG Shares”

Ms. Doan Hoang Anh, the daughter of Mr. Doan Nguyen Duc – Chairman of HAGL Group, has recently filed to sell one million HAG shares from June 4th to July 3rd. The stated purpose of this sale is personal financial management.