According to statistics from the General Statistics Office (Ministry of Finance), in the first five months of 2025, nearly 111,800 businesses were newly established and resumed operations nationwide, up 11.3% compared to the same period in 2024. On average, nearly 22,400 businesses joined and re-entered the market each month.

In May 2025 alone, there were more than 15,100 new enterprises with registered capital of over VND 156,700 billion and 98,100 registered laborers. Compared to the previous month (April 2025), the number of enterprises decreased slightly by 0.6% and the number of laborers decreased by 23.1%. However, registered capital increased significantly by 17.3%.

Compared to the same period in 2024, the indicators in May 2025 showed outstanding growth: an increase of 6.1% in the number of enterprises, 16.6% in registered capital, and 29.3% in the number of laborers.

Notably, the average registered capital of a business in the month reached VND 10.4 billion, up 18.0% compared to the previous month and up 9.9% over the same period last year.

In addition, in May 2025, more than 8,000 businesses resumed operations, down 11.1% from April 2025 but up sharply by 18.8% over the same period last year.

In the first five months of 2025, nearly 66,800 new businesses were registered nationwide, up 0.6% from the previous year, with a total registered capital of VND 647,100 billion and a total labor force of 453,900 people (up 6.2% in labor).

A particularly bright spot is that the total additional registered capital in the economy in the first five months of this year reached nearly VND 2,279,500 billion, up a strong 83.8% over the same period in 2024. This indicates the expansion and strong investment of operating enterprises.

The number of businesses resuming operations in the first five months was also encouraging, with more than 45,000 enterprises, up 32.2% over the same period.

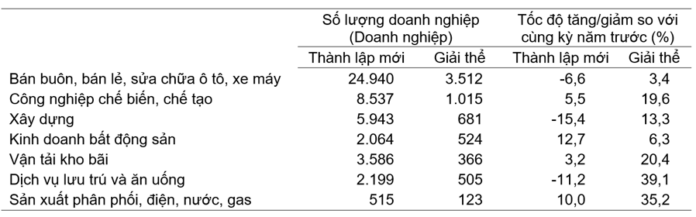

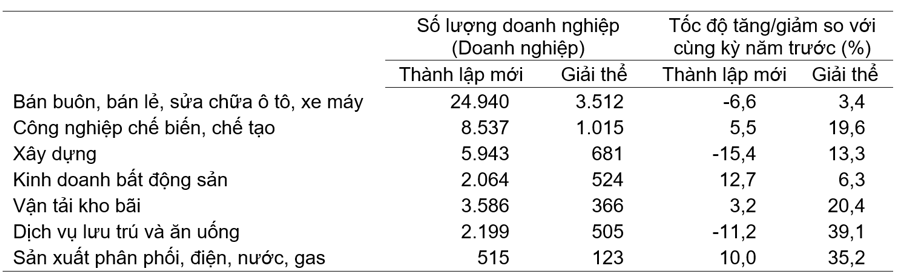

Considering the economic sectors, the service sector remains the main driver with nearly 50,900 new enterprises, up 2.0%. Meanwhile, the industry and construction sector recorded more than 15,200 enterprises (down 3.9%) and the agriculture, forestry, and fishery sector had 627 enterprises (down 1.7%).

On the other hand, the data also shows the market’s filtering and restructuring process.

In the first five months, there were nearly 74,600 businesses that temporarily ceased operations for a definite period (up 12.8% over the same period last year), more than 27,500 businesses waiting for dissolution procedures (up 18.3%), and nearly 9,600 businesses that completed dissolution procedures (up 15.7%).

Thus, on average, more than 22,300 businesses withdrew from the market each month. This number is almost equivalent to the number of newly established and resumed businesses, indicating a dynamic but also highly competitive and challenging market.

“Tech Alliance for Financial Services: KBSV and PVCB Capital Join Forces to Enhance the Fintech Ecosystem”

Recognizing the untapped potential in the investment and asset management industry, especially for products tailored for the younger generation’s pursuit of financial freedom, KB Securities Vietnam (KBSV) and Joint Stock Company of Vietnam Public Commercial Bank Fund Management (PVCB Capital) have joined forces. Together, they aim to introduce exceptional services that comprehensively cater to the needs of investors.

Stock Market Blog: Traders Take a Cautious Stance, Transaction Volumes Dip

The overall market remains volatile around old peaks, with only select small-cap and mid-cap stocks performing well. Opportunities still lie within this group, but the resilience of many codes seems unstable, increasing the likelihood of making wrong choices.