The third consecutive session of declines saw an increase in liquidity, accompanied by a very negative breadth, indicating that sellers are dominating the market. Most blue-chips are struggling, while mid- and small-cap speculative stocks are also facing strong selling pressure.

The VN-Index traded in negative territory throughout the morning session, closing down 5.59 points or 0.42% to 1,336.5. This marks the second week that the index has failed to sustain a breakthrough to new highs, which is technically unfavorable. As more “rướn” attempts fail, the likelihood of a market sell-off increases.

In reality, the sessions that briefly surpassed the 1,340-point peak did not witness explosive trading volumes. Most of these sessions reached the peak due to a few large-cap stocks unexpectedly surging rather than a broad-based rally. When these large-cap stocks falter, a decisive uptrend naturally cannot materialize.

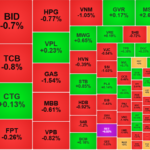

This morning, the largest stocks continued to show weakness. Among the top 10 stocks by market capitalization on the VN-Index, only HPG was in the green, gaining 1.94%. After a slide in April, this stock has also seen its market cap shrink significantly, ranking only eighth. So, despite the increase, it only supported the index by about 0.7 points. VCB, BID, CTG, FPT, and GAS all declined. Notably, VHM fell by 2.08%, and TCB dropped by 1.29%. VHM witnessed its fifth consecutive session below its three-year peak, while TCB posted its third consecutive session of declines after hitting an all-time high earlier this week.

The VN30-Index also closed the morning session lower by 0.44%, with five gainers and 21 losers. Fortunately, aside from VHM and TCB, the other decliners had relatively smaller market caps: VRE, VJC, and MWG. On the upside, aside from HPG, PLX rose by 4.16%, STB climbed by 2.3%, and BCM inched up by 1.15%, also with limited market caps.

The breadth on the HoSE this morning was poor. Even when the VN-Index rebounded to its intraday high, losing only about 0.3 points compared to the reference price, the breadth was still weak at 105 gainers versus 137 losers. By the end of the morning session, HoSE had 71 gainers and 215 losers, confirming the broad-based selling pressure.

The mid- and small-cap stocks, which were heavily speculated on in previous sessions, started to show more weakness. Among the 71 gainers, 35 rose by more than 1%, but trading volume was limited. Less than 20 stocks in this group achieved liquidity of VND10 billion or more. Notable transactions included PVD, up 2.06% with VND194.5 billion in matched orders; HAG, up 2.31% with VND123.8 billion; NKG, up 1.49% with VND110.3 billion; HSG, up 1.22% with VND108.5 billion; HDG, up 1.11% with VND88.5 billion; BSR, up 1.11% with VND55.2 billion; TCH, up 1.01% with VND54 billion; and HHS, up 1.02% with VND50.8 billion. The group with lower liquidity included NLG, DXS, GEE, and CTI, which also performed well.

Overall, the liquidity of the group that increased by more than 1%, excluding HPG and STB, accounted for approximately 11.6% of the total matched orders on the HoSE. This contraction reflects the polarization in short-term speculative sentiment, with more investors looking to take profits rather than buy more. On the other hand, liquidity also appears to be gradually decreasing, and only the stronger stocks can hold their ground. However, even within this group, sellers have pushed prices down to varying degrees. For example, HAG had to give back up to 3.27% of its gains, while PVD fell by 1.98%, HDG by 1.62%, and DXS by 3.29%…

On the downside, the situation is quite dire. Despite the VN-Index’s minor decline, 107 stocks are currently losing more than 1% in value. This group accounts for approximately 37% of HoSE’s total liquidity. In addition to some blue-chips like TCB, VHM, and MWG, many mid-cap stocks are plunging with high liquidity, such as CII, down 3.22%; VND, down 2.92%; VIX, down 1.44%; VCI, down 1.9%; DIG, down 1.4%; and PDR, down 1.92%. These stocks all matched orders exceeding VND100 billion. These stocks have fallen sharply from their peak prices.

HoSE’s liquidity this morning increased by 10.4% compared to yesterday morning, reaching nearly VND9,313 billion, but the breadth was much weaker. This indicates increased selling pressure, not only restraining price fluctuations but also actively pushing up liquidity.

Foreign investors are net selling VND212.2 billion, but the total selling scale is not strong, reaching about VND970.1 billion on the HoSE, slightly lower than yesterday morning. Notable stocks sold off include VCI (-VND54.7 billion), FPT (-VND51.2 billion), HAH (-VND47.8 billion), and STB (-VND24.4 billion). On the buying side, HPG (+VND126 billion), VIC (+VND61.6 billion), and GEX (+VND21.1 billion) stood out.

The Liquidity Crunch: Small-Cap Stocks Swimming Against the Tide

The VN-Index’s upward trajectory continued to falter after yesterday’s pause, this time primarily due to a decline in buying power. Of the 10 largest stocks by market capitalization that make up this index, 8 witnessed negative performance, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant among medium and small-cap stocks, with numerous stocks witnessing robust gains.

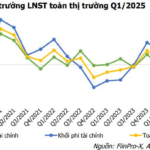

Bank Stocks in May: Rising from the Abyss

Amid the market’s rebound following the news of the U.S. delaying retaliatory tariffs on Vietnamese goods to pave the way for negotiations, the banking stock group has surged back after plunging to rock-bottom levels.