The market fluctuated within a narrow range during the June 4-6 session.

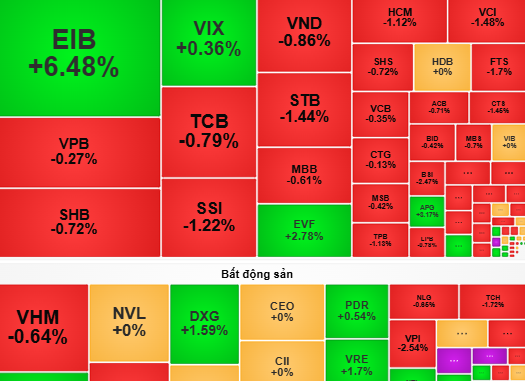

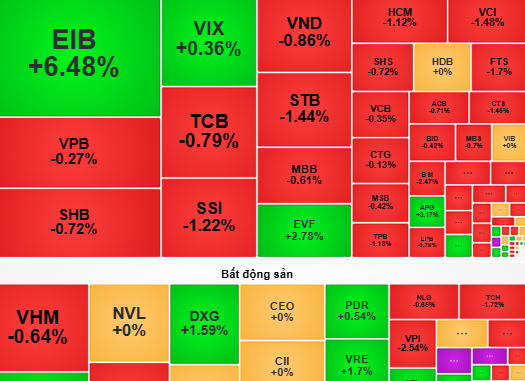

Although the VN-Index opened slightly higher on June 4, it soon faced corrective pressure as selling intensified, particularly in the real estate, construction, food, and select banking sectors.

In the afternoon session, the market continued to trade cautiously, fluctuating within a narrow range. Investment funds flowed into construction and oil & gas stocks, with notable gainers including CTI (+6.07%), NTL (+5.56%), and PVD (+1.57%). However, strong profit-taking pressure emerged in the last 15 minutes, pushing the VN-Index back towards the short-term support level of 1,340 points.

Timely buying support helped the VN-Index trim its losses, closing at 1,345.74 points.

According to Dragon Vietnam Securities, the market is facing resistance in the 1,345 – 1,350 range. Trading volume on June 6 decreased compared to the previous session, indicating a cautious sentiment among both buyers and sellers. As the market has not shown a decisive move above the resistance level, the sideways trend may persist in the next session.

VCBS recommends investors closely monitor supply-demand dynamics for individual stocks. For stocks facing strong selling pressure, consider realizing profits. Investors can prioritize allocating capital into sectors attracting investment funds, such as construction, real estate, securities, and electricity.