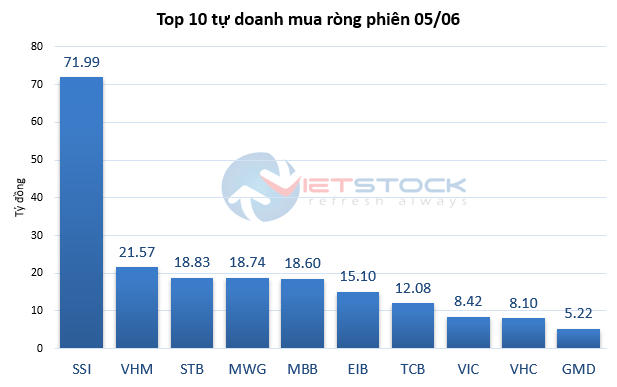

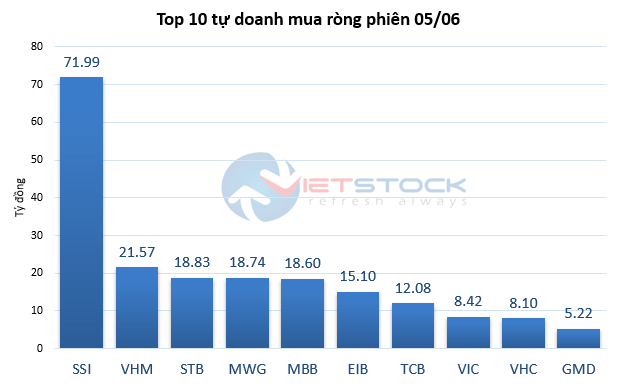

A bright spot in the session was the return of net buying by proprietary traders after eight consecutive net-selling sessions. Specifically, proprietary traders net bought nearly VND 129 billion on the HOSE exchange, with strong buying interest in SSI, reaching nearly VND 72 billion, more than triple the following codes. VHM was net bought for about VND 22 billion, while STB, MWG, and MBB were net bought around VND 19 billion each.

Source: VietstockFinance

|

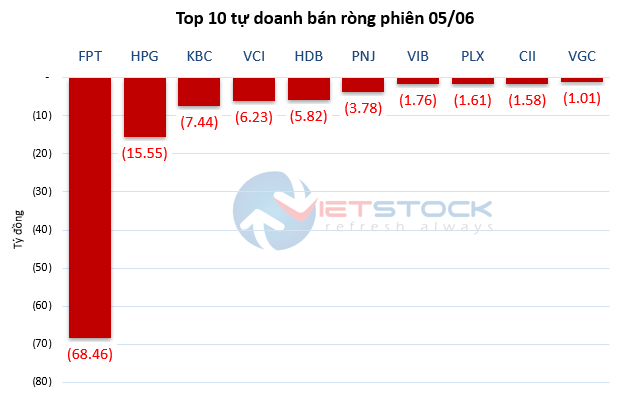

In contrast, FPT experienced the largest net sell-off by proprietary traders, with nearly VND 68.5 billion, far surpassing other codes such as HPG (VND 15.6 billion). KBC, VCI, and HDB witnessed moderate net selling, ranging from VND 6-7 billion each.

Source: VietstockFinance

|

Contrary to proprietary trading activities, foreign investors continued their net selling streak for the second consecutive session, but on a much larger scale. The total net selling value exceeded VND 490 billion, nearly seven times higher than the previous session (VND 72.5 billion). STB witnessed the strongest net selling, amounting to over VND 117 billion. Two codes from the “Vingroup family” also faced significant pressure, as VHM and VIC were net sold for VND 72 billion and VND 58 billion, respectively. Other codes like VIX, DXG, and HDB experienced net outflows of around VND 50-54 billion each.

| Block trading activities in the last 5 sessions |

On the buying side, MSN unexpectedly topped the list of foreign investors’ purchases, with a value of over VND 117.5 billion, nearly three times that of the second-placed VND (VND 41 billion). Several other stocks, including CEO, SSI, and VRE, also recorded modest net buying in the range of VND 21-24 billion.

| Top stocks traded by foreign investors on June 5th |

– 6:38 PM, June 5, 2025

Market Pulse June 4th: VN-Index Closes Slightly Lower, Foreigners Resume Net Selling

The market closed with the VN-Index down 1.74 points (-0.13%) to 1,345.51, while the HNX-Index bucked the trend and rose 1.25 points (+0.55%) to 230.19. The market breadth tilted towards decliners, with 379 stocks falling versus 340 advancing. The large-cap stocks also painted a gloomy picture, as reflected in the VN30 basket, where 21 stocks retreated, 6 advanced, and 3 remained unchanged.

Market Pulse June 4th: A Tale of Two Markets

The VN-Index witnessed a tug-of-war around the reference mark in the morning session, closing the mid-session with a slight loss of 0.64 points (-0.05%), settling at 1,346.61. Meanwhile, the HNX-Index continued its impressive winning streak, adding 1.74 points (+0.76%) to reach 230.68. The market breadth tilted slightly towards the advancers, with 353 gainers versus 290 decliners.