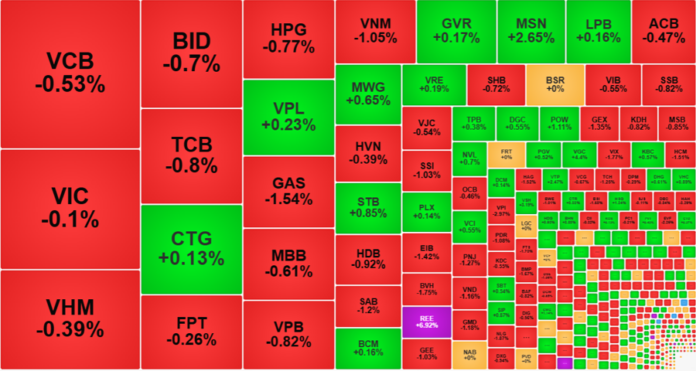

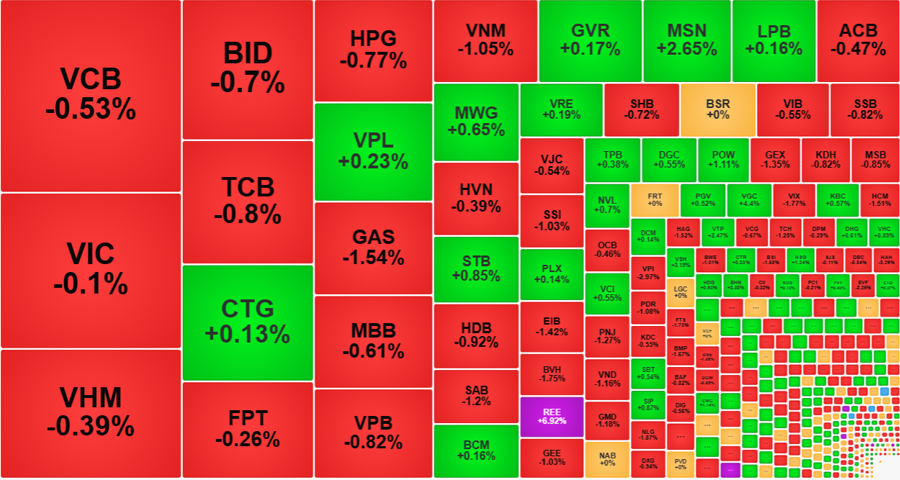

The VN-Index’s upward momentum continued to weaken after yesterday’s pause, mainly due to a decline in buying power. Of the 10 largest stocks by market capitalization, eight were in the red, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant for mid- and small-cap stocks, with many showing strong gains.

The VN-Index hit its intraday low in the afternoon session, falling more than 9.6 points before gradually recovering towards the close. At the end of the trading day, the index was down 0.27%, or 3.65 points. The VN30-Index also closed 0.2% lower, with 10 gainers and 20 losers. Unfortunately, the decline in blue-chip stocks was dominated by large-cap stocks.

Among the top 10 stocks, CTG and VPL were the only gainers, with CTG up 0.13% and VPL up 0.23%. The remaining stocks were in the red, but they showed signs of recovery in the final minutes, helping to mitigate the index’s losses. VHM, which was down nearly 1% towards the end of continuous matching, closed with a smaller loss of 0.39%. VCB, BID, FPT, HPG, and TCB also witnessed some recovery. GAS was the underperformer, closing 1.54% lower. Other stocks, such as BVH, which fell 1.75%, have much smaller market capitalizations.

The blue-chip gainers failed to provide a significant boost to the market. MSN, the best performer with a 2.65% increase, has a market capitalization ranking of only 15th and contributed just 0.6 points to the VN-Index. The gains in STB, MWG, and STB were relatively weak. Notably, the top 10 stocks supporting the index included mid-cap stocks such as REE, VGC, VSH, VTP, and POW.

Despite the overall weakness, the narrow trading range of the index provided a supportive backdrop for individual stock movements. Many mid- and small-cap stocks continued to attract hot money, resulting in vibrant trading, although it fell short of explosive volumes. REE, for instance, witnessed a surge in the afternoon session, breaking its historical high and closing at the upper limit. REE’s morning session was lackluster, with a mere 0.41% gain and a trading volume of approximately 11.3 billion VND. However, in the afternoon session, REE attracted strong buying pressure, with an additional 150 billion VND in volume, leading to a 6.92% increase and a new all-time high of 77,300 VND.

Other notable performers included HHV, which rose 1.2% with a turnover of 261.9 billion VND; VTP, up 2.47% with a turnover of 112.2 billion VND; POW, up 1.11% with a turnover of 105.4 billion VND; VGC, up 4.4% with a turnover of 99 billion VND; CSV, up 2.12% with a turnover of 92.3 billion VND; DXS, up 6.97% with a turnover of 81.4 billion VND; and CTS, up 1.34% with a turnover of 77.5 billion VND. It is rare for small-cap stocks to achieve turnovers in the range of hundreds of billions of VND. Today, the best performers in the small-cap basket had turnovers of only a few dozen billion VND. However, the total trading volume of this basket declined the least compared to other groups, with an 11% drop, while Midcap and VN30 baskets decreased by 23% and 17%, respectively, and the entire HoSE floor decreased by 18%.

On the downside, the pressure was more pronounced. While the HoSE floor saw 69 stocks rising more than 1%, with only five surpassing a turnover of 100 billion VND, there were 85 stocks falling more than 1%, and 16 of them had turnovers exceeding 100 billion VND. VIX, SSI, VND, and HCM led this group. Securities stocks plunged en masse after showing unexpected strength in the previous sessions, with 20 stocks falling over 1% across the exchanges. Today, stocks falling over 1% accounted for 29.4% of the total trading value on the HoSE.

The sharp decline in liquidity occurred as the market remained volatile near the previous peak of the VN-Index. Consecutive sessions of ups and downs have failed to trigger explosive moves. Instead, vibrant trading has been confined to mid- and small-cap stocks, driven primarily by opportunistic trading. Today’s news also brought unfavorable developments regarding the potential trade agreement that the market had been anticipating. The decline in buying power could be a response to this perceived risk.

Foreign investors net sold nearly 151 billion VND in the afternoon session on the HoSE, bringing the total net selling for the day to 475 billion VND. The stocks that witnessed heavy selling pressure included STB (-117.5 billion VND), VHM (-71.8 billion VND), VIC (-58.3 billion VND), VIX (-53.9 billion VND), DXG (-52.2 billion VND), HDB (-50.5 billion VND), FPT (-32.1 billion VND), and KDH (-30 billion VND). On the buying side, MSN (+117.9 billion VND), VND (+40.7 billion VND), SSI (+23 billion VND), and VRE (+21 billion VND) were among the top net bought stocks.

“Technical Analysis for June 5th: Breaking Free from the Tug-of-War”

The VN-Index and HNX-Index have been on a rollercoaster ride lately, with fluctuating volumes indicating investors’ shaky confidence.

Market Beat June 5th: Late Rally Sees VN-Index Trim Losses to Just Under 4 Points

The VN-Index faced significant pressure in the latter half of the morning session, extending into the afternoon with a dip to 1,336 points. However, a resilient recovery began at 1:40 pm, with the index steadily climbing to close at 1,342.09 – a marginal loss of just 3.65 points. This volatile movement around a strong resistance level was anticipated and reflects a dynamic market.

Market Beat: A Sea of Red

The VN-Index ended the morning session down 4.28 points, or 1,341.46, despite a relatively positive start. Meanwhile, the HNX-Index and UPCoM-Index stayed in the green, edging up 0.13 points and 0.16 points, respectively, to close the morning at 230.96 and 99.17.