Negotiation outcomes will be the focus in June

In an interview with Vietstock, Mr. Nguyen The Minh – Director of Research and Development, Yuanta Securities Vietnam shared that the trade negotiations between the US and Vietnam are the most significant factor in June, and he remains optimistic about a positive outcome. However, as there are already expectations for a favorable scenario, the impact may gradually diminish.

|

The Yuanta expert noted that there is still a possibility of a delay, which could cause a temporary setback for both parties and create short-term pressure on the stock market. Nonetheless, he expects a positive outcome from the negotiations to boost market recovery.

The second factor to consider is the Fed’s meeting in June. While investors anticipated the first rate cut of 2025 to occur in June last year, there is currently little to no expectation for such a move until September.

The yield on US bonds is also noteworthy. Currently, the yields on long-term US bonds (10-year and 30-year, both ranging from 4.5% to 5%) are relatively high, indicating a sell-off that puts pressure on US public debt and capital costs. This will undoubtedly impact the short-term macroeconomic landscape, particularly exchange rates.

If the yield trend continues to rise, even surpassing 5% for 30-year bonds, Vietnam’s exchange rate risk will increase, affecting foreign capital inflows.

Another aspect to monitor is the FDI in May, which is likely to stagnate, especially in new registrations, due to the impact of trade policies.

Meanwhile, risks related to import and export, although frequently mentioned lately, are not yet concerning, according to the Yuanta expert. Specifically, exports have not been significantly impacted by tariff differences, as higher taxes have not yet been officially imposed. On the other hand, imports have slowed down as businesses are cautious about importing raw materials.

Sharing a similar view on the significance of trade negotiation outcomes, Mr. Luu Chi Khang – Head of Proprietary Trading, CSI Securities Vietnam predicted that the tariff rate is unlikely to return to 0% but could settle between 15% and 20%.

|

A positive outcome from the negotiations will support the market’s recovery and potentially push it to new highs. Similarly, a Fed rate cut will not have a significant impact. Domestically, Vietnam’s macroeconomy does not raise significant concerns.

Although GDP in the second quarter may be affected by the 10% retaliatory tariff already in place, the impact is not substantial. Ultimately, a 10% tax on 30% of exports to the US will not result in a considerable number.

Regarding listed companies, after experiencing the first quarter with a 12% year-on-year growth in business results, lower than the 20% average in 2024, the comparative base is no longer low. For 2025, with expectations of positive negotiation outcomes, the market-wide business plan of approximately 14% is likely to be achieved, given the numerous orientations and policies to boost the economy and support businesses in accessing cheaper capital…

Profit-taking will create opportunities for investors

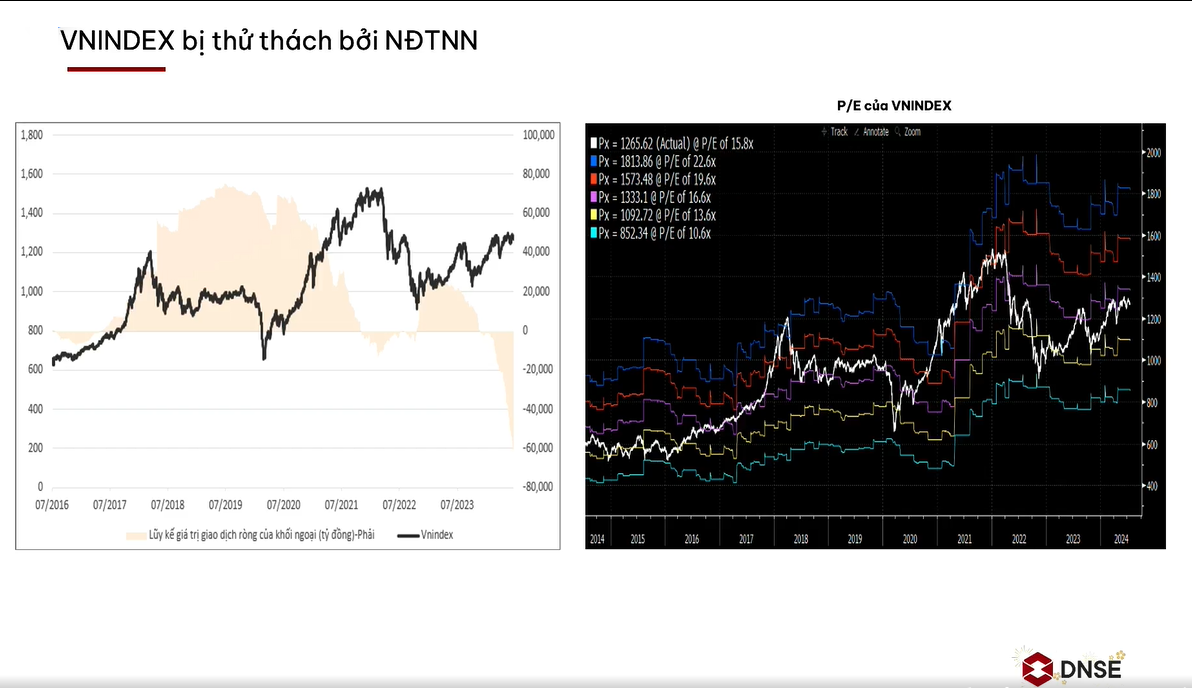

According to Mr. Luu Chi Khang, the Vietnamese stock market recovered impressively in May, regaining all the points lost when the news of the 46% retaliatory tariff broke. Capital inflows into the market also improved, with foreign investors net buying again.

While the rise was largely driven by large-cap stocks, especially the VinGroup, it is worth acknowledging that many sectors have begun to recover. From another perspective, the impact of large-cap stocks has helped spread capital to other groups.

With many positive factors, the CSI expert forecasts that the market will continue its upward trend in June. However, after a strong recovery from the bottom, the market is approaching the 2025 peak of 1,343 points, and profit-taking pressure may cause volatility, leading to a correction towards the support level of 1,285 – 1,300. At that point, investors can increase their positions and aim to take profits in the 1,398 – 1,418 range.

Real estate stocks are expected to break out

“Regardless of the negotiation outcome, the US aims to reduce its trade deficit, so the tariff rate will never return to 0%, but it will be significantly lower than the initial 46%”, shared Mr. Nguyen The Minh. He added that key export sectors like seafood and textiles will continue to be affected, and investors should restructure their portfolios instead of expecting a recovery cycle.

On the other hand, investors can seek sectors with growth potential, starting with banks. Bank stocks have risen but are differentiated. In the last quarter, NIM may improve as credit flows into the real estate sector, which the government is actively addressing.

Secondly, real estate, especially commercial real estate, will recover business results from the third quarter. Stock prices have risen sharply, and there could be another cycle of increases.

Technology stocks have long-term growth drivers, but prices are only recovering relatively weakly. The construction and building materials groups are boosted by public investment and real estate, with improved profit margins due to low input material prices. For food producers, the goal of boosting GDP growth means that domestic consumption will be a key driver. Resolution 68 on promoting the private economic sector also acts as a strong catalyst.

Additionally, a group with a unique story but strong potential if tariffs stabilize is transportation. Vietnam will continue to benefit from supply chain shifts in the coming period.

From the perspective of Mr. Luu Chi Khang, for banks, the NIM is currently at its lowest since 2018, which may result in less impressive performance, despite attractive valuations. Therefore, investors can maintain a relatively low proportion of bank stocks in their portfolios as a defensive strategy, considering their large market capitalization.

In contrast, the group expected to witness the strongest price increases is commercial real estate. After a strong first quarter in terms of business results and recent net buying by foreign investors, this sector is likely to benefit from Resolution 68 and other supportive actions to restart projects.

Industrial real estate may recover after a deep decline if there is positive news on tariffs.

The retail group is also expected to perform well, following an impressive first quarter. The reduction of VAT is likely to continue until the end of 2026, and accelerating domestic consumption when exports slow down will benefit the retail sector.

The CSI expert also has high hopes for the oil and gas group. Despite a decline in business results in the first quarter, the sector is attractive in terms of valuation and has the potential for recovery. Investors can hold a smaller proportion of these stocks in their portfolios.

– 09:57 05/06/2025

“Small and Mid-Cap Stocks Soar: Real Estate Takes the Lead”

The lackluster performance of blue-chip stocks once again dampens the momentum of VN-Index’s peak. While the breadth of the index remains favorable, the gainers are predominantly mid and small-cap stocks, with a surprising surge in the real estate sector.

The Stock Market Slump: Shares Tumble Across the Board

The pressure to secure profits after a streak of consecutive gains, coupled with the fatigue of leading stocks, dragged the benchmark away from its previous peak. As the week’s final trading session concluded, the VN-Index witnessed a decline of over 9 points, with more than 230 stocks drowning in red.