Investor Alert: Upcoming ETF Reconstitution

An upcoming event that investors should pay attention to is the reconstitution of foreign ETFs. Specifically, on June 6, FTSE Russell will announce the constituent stocks of the FTSE Vietnam All-share and FTSE Vietnam Index.

A week later, in the early morning of June 13, MarketVector will also announce the stocks included in the MarketVector Vietnam Local Index. By June 20, the reconstitution of these ETFs will be completed.

Currently, the total assets of the FTSE ETF referencing the FTSE Vietnam Index stand at VND 7,100 billion. Since the beginning of 2025, the fund’s net asset value has increased by 6.5%, however, the number of fund certificates has decreased by 7%, to 9.5 million units, resulting in a 15% increase in NAV/fund unit. The reduction in the number of fund certificates somewhat reflects a net capital outflow from the fund, amounting to VND 511 billion (equivalent to USD 19.8 million) since the beginning of the year.

Meanwhile, the V.N.M ETF, which references the MarketVector Vietnam Local Index, has a scale of VND 11,050 billion. Since the beginning of the year, the net asset value has decreased by 0.25%, while the number of fund certificates has decreased by nearly 15% to 30.6 million units, resulting in a 16.8% increase in NAV/fund unit. The net capital outflow is approximately VND 1,500 billion (USD 60 million).

SSI Securities Corporation has recently released a projection about the ETF reconstitution.

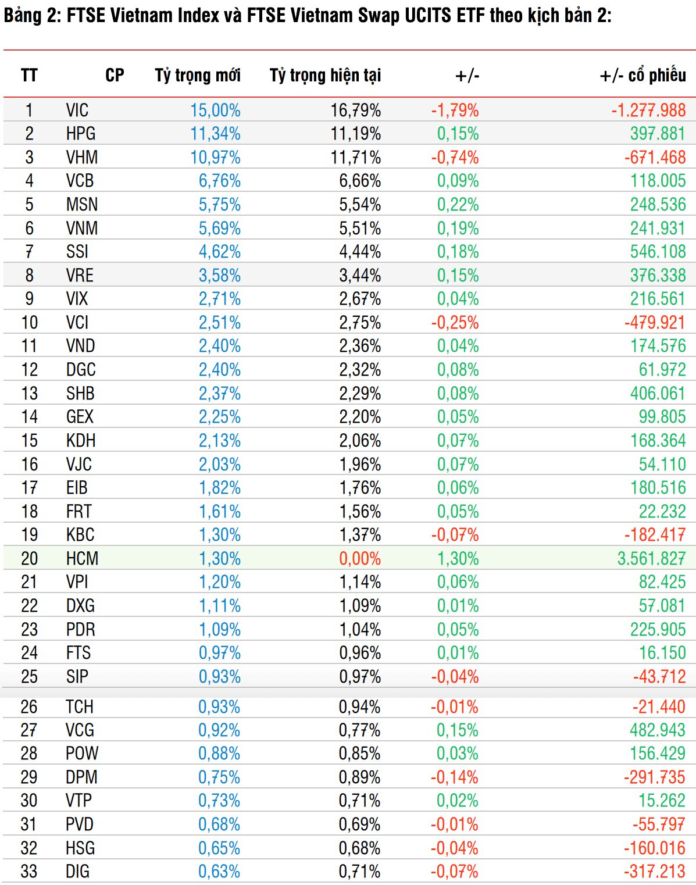

For the FTSE Vietnam Index: SSI Research predicts that HCM may be added as it meets all the conditions. No stocks are expected to be removed.

SSI Research notes that the foreign ownership limit for HCM as of May 30, 2025, was 10.21%, close to the minimum threshold of 10% set by FTSE Vietnam. Therefore, the report presents two scenarios.

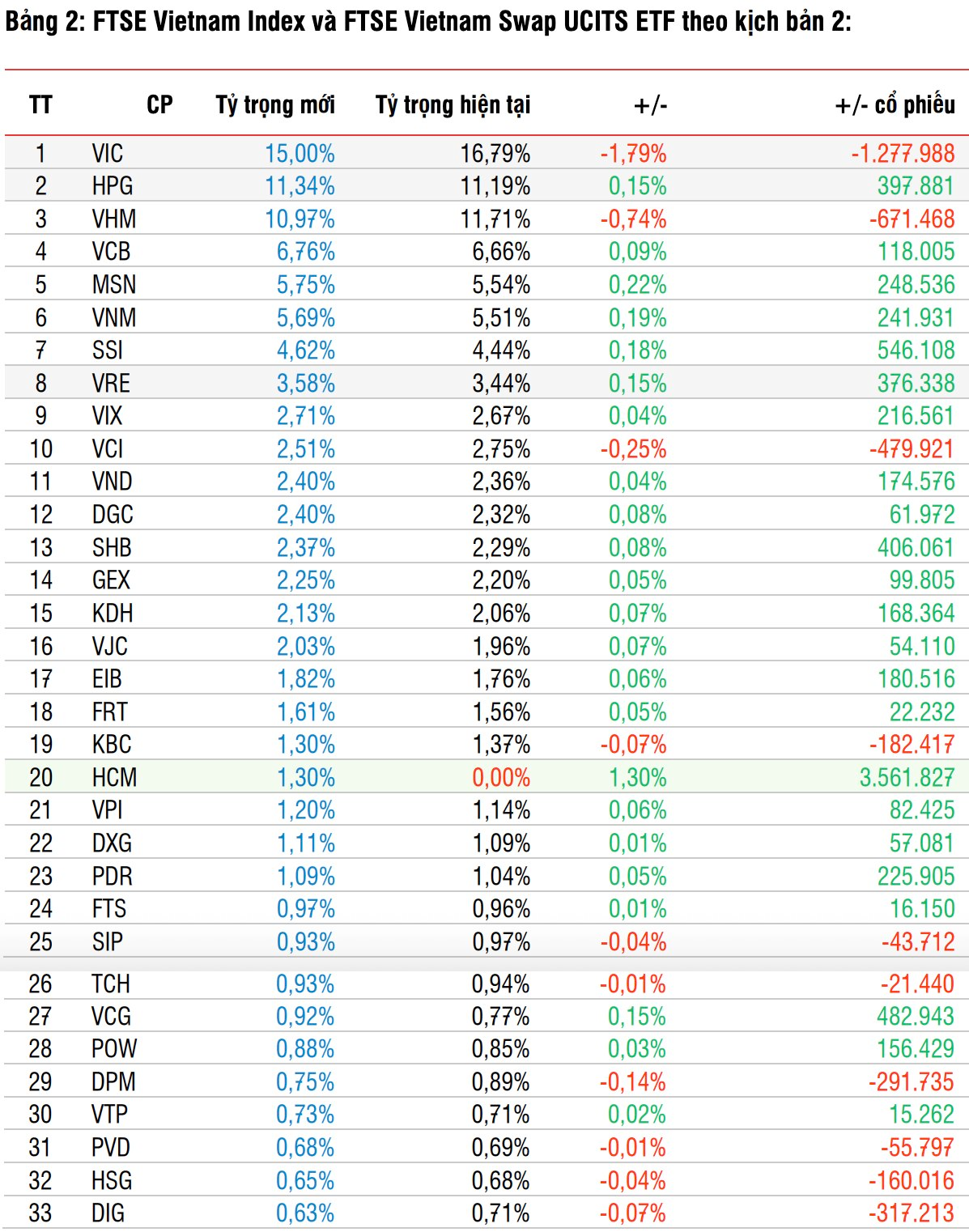

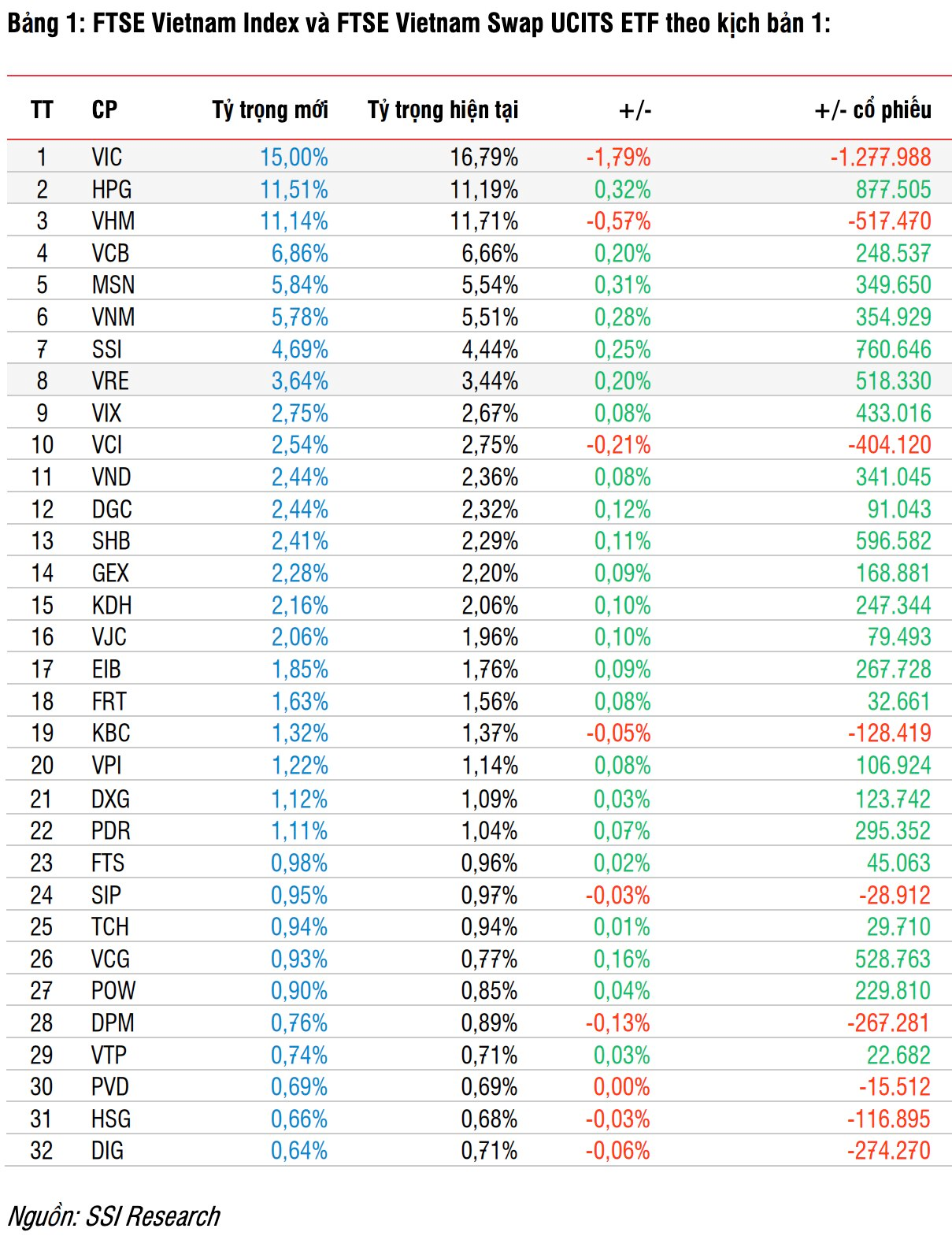

Scenario 1: HCM is added to the FTSE Vietnam Index. In this case, SSI Research estimates that the FTSE Vietnam Swap UCITS ETF will purchase approximately 3.5 million HCM shares (a weight of 1.3%). Other stocks that the fund may buy include SSI (+540,000 shares), VCG (+480,000 shares), SHB (+406,000 shares), and HPG (+397,000 shares). On the selling side, the fund may trade a large volume of VIC shares (-1.27 million) and VHM (-671,000 shares).

Scenario 2: No stocks are added to the FTSE Vietnam Index. In this case, SSI estimates that the FTSE Vietnam Swap UCITS ETF may sell 1.27 million VIC shares, 517,000 VHM shares, VCI shares, and DIG shares. On the buying side, the fund may accumulate 518,000 VRE shares, along with significant purchases of HPG, SSI, and SHB shares.

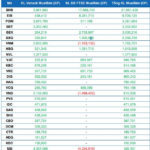

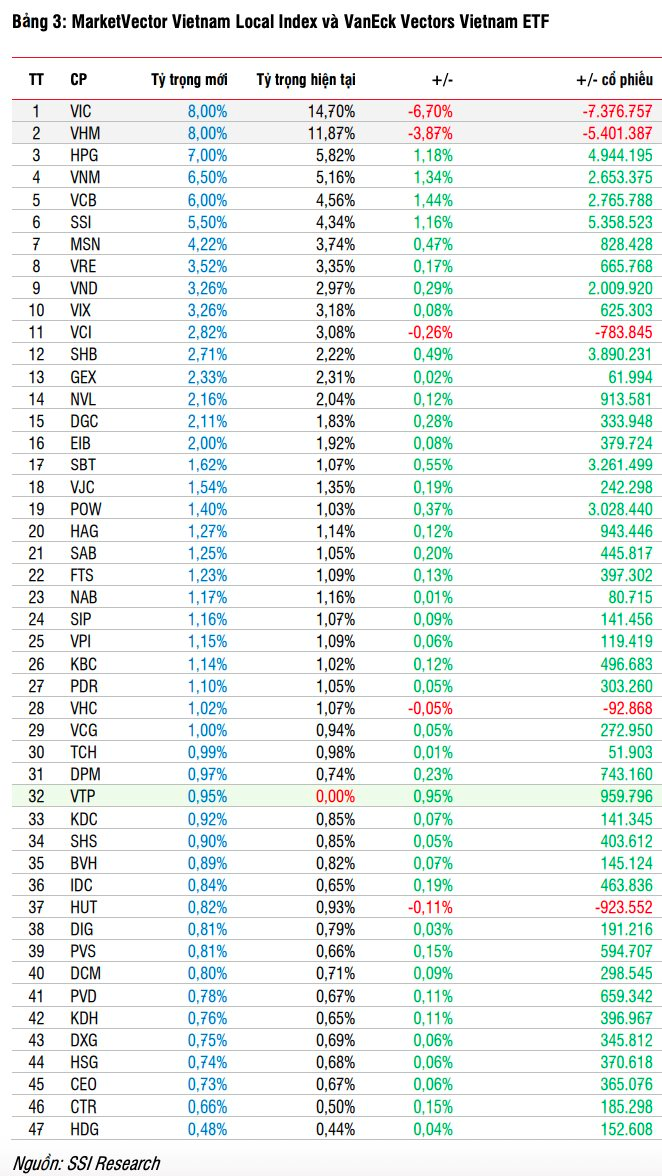

For the MarketVector Vietnam Local Index: SSI Research predicts that VTP may be added to the index as it is in the top 85% of the accumulated free-float market cap among eligible stocks. No stocks are expected to be removed from the index.

Assuming the above changes, the index portfolio will include 47 stocks. Similar to the FTSE Vietnam Index, SSI notes that the current weights of VIC (14.7%) and VHM (11.8%) in the index are significantly high due to their recent price increases. Both stocks have a weight limit of 8%. Therefore, during this reconstitution, the fund will sell these two stocks to reduce their weights.

Regarding the potential inclusion of VPL in the index, the stock currently meets the criteria for market cap and free-float but has not met the minimum listing time requirement of 9 months.

SSI estimates that the VanEck Vectors Vietnam ETF will purchase approximately 959,000 VTP shares (a weight of 0.95%). The fund may also buy SSI, HPG, SHB, SBT, and POW shares.

On the selling side, the fund may offload 7.3 million VIC shares and 5.4 million VHM shares.

“VNM ETF and FTSE Review Forecast: Hotspot in Securities and Banking Stocks”

June 2025 is set to be a pivotal month for Vietnam’s stock market, with two large foreign ETFs gearing up for their periodic portfolio restructuring. This upcoming event has the potential to cause significant fluctuations in the market, making it a critical period for investors and market enthusiasts alike.

The Dynamic Duo of Stocks: Unveiling the Potential Sell-Off by Vietnam’s Oldest ETFs in June’s Restructuring

The BSC predicts that two ETFs could buy millions of securities, while the Vingroup duo might face significant selling pressure.