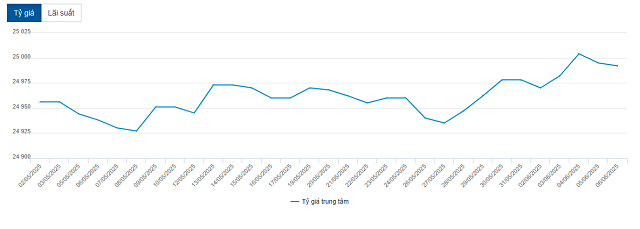

On June 4, the State Bank of Vietnam (SBV) unexpectedly announced the central exchange rate at 25,004 VND/USD, an increase of 22 VND compared to the previous day’s rate. This also marked the first time the central rate surpassed the 25,000 VND threshold.

However, on June 5, the central rate decreased to 24,995 VND/USD, a reduction of 9 VND, and on June 6, it further dropped by 3 VND to 24,992 VND/USD.

With a 5% fluctuation band, the current allowable trading range for commercial banks is between 23,742 and 26,242 VND/USD.

|

Central exchange rates announced by the SBV in the past month

Source: VietstockFinance

|

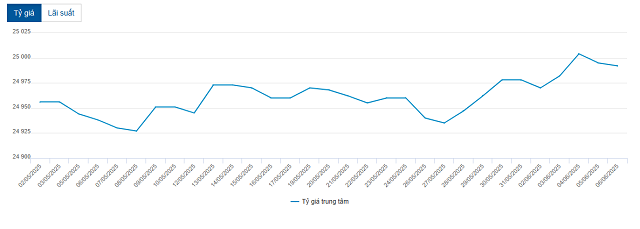

On the international market, the US Dollar Index (DXY) declined from over 101 points on May 12 to 98.77 points on June 6, a decrease of nearly 3%. The US dollar weakened amid concerns about the country’s fiscal situation, economic growth, and trade policies.

|

US Dollar Index performance year-to-date

Source: TradingView

|

The USD/VND exchange rate depends on the outcome of the first tariff negotiation between the US and Vietnam.

Mr. Pyon Young Hwan – Director of Foreign Exchange and Derivatives Trading, Shinhan Bank Vietnam

|

Mr. Pyon Young Hwan, Director of Foreign Exchange and Derivatives Trading at Shinhan Bank Vietnam, stated that the market anticipates the Federal Reserve to initiate an interest rate cut cycle by the end of 2025. In this scenario, the US dollar could enter a phase of gradual weakening in the second half of the year. However, uncertainties surrounding tariff negotiations will likely prevent a sharp decline in the dollar’s value.

America’s tariff policies have become a pivotal variable influencing the Fed’s interest rate decisions. The current tariff measures are facing negative reactions and declining support rates, compelling the US administration to pursue trade agreements and implement tax cuts to stabilize the economy.

At the FOMC monetary policy meeting in May, the Fed maintained interest rates, demonstrating a cautious stance towards inflation risks and low unemployment rates. The latest employment data indicates a high likelihood of the Fed keeping rates unchanged in the June meeting.

Given the potential for inventory stockpiling to drive up inflation, the Fed will await a clearer assessment of the impact of tariff policies before making any decisions. Consequently, the probability of the Fed cutting rates three times in the second half of the year is not high.

Nevertheless, if tariff negotiations progress favorably and the Fed initiates rate cuts to bolster economic growth, the US dollar could weaken. However, as witnessed during President Donald Trump’s first term, agreements that seemed imminent were reversed at the last minute, causing exchange rates to surge.

In the event of prolonged trade conflicts, the US dollar may strengthen in the short term, exacerbating global financial volatility. Notably, in bilateral negotiations between the US and Japan and South Korea, exchange rates have been included in the discussions. However, according to Mr. Pyon Young Hwan, unlike the Plaza Accord, the likelihood of agreeing on a fixed exchange rate is very low, as it contradicts the principles of the global economy.

The US is currently employing two contrasting strategies, “strong USD” and “weak USD,” depending on the situation, to maximize benefits in trade and economic management. This creates inconsistent market expectations while the US administration pursues its long-term goals.

Mr. Pyon Young Hwan asserts that tariff policies are the core factor influencing the value of the US dollar and guiding the Fed’s interest rate decisions. If tariff-induced inflation continues to rise, the Fed may be compelled to delay rate cuts. Meanwhile, tariff measures can reduce trade deficits but also heighten the risk of a global economic recession and trigger trade retaliations.

In the current context, the US dollar is influenced by contrasting factors, making one-sided predictions challenging. Nonetheless, market confidence in the US and USD-denominated assets is showing signs of erosion. The world is starting to contemplate the formation of a trade and financial cooperation system that is less reliant on the US. If this trend persists, the value of USD-denominated assets may disperse, potentially leading to a long-term weakening of the US dollar.

In the scenario of Fed rate cuts, emerging markets like Vietnam will have more room to loosen monetary policies.

Currently, the exchange rate is rising, and Vietnam’s foreign reserves have decreased to around 80 billion USD. Fed rate reductions could help stabilize the USD/VND exchange rate, providing favorable conditions for the SBV to implement flexible monetary policy adjustments.

However, Vietnam may need to maintain higher interest rates than the US for a certain period. Higher interest rates are crucial for attracting investment into emerging markets. Historically, when Vietnam’s interest rates were lower than those in the US, attracting FDI became more challenging, and maintaining domestic economic stability was difficult.

Assuming positive progress in trade negotiations, even if the US implements one to three rate cuts by the end of the year, it is likely that Vietnam will keep its basic interest rate unchanged. Nevertheless, there may still be pressure from the government for lower interest rates to boost the domestic economy.

Businesses should closely monitor exchange rate fluctuations.

In the short term, the USD/VND exchange rate trend will depend on the outcome of the initial tariff negotiation between the US and Vietnam.

Mr. Pyon Young Hwan forecasts that by the end of the third quarter of 2025, the exchange rate will fluctuate between 25,600 and 26,000. The reason for this prediction is that, without certainty in tariff matters, allowing the VND to strengthen does not offer significant benefits to the domestic economy.

However, during the negotiation process, the US will undoubtedly demand that Vietnam allow its currency to appreciate. This could lead to unexpected sharp drops in the USD/VND exchange rate.

In the fourth quarter of 2025, market attention may shift towards a slowing US economic growth and reduced tariff tensions. Consequently, the US dollar could weaken, and the USD/VND exchange rate is expected to witness a mild decline. The exchange rate is projected to fluctuate between 25,000 and 25,600 in the final quarter of 2025.

Based on the prediction of a decreasing USD/VND exchange rate in the latter half of the year, export-oriented businesses should devise specific plans for their foreign currency receipt schedules from export activities. Determining the timing of foreign currency receipts in advance will enable these businesses to implement effective risk management strategies.

– 11:45 06/06/2025

Save with Hong Leong Vietnam – Enjoy Luxurious Getaways

From May 19th to July 31st, 2025, Hong Leong Bank Vietnam (“Hong Leong Vietnam”) has partnered with Anantara Vacation Club to launch an exclusive promotion, “Privilege of Savings”, offering luxurious vacation prizes to show appreciation to their valued customers who have trusted the bank with their financial planning and long-term savings goals.

“Housing Revolution: Bank Pledges $330 Million for 100 Social Housing Projects”

The commercial banks have pledged a credit package worth VND 7.8 trillion for 100 social housing projects. This significant financial commitment underlines their support for the development of much-needed social housing initiatives across the country.