VN-Index closes at 1,342.09 points on June 5th, a decrease of 3.65 points or 0.27%

On June 5th, the VN-Index opened slightly higher due to returning buying pressure, but the momentum quickly faded. Towards the end of the morning session, buying pressure increased again, reducing the decline.

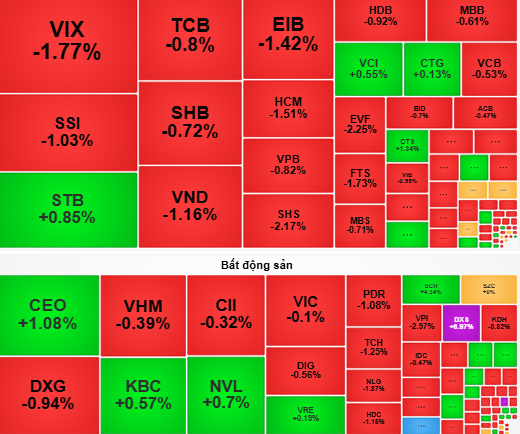

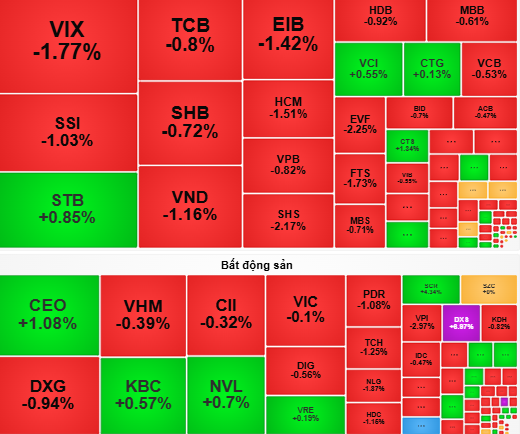

In the afternoon session, the market continued to fluctuate as selling pressure intensified, causing the VN-Index to dip by approximately 9 points at one point. However, mid-afternoon buying pressure for several large-cap stocks helped curb the decline. Notably, REE surged by 7%, VGC rose by 4.4%, STB gained 0.85%, and MSN maintained its increase of over 2%, providing market support.

At the close, the VN-Index settled at 1,342.09 points, down 3.65 points or 0.27%. Foreign investors continued to offload stocks, with a net sell value of VND 474.77 billion, focusing on STB, VHM, and VIC.

According to some securities companies, trading volume decreased by about 20% on June 5th compared to the previous session, indicating investors’ caution amid increased selling pressure. With the current situation, the market is likely to continue fluctuating in the coming sessions.

VCBS recommends that, given the heightened selling pressure, investors may realize short-term profits for stocks that have reached their targets. Monitor market movements and select stocks that show signs of attracting cash flow after adjusting to lower price levels. Consider cautious allocation in small proportions during market fluctuations in the next sessions.

The US Economy Will Weaken This Year Due to Tariff Woes.

In the latest edition of ‘Gateway To Vietnam’, organized by SSI Securities on June 5th, experts delved into the intricacies of US tariff policies and their far-reaching implications. The discussion, titled “The Art Behind the Tariff Wave”, explored how these policies impact trade flows, investment patterns, and Vietnam’s economic growth prospects.

The Liquidity Crunch: Small-Cap Stocks Swimming Against the Tide

The VN-Index’s upward trajectory continued to falter after yesterday’s pause, this time primarily due to a decline in buying power. Of the 10 largest stocks by market capitalization that make up this index, 8 witnessed negative performance, with a 17% drop in the VN30 basket’s liquidity. However, trading remained vibrant among medium and small-cap stocks, with numerous stocks witnessing robust gains.