Oil prices dropped by 1% after US data showed higher-than-expected gasoline and diesel inventories, with fuel supplies rising as OPEC+ plans to increase output and trade tensions clouding the energy demand outlook.

Oil Falls by 1%

Brent crude oil fell 77 cents, or 1.2%, to $64.86 a barrel, while WTI crude fell 56 cents, or 0.9%, to $62.85, on June 4th. These declines came after a report from the Energy Information Administration (EIA) revealed a surprise increase in US gasoline and distillate inventories, along with a smaller-than-expected decline in crude stocks.

The EIA data showed that gasoline stocks rose by 5.2 million barrels, far exceeding the expected increase of 600,000 barrels. Distillate inventories, which include diesel and heating oil, also rose by 4.2 million barrels, compared to predictions of a 1-million-barrel increase. While crude stocks fell by 4.3 million barrels, analysts had expected a larger decline of 1 million barrels.

Adding to the downward pressure on prices was the plan by OPEC+ producers to increase output by 411,000 barrels per day (bpd) in July 2025. This increase in supply could potentially outweigh the impact of rising demand during the peak summer driving season in the Northern Hemisphere.

US Natural Gas Prices Hit Near 3-Week High

Natural gas prices in the US dipped but remained near a three-week high as lower-than-expected demand forecasts for the next two weeks overshadowed a decline in production. Natural gas futures for July delivery on the New York Mercantile Exchange fell 0.6 cents, or 0.2%, to $3.716 per million British thermal units (mmBtu).

Gold Prices Steady

Gold prices held firm as solid US jobs data for April offset lingering US-China trade tensions and concerns about the global economy. Spot gold was steady at $3,351.49 per ounce, while US gold futures for August delivery were unchanged at $3,375. A strong US jobs report eased concerns about a slowdown in economic growth, but the ongoing trade dispute and warnings from the OECD about the impact of Trump’s trade policies on the US economy kept investors cautious.

Copper Prices Slip

Copper prices slipped as concerns about potential tariffs overshadowed better-than-expected US jobs data, with investors shifting their focus to trade negotiations led by President Trump. Three-month copper on the London Metal Exchange fell 0.1% to $9,624.50 a ton.

Rising Dalian Iron Ore and Steel Prices

Dalian iron ore futures rose, supported by profit-seeking investors, although the gains were limited by seasonally weak demand. The most-traded iron ore contract on the Dalian Commodity Exchange, for September delivery, rose as much as 1.37 percent to 704.5 yuan ($97.98) per ton after touching its lowest since April 9 in the previous session.

Meanwhile, on the Singapore Exchange, iron ore futures for July rose 0.95 percent to $95.20 a ton. Shanghai steel futures also rose, with steel rebar and hot-rolled coil up 1.57 percent and 1.61 percent, respectively. Stainless steel gained 0.59 percent.

Rising Rubber Prices in Japan

Rubber futures in Japan rose as a weaker yen and wet weather in top producer Thailand raised concerns about seasonal supply. The most active rubber contract on the Osaka Exchange (OSE) for November delivery rose 3.9 yen, or 1.36 percent, to 290.9 yen ($2.02) per kg.

Meanwhile, rubber futures for June delivery on Singapore’s SICOM exchange rose 0.9 percent to 160.1 US cents per kg. According to Longzhong Information, a Chinese commodity data provider, rubber output has been affected by increased rainfall in producing regions both domestically and abroad.

Rising Coffee Prices

Robusta coffee on London’s Liffe rose $8 or 0.2 percent to $4,345 a ton after touching a 9-1/2 month low of $4,235 in the previous session. Arabica coffee on ICE rose 1.6 percent to $3,4615 per lb.

The US Department of Agriculture (USDA) forecast Ethiopia’s 2025/26 coffee output at 11.56 million 60-kg bags, up from 10.63 million the previous year. Global coffee exports fell 6.8 percent in April from a year earlier to 10.2 million 60-kg bags, the International Coffee Organization (ICO) said.

Falling Sugar Prices

Raw sugar on ICE fell 0.15 cent, or 0.9 percent, to 16.75 cents per lb, having touched a four-year low of 16.66 cents on Wednesday. White sugar on London’s Liffe fell 1.2 percent to $468.10 a ton.

Rising Wheat, Corn, and Soybean Prices

Wheat on the Chicago Board of Trade rose more than 1 percent as signs of escalating conflict between Russia and Ukraine, along with dry weather in China, sparked buying. CBOT July wheat rose 6 cents, or 1.1 percent, to $5.42 a bushel, with corn for July up half a cent at $4.39 a bushel and soybeans for July up 4-1/4 cents, or 0.4 percent, to $10.45 a bushel.

Malaysian Palm Oil Prices Rise

Malaysian palm oil futures rose on bargain hunting, with the contract for August delivery on the Bursa Malaysia Derivatives Exchange up 16 ringgit, or 0.41 percent, at 3,950 ringgit ($930.73) per ton.

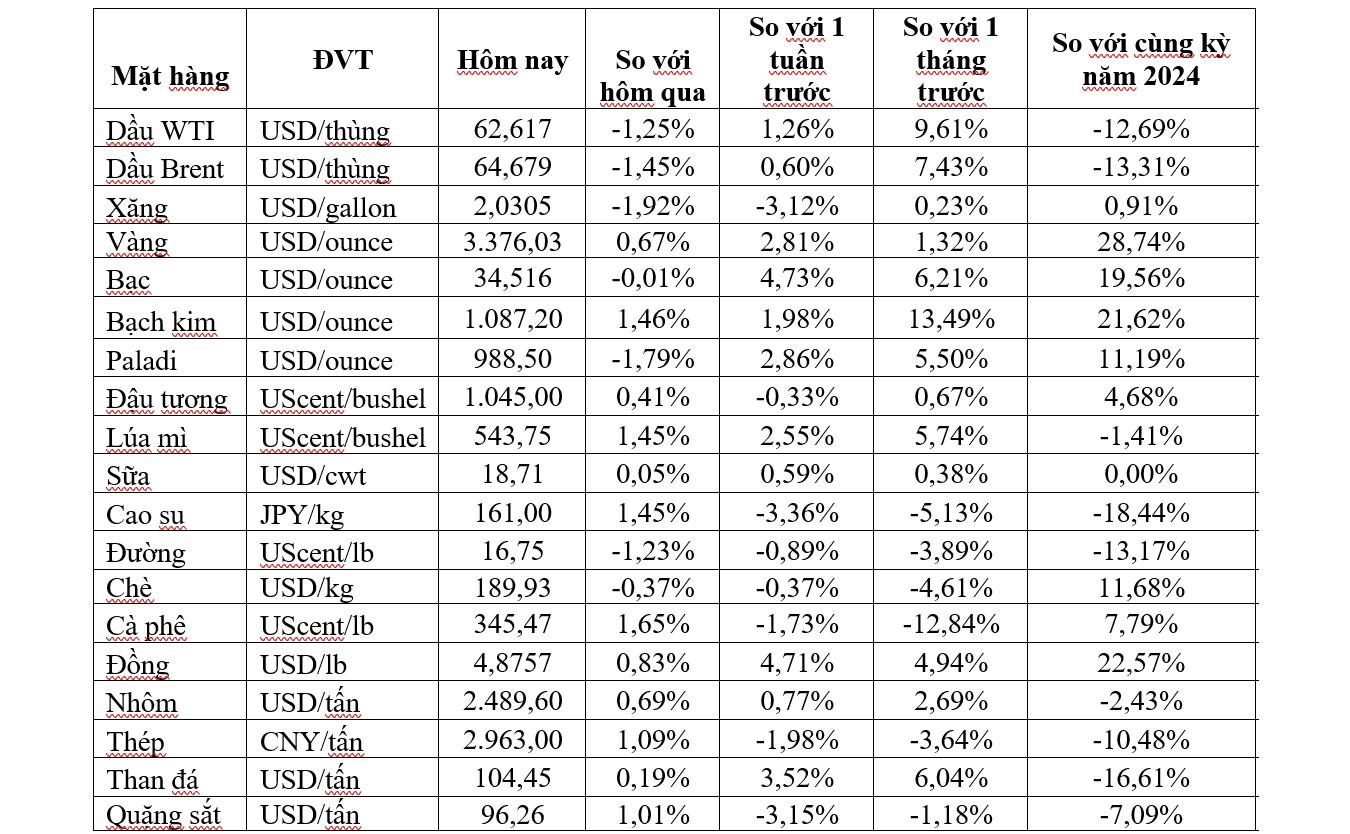

Key Commodity Prices as of June 5th

Gold Prices Slip as Dollar Recovers, SPDR Gold Trust Sharks Circle

“Market analysts attribute the recent fluctuations in gold prices to seasonal factors and the ongoing trade negotiations. In a bid to expedite the process, the Trump administration has urged its trade partners to submit proposals before the Wednesday deadline. This development has stirred anticipation and uncertainty in the market, with investors closely monitoring the situation.”

“Oil Prices Surge to a Two-Week High: A Market Update”

The energy complex witnessed a boost on June 3rd, with oil prices reaching a 2-week high. Silver maintained its strength, holding near a 7-month high, while gold experienced a notable decline of almost 1%. In contrast, rubber plunged to a 1-year low, and raw sugar prices plummeted to levels not seen in 4 years, creating a challenging environment for commodities.

“Global Markets on June 3rd: Oil Prices Surge by Almost 3%, Robusta Coffee Plunges to a 7-Month Low”

As of the market close on June 2nd, oil prices surged by nearly 3%, while natural gas and gold reached their highest levels in three weeks. Silver shone even brighter, climbing to its highest point in over seven months. Conversely, Robusta coffee prices plummeted to a seven-month low, marking a stark contrast in the commodities market.

Is Now the Right Time to Buy or Sell Gold?

The domestic gold price has been on a downward spiral in recent sessions, leaving many investors wondering whether now is the time to buy or sell.