Market liquidity increased compared to the previous trading session, with the matched trading volume of VN-Index reaching over 900 million shares, equivalent to a value of more than 20.3 trillion dong; HNX-Index reached over 114.9 million shares, equivalent to a value of more than 2 trillion dong.

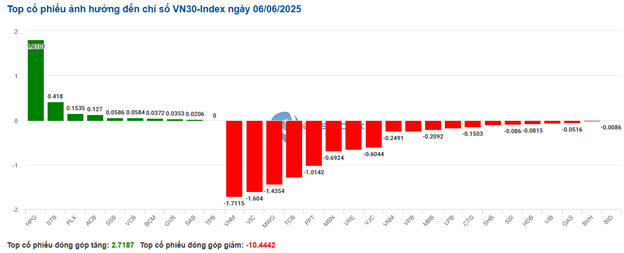

VN-Index opened the afternoon session with continued sideways movement below the reference level but towards the end of the session, selling pressure increased, causing the index to continue its downward spiral and close in pessimistic red. In terms of impact, TCB, VIC, GVR, and VHM were the codes with the most negative impact on the VN-Index, with a decrease of 3.7 points. On the other hand, HPG, PLX, STB, and HDB remained in the green and contributed more than 1.1 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on 06/06/2025 (in points) |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by the codes KSV (-4.19%), MBS (-3.56%), HUT (-3.4%), and CEO (-3.72%)…

|

Source: VietstockFinance

|

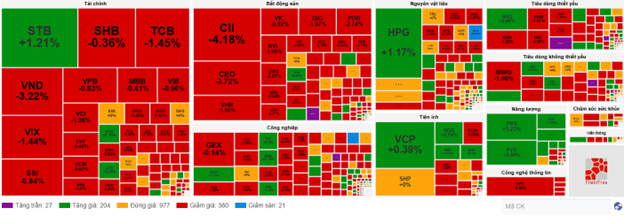

The information technology industry was the group with the largest decrease in the market, falling by 1.55%, mainly due to the codes FPT (-1.54%), CMG (-1.98%), ITD (-0.36%), and HPT (-3.59%). This was followed by the real estate and industrial sectors, which decreased by 1.03% and 0.97%, respectively. On the other hand, the energy sector was the only group to record a gain, increasing by 0.14%, mainly driven by the codes PVS (+0.62%), PVD (+0.52%), and TMB (+0.59%).

In terms of foreign trading, foreigners continued to net sell more than 705 billion dong on the HOSE exchange, focusing on the codes SHP (185.62 billion), VCI (106.49 billion), FPT (83.04 billion), and HAH (70.41 billion). On the HNX exchange, foreigners net bought more than 19 billion dong, focusing on the codes CEO (36.9 billion), IDC (25.26 billion), VGS (5.28 billion), and LAS (3.78 billion).

| Foreign trading net buying and selling |

Morning Session: Steel Stocks Surge Amid Gloomy Market

The recovery efforts did not yield significant results towards the end of the morning session. Before the midday break, the VN-Index stood at 1,336.5 points, down 0.42%; HNX-Index also ended its winning streak, adjusting 0.72% lower to 229.53 points. Sellers remained dominant, with 407 declining stocks and 227 advancing stocks before the afternoon session.

In terms of impact, VHM was the most negative stock, causing the VN-Index to lose 1.5 points. This was followed by TCB and CTG, which also dragged the index down by more than 1 point. Meanwhile, HPG, PLX, and STB were the main pillars supporting the index, contributing approximately 1.5 points.

The market continued to witness a clear divergence among sectors. On the declining side, the industrial and real estate sectors were the worst performers, falling by about 1% at the end of the morning session. The decline was driven by large-cap stocks such as ACV (-2.33%), HVN (-1.16%), VJC (-1.53%), VTP (-0.98%), VCG (-1.35%); VHM (-2.08%), VRE (-1.48%), KBC (-1.71%), PDR (-1.92%), and KDH (-2.15%).

Similarly, the financial sector also witnessed a decline, with only STB remaining as the brightest spot in the industry, attracting strong buying interest. The rest of the sector was mostly in the red, especially securities stocks, which saw significant selling pressure, such as VND (-2.92%), VIX (-1.44%), VCI (-1.9%), MBS (-1.42%), CTS (-1.88%), and VDS (-3.14%)…

On the positive side, the energy sector led the market with the outstanding performance of BSR (+1.11%), PVD (+2.06%), PVC (+1.98%), PVB (+1.05%), and PSB (+2.38%).

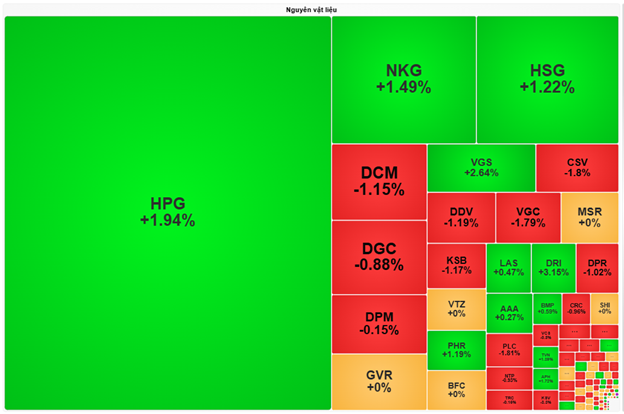

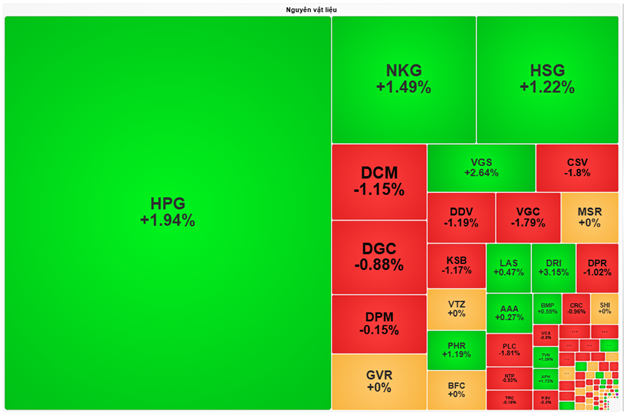

Steel stocks also stood out with a nearly 2% surge, contributing to the slight gain in the materials sector. HPG, HSG, NKG, TVN, and VGS all rose between 1-3%.

Source: VietstockFinance

|

10:40 am: Financial Group Sold Off, PVD Continued to Recover

The market continued to fluctuate amid cautious sentiment. As of 10:40 am, the VN-Index decreased by 7.49 points, trading around 1,334 points. The HNX-Index dropped by 1.8 points, trading around 229 points.

The red dominated the VN30 basket. Specifically, VHM, VIC, MWG, and TCB negatively impacted the overall index, taking away 1.71 points, 1.6 points, 1.43 points, and 1.28 points, respectively. Conversely, HPG, STB, PLX, and ACB were the pillar stocks that helped the VN30 retain more than 2.5 points.

Source: VietstockFinance

|

The red dominated most sectors, with real estate being the weakest group in the market, falling by 0.91% as the red spread widened compared to the beginning of the session. Selling pressure was concentrated in large-cap stocks such as VIC, which decreased by 0.82%; VHM, down 1.43%; VRE, down 1.67%; and SSH, down 0.34%…

Following closely was the industrial sector, which also witnessed a decline. Specifically, the red dominated transportation and port stocks such as ACV, down 1.16%; VJC, down 1.75%; HVN, down 0.39%; and GMD, down 0.68%…

On the other hand, the financial sector continued to face headwinds, with most codes in the red. Notably, BID fell by 0.28%, TCB by 1.13%, CTG by 0.52%, and MBB by 0.2%… Conversely, some stocks showed slight recovery, such as VCB, up 0.18%; ACB, up 0.48%; and STB, up 2.3%…

In contrast, the consumer staples sector performed positively, increasing by 0.25%. Within the sector, the green appeared in MCH, up 1.41%; SAB, up 0.1%; QNS, up 0.21%… Notably, HAG surged from the beginning of the session. Additionally, on June 6, 2025, HAGL Joint Stock Company held its annual general meeting of shareholders and presented to shareholders the plan to issue a maximum of 210 million shares to convert debt into bond group B worth 2,520 billion dong.

Furthermore, the energy sector continued its recovery, led by the duo of PVS, up 2.15%, and PVD, up 3.87%. From a technical perspective, the PVD stock surged positively in the morning session of June 6, 2025, accompanied by trading volume exceeding the 20-session average, indicating increased trading activity. Additionally, the MACD indicator continued its upward trajectory after previously giving a buy signal, further reinforcing the short-term recovery momentum. Currently, PVD has successfully broken through the neckline (equivalent to the 19,200-19,700 range) of the Ascending Triangle pattern while the price has surpassed the SMA 50-day and continues to trade above this level. If the positive outlook persists, the potential price target range is 21,800-22,000.

Source: https://stockchart.vietstock.vn/

|

Compared to the beginning of the session, sellers remained dominant. There were 380 declining stocks and 204 advancing stocks.

Source: VietstockFinance

|

Opening: VN-Index Fluctuates as Real Estate and Financial Sectors Remain Weak

The market started on a negative note, with the red engulfing the two largest sectors by market capitalization: finance and real estate. Consequently, the main indices exhibited a lackluster performance at the opening. Notably, the VN30 index had the most negative impact as most of the stocks within this basket declined.

Specifically, the financial sector experienced divergence, with sellers holding the upper hand. Prominent decliners included BID, down 0.14%; TCB, down 0.8%; CTG, down 0.52%; and MBB, down 0.41%… Only a handful of stocks managed to stay in the green, such as ACB, up 0.24%; EIB, up 1.23%; SSB, up 0.28%; and FTS, up 0.54%…

The real estate sector fared no better, especially the Vingroup stocks, which dragged the sector down. Specifically, VIC fell by 0.92%, VHM by 1.17%, and VRE by 1.67%. Additionally, SSH decreased by 0.45%, KDH by 0.5%, PDR by 0.82%… and a few other codes also contributed to the rather gloomy picture at the opening.

As of 9:30 am, strong divergence was evident, with over 1,000 stocks trading sideways and the red slightly dominating with 223 declining stocks and 210 advancing stocks.

– 15:15 06/06/2025

The US Economy Will Weaken This Year Due to Tariff Woes.

In the latest edition of ‘Gateway To Vietnam’, organized by SSI Securities on June 5th, experts delved into the intricacies of US tariff policies and their far-reaching implications. The discussion, titled “The Art Behind the Tariff Wave”, explored how these policies impact trade flows, investment patterns, and Vietnam’s economic growth prospects.

The Stock Market Blues: Triple Trouble for Stocks as Selling Pressure Mounts and VN-Index Slips Below 1340 Points

The third consecutive session of decline witnessed a surge in liquidity, with an extremely negative breadth indicating that sellers are dominating the market. Most blue-chips are exhausted, while mid and small-cap speculative stocks are also facing heavy selling pressure.

The Liquidity Crunch: Small-Cap Stocks Swimming Against the Tide

The VN-Index’s upward trajectory continued to falter after yesterday’s pause, this time primarily due to a decline in buying power. Of the 10 largest stocks by market capitalization that make up this index, 8 witnessed negative performance, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant among medium and small-cap stocks, with numerous stocks witnessing robust gains.