The resilient and persistent cash flow didn’t allow for a deep correction for the VN-Index, despite approaching the 1,350-point threshold. After strong rallies, the VN-Index faced profit-taking pressure, but cash inflows for bottom-fishing repeatedly kept the index afloat, resulting in a negligible loss of 1.51 points, settling at 1,345.74, with a nearly equal number of declining and advancing stocks, 151 to 153.

There was a noticeable shift in cash flow from large-cap stocks to mid and small-cap ones. Banking, real estate, and securities sectors experienced substantial sell-offs, mostly plunging into a sea of red. Among banks, only EIB, NAB, and EVF managed to stay in positive territory.

Meanwhile, livestock stocks exploded in today’s session, with DBC surging to the daily limit-up with a buying queue of 2.6 million shares. MML also climbed by 4.85%, and BAF rose by 1.67%. Food producers VNM and MSN contributed positively to the market. Construction and infrastructure investment stocks attracted cash flow, including THD, PC1, and C4G.

Overall, cash is flowing into sectors that benefit from boosting domestic economic growth. The cash flow is robust and decisive, with impressive liquidity across the three exchanges, reaching VND25,000 billion. Foreign investors recorded a negligible net sell position of VND54.2 billion, and their net sell position in matched transactions was VND31.9 billion. Their net buy positions in matched transactions were in the Food & Beverage and Oil & Gas sectors. The top net buy positions included EIB, DBC, NVL, VND, GEX, PVD, DIG, NLG, MSN, and VNM.

On the sell side, foreign investors net sold Banking stocks in matched transactions. The top net sell positions included VHM, STB, DXG, MWG, VPB, VCI, BID, FPT, and HCM.

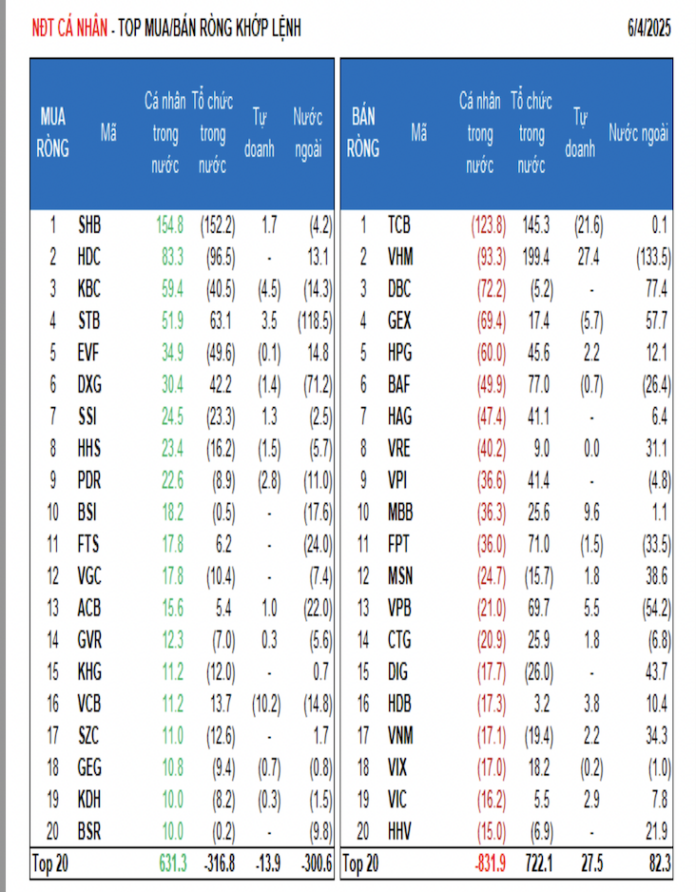

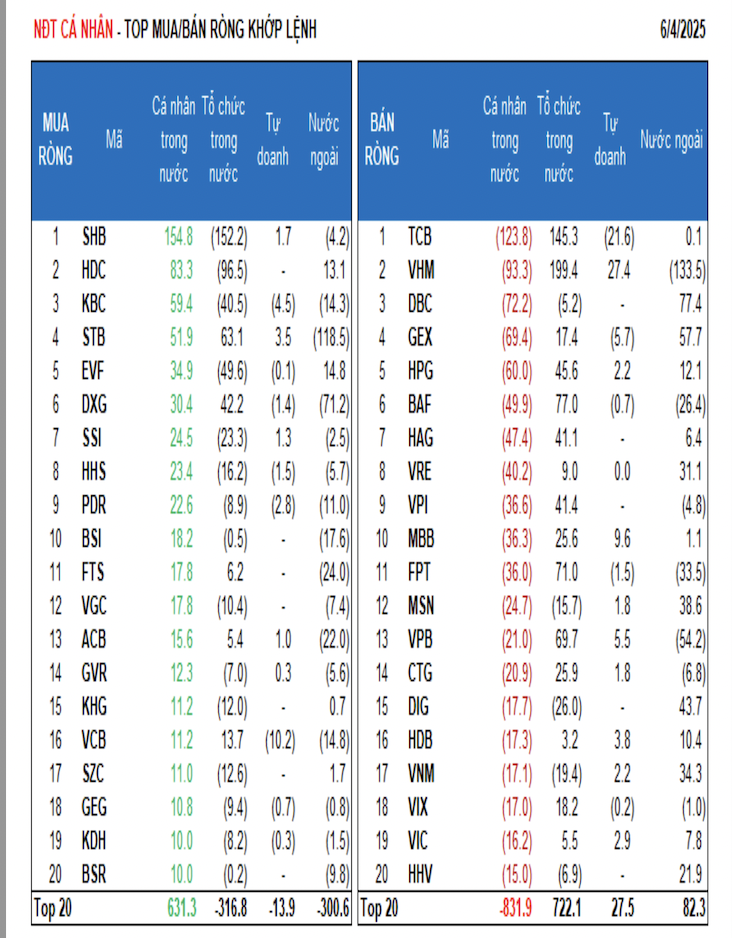

Individual investors net sold VND45.8 billion, with a net sell position of VND255.1 billion in matched transactions. In matched transactions, they net bought 7 out of 18 sectors, mainly in the Financial Services sector. The top net buy positions included SHB, HDC, KBC, STB, EVF, DXG, SSI, HHS, PDR, and BSI.

On the net sell side in matched transactions, they net sold 11 out of 18 sectors, primarily in the Food & Beverage and Industrial Goods & Services sectors. The top net sell positions included TCB, VHM, DBC, GEX, HPG, BAF, VRE, VPI, and MBB.

Proprietary trading accounted for a net sell position of VND22.6 billion, with a net buy position of VND18.3 billion in matched transactions. In matched transactions, proprietary trading net bought 9 out of 18 sectors. The most substantial net buy position was in Real Estate, followed by Financial Services. The top net buy positions included VHM, MBB, EIB, PVT, VPB, HDB, DGC, STB, VIC, and HPG.

The top net sell positions were in Retail. The top net sold stocks were TCB, VCB, NLG, MWG, GEX, KBC, VCG, PDR, PLX, and HHS.

Domestic institutional investors net bought VND81.9 billion, with a net buy position of VND268.7 billion in matched transactions. In matched transactions, domestic institutions net sold 8 out of 18 sectors, with the most significant value in the Financial Services sector. The top net sell positions included SHB, EIB, HDC, VND, NVL, EVF, PVD, NLG, KBC, and DIG. On the net buy side, the most significant value was in the Banking sector. The top net buy positions included VHM, TCB, BAF, MWG, FPT, VPB, STB, VCI, HPG, and HAH.

Today’s matched transactions’ value reached VND2,740.8 billion, down 7.9% from the previous session, contributing 10.6% of the total trading value. Notably, there was a transaction involving EIB, with 26 million units worth VND607 billion traded between individual investors. Additionally, there was a transaction of over 2.8 million FPT shares (valued at VND338.9 billion) between domestic institutions.

Cash flow allocation shifted towards Real Estate, Banking, Construction, Agricultural & Seafood Farming, Food, Electrical Equipment, Oil & Gas, Power Generation & Distribution, and Personal Finance sectors while decreasing in Securities, Chemicals, and Chemicals sectors.

In matched transactions, cash flow allocation increased in the small-cap sector (VNSML) and decreased in the large-cap sector (VN30), while remaining stable in the mid-cap sector (VNMID).

“Equity Liquidity Crunch: Small-Cap Stocks Feel the Pinch”

The market continues to show no signs of breaking through, despite the VN-Index hovering around the 1340-point mark. The main culprit is the largest bloc of blue-chip stocks turning southward. Meanwhile, overall liquidity has also taken a significant hit, and opportunities are now scarce outside a handful of mid-to-small-cap stocks.

The Foreign Turn: Heavy Selling in Two Blue-chip Stocks

The foreign transactions balanced out with net selling of approximately VND 49 billion across the market.

Market Tug-of-War: The Ongoing Battle Unveiled

The VN-Index witnessed a slight dip with a tug-of-war session, coupled with below-average trading volume. A throwback is currently unfolding as the VN-Index has recently breached a strong resistance level of 1,320-1,340 points. Notably, the MACD indicator has been narrowing its gap with the Signal line in recent sessions. Should this indicator flash a sell signal in the upcoming periods, the risk of a short-term correction may emerge.

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.