The Digital Asset Revolution: Vietnam’s Foray into the World of Crypto and Blockchain

Illustrative image.

|

The world of digital assets is buzzing with activity, and Vietnam is witnessing a surge in crypto inflows, amounting to hundreds of billion USD annually. Despite the inherent risks, experts believe that the digital asset market holds immense potential. With Vietnam currently crafting a legal framework for digital assets, the opportunities are becoming clearer.

Consequently, many fund management companies have been gearing up by strategizing and taking concrete steps to seize the opportunities that a legal framework for digital assets will bring.

According to MarketsandMarkets research, the global digital asset market is projected to reach $8,050 billion USD by 2027, exhibiting a compound annual growth rate (CAGR) of 61.5% during 2022-2027.

In Vietnam, despite the lack of recognition for digital assets, the Vietnam Blockchain Association estimates that approximately 20 million people own some form of digital assets, ranking second globally in terms of digital asset ownership. It is estimated that about $120 billion USD worth of cryptocurrencies are transferred to Vietnam each year. Previously, during 2023-2024, Vietnam attracted over $105 billion USD in capital inflows from the blockchain market.

Illustrative image.

|

However, due to the absence of specific legal foundations, all of this capital is transacted through foreign companies, resulting in tax losses for Vietnam. Moreover, the lack of a legal framework exposes investors to risks, including loss of assets due to scams or hacker attacks.

At a working session with the Central Committee on Policy and Strategy on February 24, 2025, General Secretary To Lam emphasized the importance of establishing a legal framework for the digital asset market. He urged the National Assembly and government agencies to promptly enact regulations for managing digital currencies, suggesting the consideration of a controlled pilot program for establishing a trading platform. He emphasized the need for a specialized legal framework to seize the opportunities presented by new financial paradigms and modern transaction methods.

In fact, crafting a legal framework to regulate and promote the healthy and efficient development of digital assets and digital currencies has become a key task for Vietnam. The Prime Minister has assigned this responsibility to the Ministry of Finance and the State Bank of Vietnam, as outlined in Directive No. 05/CT-TTg dated March 1, 2025.

Additionally, the draft Law on Digital Industry, which introduces the concept of digital assets for the first time, has been presented for public opinion and is currently under discussion in the National Assembly. The passage of this law would signify a significant step forward in Vietnam’s recognition of digital assets and digital currencies.

A seminar on the legal aspects of digital assets. (Source: VNA)

|

However, according to expert Nguyen Linh Chi from the Legal Department of VICIN Asset Management and Investment JSC, caution is necessary when establishing a legal framework for digital assets. This is a novel, complex, and challenging issue, and even globally, there is no comprehensive and unified legal framework addressing it.

At the PHỞ SIDE CHAT Episode 2: “CEO VanEck- What is the potential of digital assets in Vietnam?” organized by SSI Digital Ventures (SSID) in March this year, Mr. Jan Van Eck, CEO of VanEck Asset Management, emphasized that any legal framework must prioritize the protection of digital assets. He highlighted the risks of asset loss, citing a recent large-scale attack in Asia that resulted in the theft of Ethereum worth $1.5 billion USD. Even in the US, where 11 Bitcoin ETFs are approved, no entity truly guarantees the safety of investors’ assets. While funds often rely on third-party custodians, there are always gaps in security and safety, Mr. Van Eck noted.

At the Vietnam Tech Impact Summit 2024, held on December 3, Mr. Nguyen Duy Hung, Chairman of SSI Securities Corporation, asserted that harnessing the full potential of digital assets requires a core focus on transparency and clarity in the legal framework. This enables investors, businesses, and the community to thrive in a safe and sustainable environment. Countries that take the lead in digital assets will establish strategic positions in the global economy while fostering innovation.

Recognizing the vast potential of the digital asset market, two investment funds, IDGX and SSI Digital Ventures, in collaboration with the Ho Chi Minh City Institute for Development Studies (HIDS), recently launched the BlockStar Incubation Program 2025 in mid-April. This program aims to incubate eight Web3 startups over ten weeks, providing them with product development support, legal compliance guidance, and investor connections.

SSI Digital Ventures, with a commitment of $200 million USD, invests in digital asset technology initiatives, while IDGX focuses on Web3, fintech, and AI startups. The BlockStar program is expected to foster a sustainable Web3 ecosystem in Vietnam.

SSI Digital Ventures (SSID) is the innovation investment arm of SSI Securities Corporation (SSI).

Mr. Mai Huy Tuan, CEO of SSID, stated that with a commitment of $200 million USD and a co-investment portfolio of $500 million USD, SSID will bridge the traditional capital market with new-generation financial technology.

Also, in April, Dragon Capital, which manages assets exceeding $6 billion USD, proposed the creation of digital assets backed by traditional assets (Real World Assets – RWAs) in the form of exchange-traded funds (ETFs) listed and traded on the HOSE. All transaction, valuation, and asset management activities will be transparent, utilizing blockchain technology for real-time auditing and instant data retrieval.

Earlier, in March, Mr. Jan van Eck, CEO of VanEck Asset Management, a company managing assets worth over a hundred billion USD, visited Vietnam. He had discussions with the State Securities Commission of Vietnam regarding digital assets and suggested a cautious yet proactive step-by-step approach for Vietnam to operate in this market. He proposed the idea of establishing a Bitcoin (BTC) investment fund.

Van Giap

– 08:43 06/05/2025

The Ministry of Construction: 2,800km of Highways to be Completed by September 2025

As of September 2025, Vietnam will have completed a remarkable 2,800 kilometers of expressway, according to Minister of Construction Tran Hong Minh. This impressive feat of engineering is a testament to the country’s dedication to improving its infrastructure and connectivity. With this extensive network of high-speed roads, Vietnam is poised to boost its economy and facilitate seamless travel and trade across its vast landscape.

The Green Revolution: BSR Launches Its First Sustainable Aviation Fuel Offering

On June 4, 2025, Binh Son Refinery and Petrochemical Joint Stock Company (BSR) successfully launched and sold its first commercial batch of Sustainable Aviation Fuel (SAF). This groundbreaking achievement marks a significant step forward in the company’s commitment to fostering sustainability and innovation in the aviation industry.

The Art of Negotiation: Vietnam and US Accelerate Talks on Reciprocal Tariffs

“Vietnam and the United States agree on the need to accelerate negotiations on a bilateral reciprocal trade agreement. With a shared vision of strengthening economic ties, both nations are committed to fostering a robust and dynamic trade relationship. This agreement aims to create a mutually beneficial framework that promotes fair and equitable commerce, addressing key issues such as market access, intellectual property rights, and trade balance.”

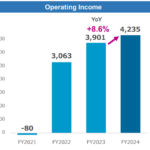

AEON MALL: Profiting Over $85,000 on Average Per Day in Vietnam

According to the latest business performance report, AEON MALL’s operating profit in Vietnam reached approximately 4.24 billion Yen in the 2024 fiscal year, an impressive 8.6% increase from the previous year. With a hypothetical conversion rate of 1 Yen to 180 VND, the Japanese giant raked in nearly 772 billion VND in profits in the latest fiscal year.