|

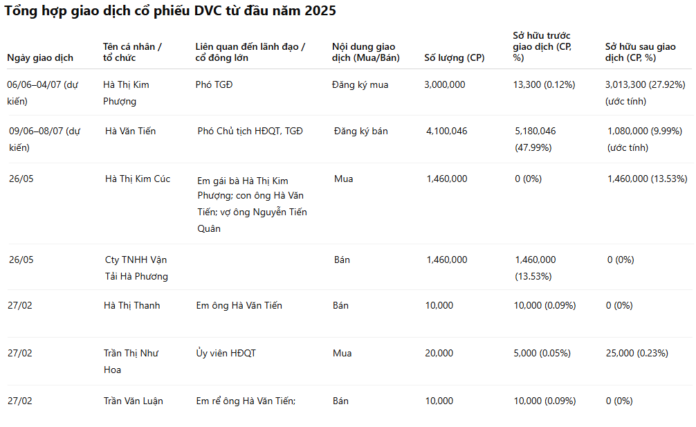

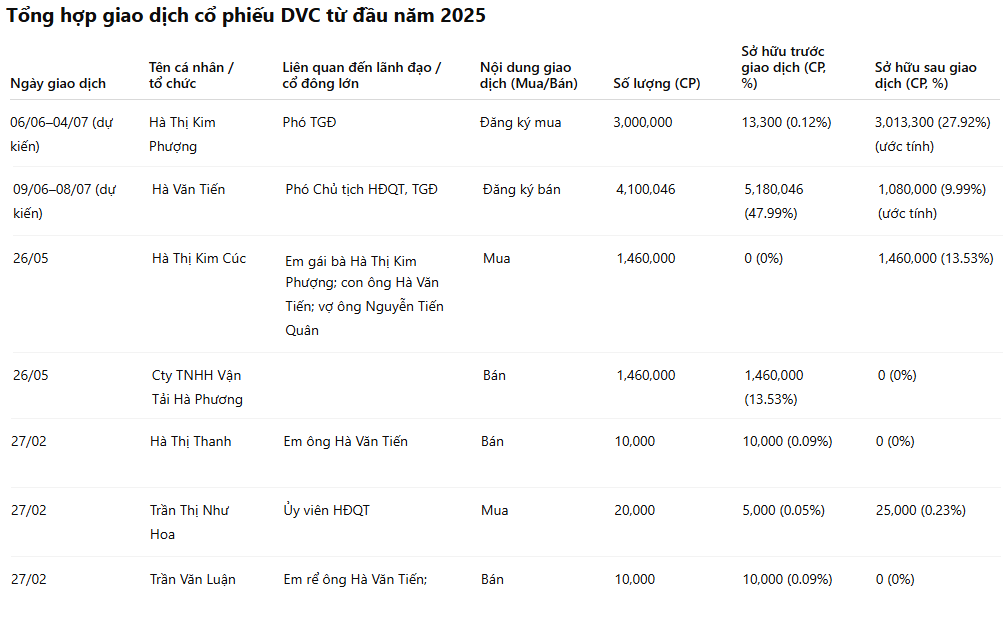

Mr. Ha Van Tien, Vice Chairman of the Board of Directors and General Director of DVC, has

registered to sell more than 4.1 million shares out of his total holdings of 5.18 million DVC shares. The transaction is expected to take place from June 9, 2025, to July 8, 2025. After the transaction, Mr. Tien’s ownership will decrease from 47.99% to 10%, equivalent to 1.08 million shares. The purpose of this transaction, as stated by Mr. Tien, is personal financial restructuring.

On the opposite side, Ms. Ha Thi Kim Phuong, Deputy General Director of DVC, has registered to purchase 3 million DVC shares from June 6, 2025, to July 4, 2025. Prior to this transaction, Ms. Phuong held a very small proportion of shares (0.12%), and if the purchase is completed, her ownership will increase to nearly 28%.

Ms. Phuong is the daughter of Mr. Ha Van Tien and the sister of Ms. Ha Thi Kim Cuc, who holds multiple positions at DVC, including Administration Manager, Company Secretary, and Authorized Information Disclosure Person. Meanwhile, Ms. Cuc is the wife of Mr. Nguyen Tien Quan, another Deputy General Director of DVC.

Notably, Ms. Cuc also recently purchased 1.46 million DVC shares on May 26, 2025, increasing her ownership from 0% to 13.53%. The number of shares she purchased was equal to the number of shares sold by Ha Phuong Transport Company on the same day, leading to the company’s official withdrawal from the list of DVC shareholders. On May 26, 2025, all 1.46 million DVC shares were traded through a matching method at an average price of VND 9,600 per share, 8% lower than the market price of VND 10,400 on the same day.

Ms. Ha Thi Kim Phuong, who has just registered to buy 3 million DVC shares, used to represent Ha Phuong Transport Company’s invested capital in DVC, according to the company’s announcement in 2016.

Previously, on February 27, 2025, Ms. Tran Thi Nhu Hoa, a member of the Board of Directors of DVC, received a transfer of 20,000 DVC shares from her parents, Mr. Tran Van Luan and Mrs. Ha Thi Thanh (each selling 10,000 shares). After the transaction, Mr. Luan and Mrs. Thanh no longer hold any shares, while Ms. Hoa’s ownership increased to 25,000 shares (0.23%).

These large internal transactions took place after a period of sharp declines in DVC share prices in the second half of January 2025, falling from above VND 13,000 per share to below VND 8,000 per share, a decrease of nearly 38%. Subsequently, the share price recovered strongly and reached a 3-year high on June 5, 2025, at VND 13,400 per share, just 3% shy of its historical peak in mid-September 2021.

| Price movement of DVC shares since the beginning of 2025 |

|

|

However, by the morning of June 6, 2025, the market price of DVC dropped sharply by 14% to VND 11,500 per share, just above the floor price, with a trading volume of only 2,000 shares. Nonetheless, the share price still reflected a 34% increase over the past quarter. At this price, Mr. Ha Van Tien could potentially earn more than VND 47 billion if he sells all 4.1 million DVC shares as registered. On the buying side, Ms. Ha Thi Kim Phuong would need to spend approximately VND 34.5 billion to purchase the full 3 million shares she registered for.

DVC, formerly known as the Business Services Enterprise under Hai Phong Port (under the Vietnam Maritime Corporation – VIMC), transitioned to a joint-stock company model in 2000. As of the end of 2024, DVC had 78 employees, a significant decrease from 117 at the beginning of the year and 369 in August 2016. The company operates in various fields, including water and road transportation, loading and unloading, freight forwarding, maritime supply, and warehouse leasing. DVC discontinued its fuel business in April 2024 and its catering services in June 2024 due to land handover requirements from authorities.

In terms of financial performance, DVC‘s revenue in recent years has declined considerably compared to its peak. While the company achieved over VND 300 billion in annual revenue in 2011, in 2024, revenue dropped to VND 102 billion, the lowest in its operating history. However, net profit in 2024 reached a record high of VND 19 billion, more than six times higher than the previous year, thanks to a compensation income of VND 9.63 billion received from land compensation after the state reclaimed over 4,900 square meters of land previously used for fuel business and catering services.

For 2025, DVC sets a cautious business target with expected revenue of nearly VND 94 billion and pre-tax profit of VND 21 billion, a decrease of 9% and 30%, respectively, compared to the actual figures in 2024.

| Annual financial results of DVC since its information disclosure |

|

|

– 14:02 06/06/2025

“Kido’s Grand Vision: Forging Ahead with a 662% Profit Surge, Unveiling Prime Real Estate Ventures, and the Triumphal Return of the Vạn Hạnh Mall”

This time, KIDO is seeking shareholder approval regarding its shareholding in KDF and matters related to the KIDO brand and the Celano and Merino trademarks.

A Stock Market “Purple Wonder” Emerges as Chairman Spends Billions to Become a Major Shareholder

As of Q1 2025, the company reported a net profit of over $430,000, a 31% decrease year-over-year, yet surpassing the full-year plan.